FATF Identifies Pakistan’s Role in State-Sponsored Terrorism

In a groundbreaking development, the Financial Action Task Force (FATF) has officially acknowledged for the first time that certain states play a direct role in sponsoring terrorism—casting Pakistan under an intensified global spotlight. Released in July 2025, the FATF’s comprehensive report aligns closely with India’s persistent allegations that Pakistan facilitates terror groups crossing borders and provides financial networks that sustain extremist violence.

Shifting the Global Narrative on Terror Financing

The FATF’s latest report titled “Comprehensive Update on Terrorist Financing Risks” marks a strategic evolution in international counterterrorism efforts, explicitly naming the involvement of governments in harboring and financing terrorist organizations. This marks a departure from previous reports that primarily focused on non-state actors without as direct a reference to state complicity.

The report underscores that elements within Pakistan’s military and intelligence establishments remain instrumental in supporting groups such as Lashkar-e-Taiba and Jaish-e-Mohammad. These groups have long been accused by India of orchestrating cross-border attacks, including deadly assaults in Jammu and Kashmir and other sensitive regions.

The Digital Frontier: Financing Terror Through E-commerce and Virtual Platforms

Another critical highlight from the FATF concerns the exploitation of digital financial ecosystems—such as e-commerce marketplaces, virtual payment platforms like PayPal, Electronic Point of Sale Machines (EPOMs), and even VPN networks—to funnel money and procure weapons for terrorist operations. Notably, the 2019 Pulwama suicide attack and the 2022 Gorakhnath Temple attack were cited as case studies where such sophisticated digital financing techniques were employed.

This revelation exposes a growing vulnerability in global financial systems, emphasizing the need for tighter regulation and surveillance of online monetary transactions to thwart extremist funding chains.

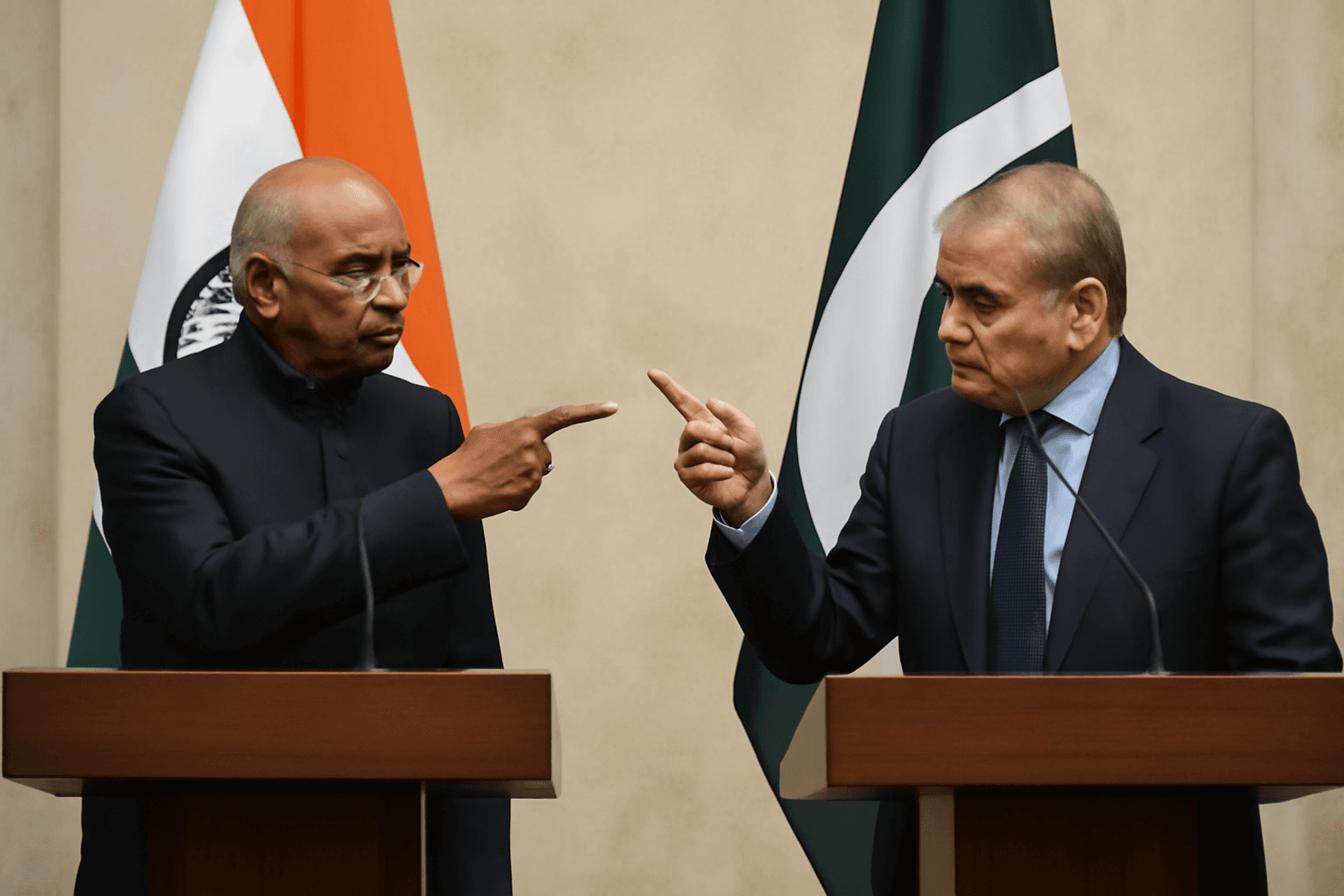

India’s Diplomatic Push and Reinforcing International Pressure

While the FATF refrained from explicitly naming Pakistan in the report, its findings bolster India’s diplomatic campaign urging the re-instatement of Pakistan on the FATF grey-list. Indian policy makers are advocating for rigorous international sanctions, travel restrictions on individuals linked to terror finance, and opposition to loans and international aid flowing to Pakistan until it demonstrates credible action against terror networks.

In April 2025, India escalated its efforts at major forums like the World Bank and FATF, highlighting the urgency to apply direct financial pressure on Pakistan—an approach now vindicated by the FATF’s acknowledgment of state-sponsored terrorism dynamics.

Why This Report Matters: Strategic and Policy Implications

- International Accountability: By explicitly citing state involvement, FATF sets a precedent for holding sovereign nations accountable, compelling a coordinated global response.

- Enhanced Sanction Mechanisms: The findings empower advocates for multilateral sanctions, including tighter financial monitoring and punitive measures targeting networks that facilitate terror financing.

- Addressing Evolving Threats: Focus on digital platforms reveals how terrorist financing adapts to technological advancements, underscoring the evolving nature of counterterrorism challenges.

- Regional Security Dynamics: For South Asia, particularly India and its neighbors, this framework strengthens mechanisms to combat cross-border terrorism and destabilization efforts.

Expert Commentary: Navigating Complexities Ahead

Security analysts emphasize that while FATF’s report is a historic stride, implementing effective change is fraught with geopolitical sensitivities. Pakistan’s strategic position and its denial of allegations complicate enforcement. Nonetheless, FATF’s report offers a critical tool not only for India but also international partners seeking to isolate terror networks financially.

Legal experts point out that disrupting terror financing is central to undercutting extremist operations, highlighting the necessity for enhanced cooperation among financial institutions, intelligence agencies, and governments worldwide.

Looking Forward: Challenges and Opportunities

Global stakeholders must grapple with balancing diplomacy and security interests while adapting to the accelerating digitization of financial transactions exploited by extremist groups. Strengthening cross-border financial intelligence-sharing and fortifying regulations on virtual payment systems will be vital steps.

Editor's Note

The FATF’s unprecedented acknowledgement of state-backed terrorism ushers in a new era of international accountability. This move not only validates long-standing concerns raised by India but also shines a flashlight on the dark corners of digital finance exploited by extremist networks. As nations race to adapt regulatory frameworks and diplomatic approaches, the report compels us to ask: Will this lead to tangible action or remain another chapter in a cyclical geopolitical tug-of-war? The stakes for regional peace and global security have never been higher.