Boeing Revises Long-Term Jet Demand Forecast

Boeing has adjusted its 20-year forecast for global commercial aircraft demand, maintaining a strong outlook but tempering growth expectations. The aerospace giant projects a need for 43,600 new airliners through 2044, nearly matching last year’s estimate of 43,975 jets through 2043. This forecast reflects a global air travel rebound anticipated to surge over 40% by 2030.

Demand Breakdown and Market Expectations

The firm’s projections are driven by an estimated 33,300 single-aisle jets—including its own 737 MAX and Airbus’s A320neo family—alongside 7,800 widebody aircraft, 955 factory-built freighters, and 1,545 regional jets. Single-aisle airplanes continue to dominate, typically accounting for about 80% of annual deliveries.

Despite the nearly steady volume forecast, Boeing has revised downward several growth indicators compared to last year:

- Passenger traffic growth lowered from 4.7% to 4.2%

- Global economic growth scaled back from 2.6% to 2.3%

- Cargo traffic growth eased from 4.1% to 3.7%

- Fleet growth rate dipped slightly from 3.2% to 3.1%

Trade Volatility and Long-Term Air Cargo Outlook

Despite recent trade tensions affecting global markets, Boeing’s Vice President of Commercial Marketing emphasized that these developments are unlikely to heavily disrupt long-term demand. He recalled that air cargo has consistently grown around 4% annually over the past several decades, underscoring its steady value even amid economic shifts.

Production Challenges and Safety Concerns

The industry continues grappling with the aftermath of the pandemic, as aircraft production remains roughly half of pre-COVID levels. This shortfall has led to an estimated deficit of 1,500 to 2,000 jets. Both Boeing and Airbus have faced hurdles in restoring production capacity.

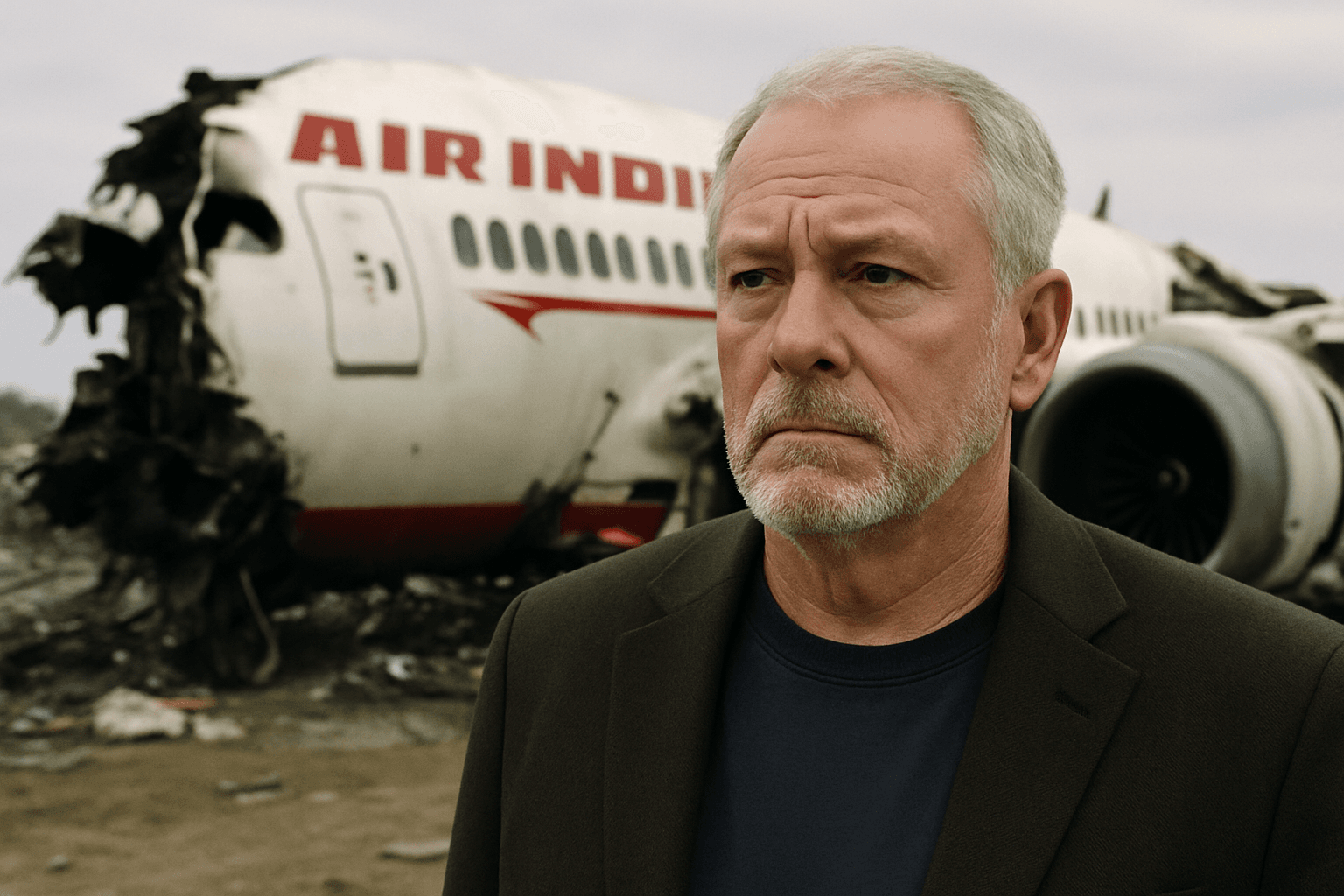

Boeing’s production has also been hampered by safety and quality issues. Following a mid-air panel blowout incident on a relatively new 737 MAX in early 2024, the Federal Aviation Administration capped monthly 737 production at 38 units. While production quality improvements have been made, a recent incident involving an Air India 787-8 Dreamliner has raised fresh concerns, prompting Boeing’s CEO Kelly Ortberg to cancel plans for the Paris Airshow to focus on the investigation.

Regional Demand and Replacement vs. Growth

Boeing projects that 51% of new aircraft demand in the coming two decades will come from growth needs rather than replacing older fleets. The fastest demand is expected from China and South/Southeast Asia, including India, which together will drive half of the additional capacity. Meanwhile, North America and Eurasia primarily account for airplane replacements.

China, representing approximately 10% of Boeing’s current order backlog, temporarily halted new deliveries amid tariff disputes with the U.S. However, Boeing anticipates deliveries will resume soon, potentially as early as this month.