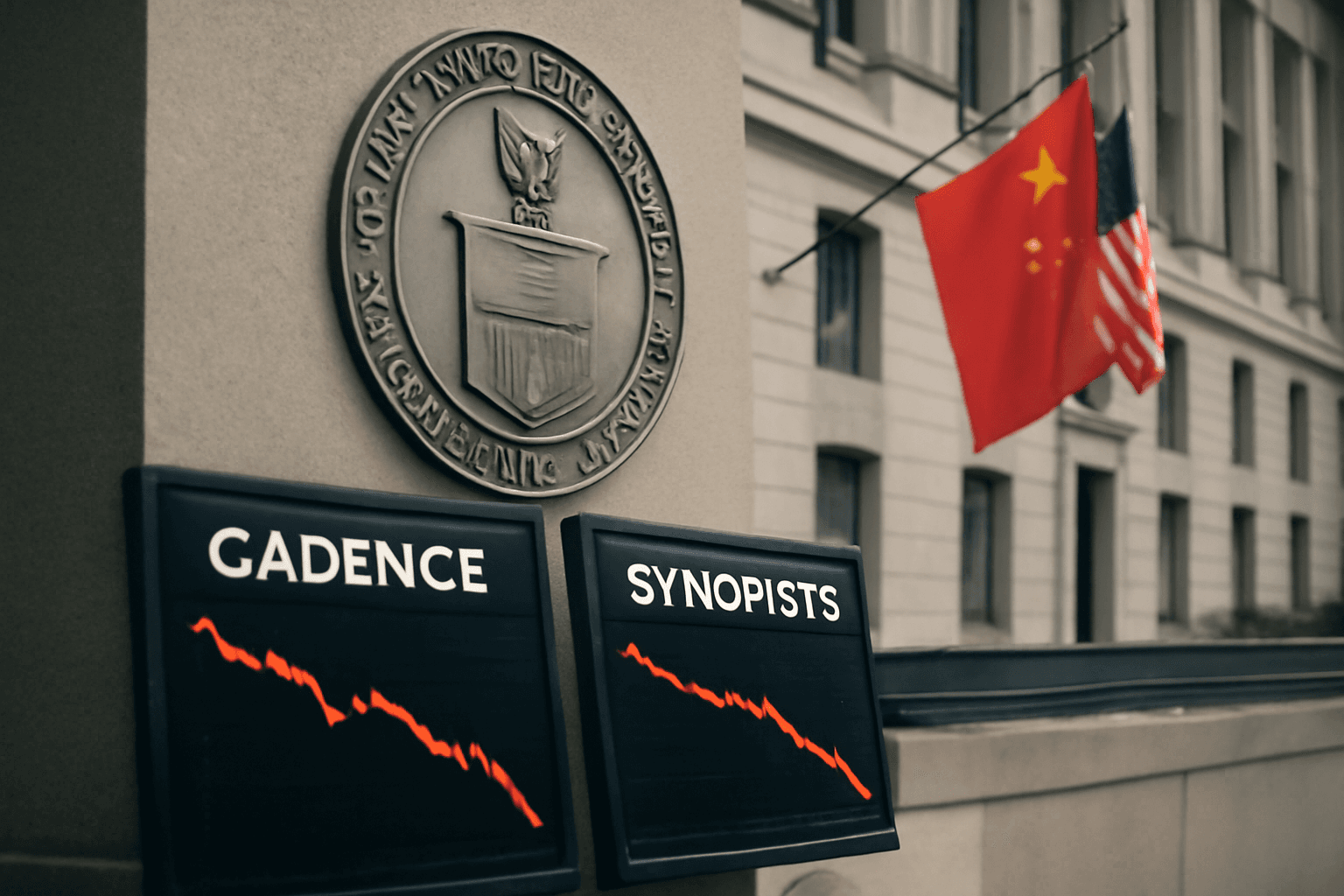

Shares of leading chip design software companies Cadence and Synopsys experienced significant declines on Wednesday following a Financial Times report that alleged the White House directed these firms to cease sales to Chinese clients. Cadence’s stock fell nearly 11%, while Synopsys shares dropped approximately 10% during trading.

The report indicated that the Bureau of Industry and Security (BIS) under the U.S. Department of Commerce issued letters instructing Cadence, Synopsys, and Siemens to halt their transactions with organizations based in China. Earlier this month, BIS also warned U.S. companies about potential enforcement actions if they use Huawei’s Ascend artificial intelligence chips.

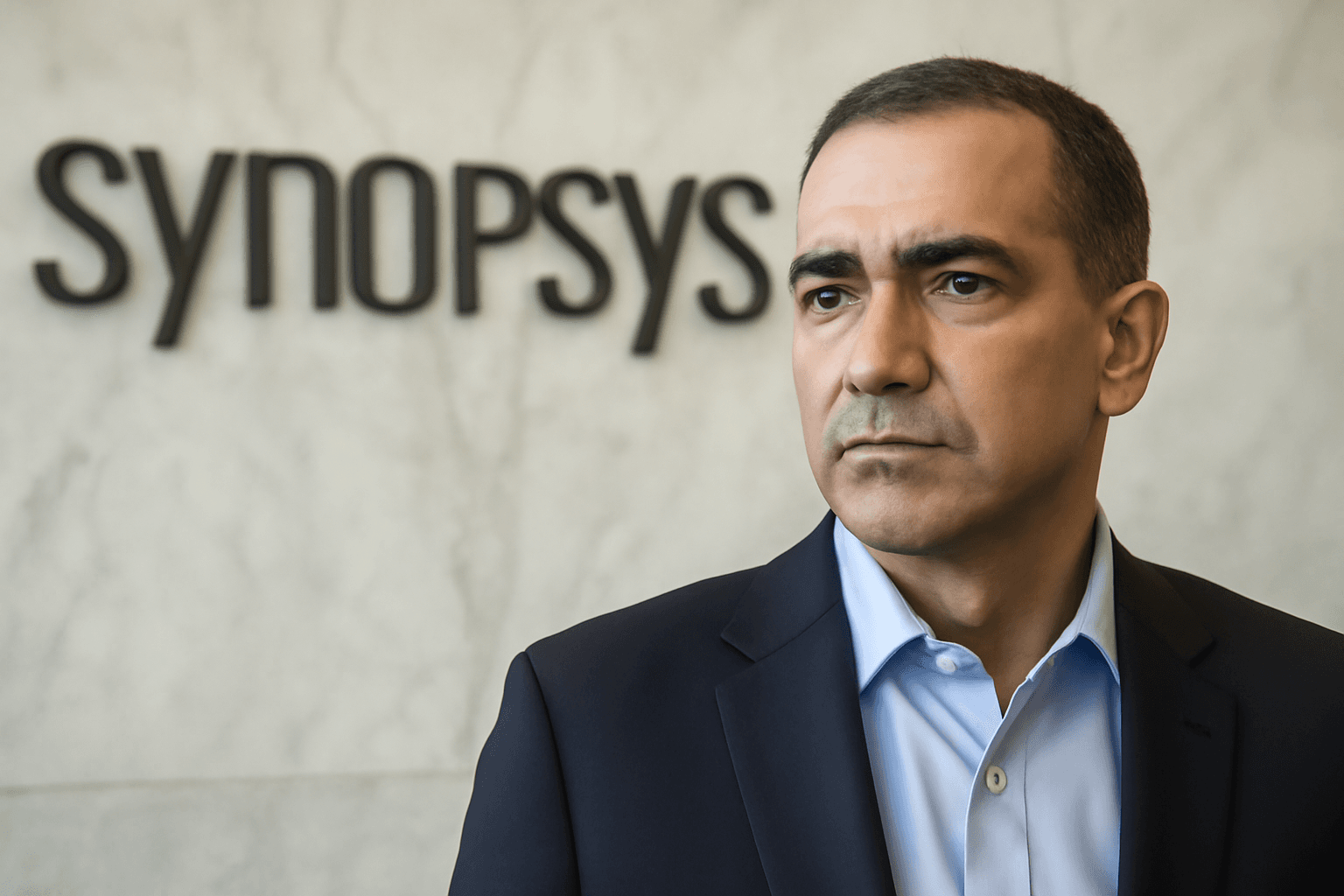

In response, Synopsys CEO Sassine Ghazi stated during a conference call that the company had not officially received a notice from BIS but anticipates reduced revenue from China for the full year. Representatives from Cadence and Siemens had yet to comment.

This development comes amid heightened trade restrictions concerning advanced semiconductor technologies, following the Trump administration’s repeal of the Biden-era chip export restrictions known as the "Diffusion Rule." Industry observers are closely watching how evolving U.S. policies might affect major players like Nvidia, which was scheduled to report earnings after market close on the same day.

China’s Ministry of Commerce criticized the move, arguing it violates the bilateral trade agreement and urged the U.S. government to reverse its decision.

The situation remains fluid as geopolitical tensions continue to influence the semiconductor sector, affecting the operations and stock performance of firms involved in chip design and related technology sales.