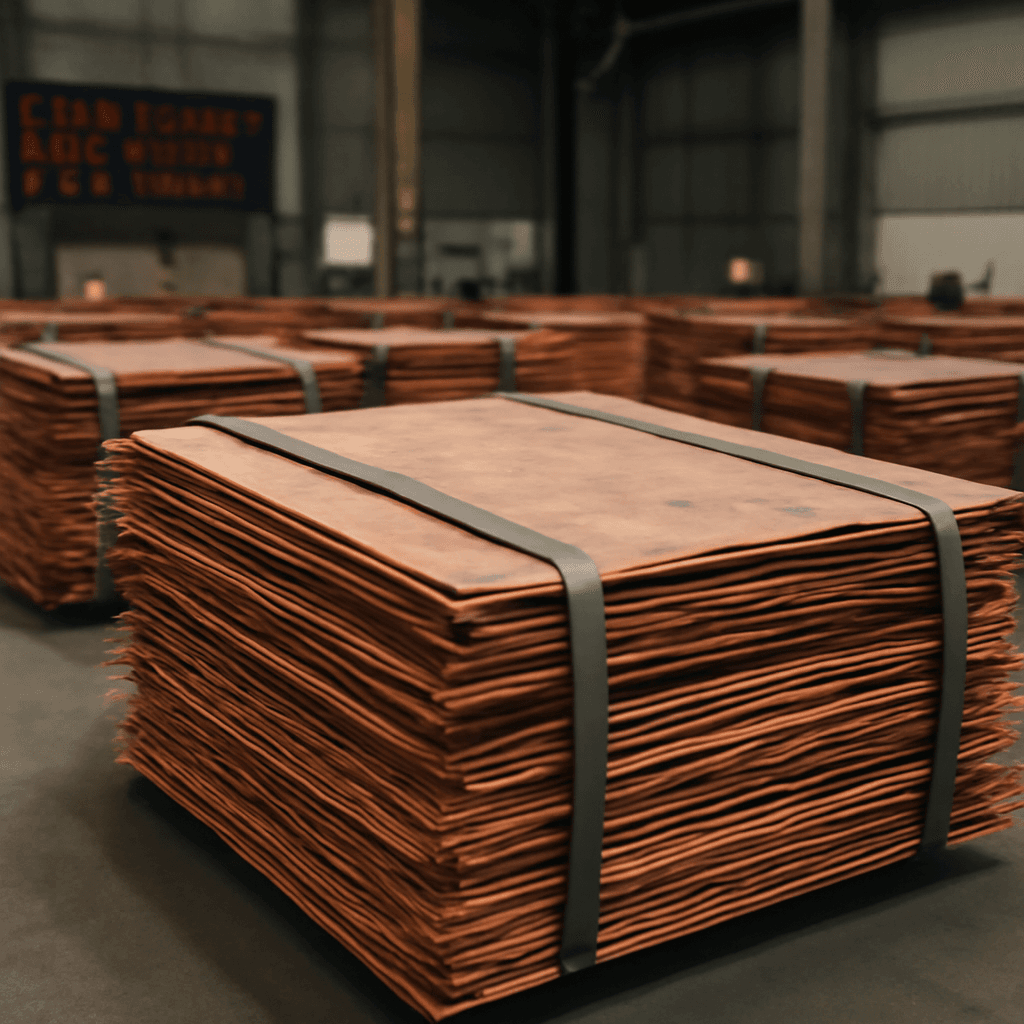

The Tug of War in the Copper Market Amid Tariff Uncertainty

The copper market is currently caught in a complex push-pull dynamic driven by uncertainty around tariffs. As traders and businesses try to anticipate shifts in government policy, traditional market signals have become increasingly unreliable.

Dr. Copper and Its Economic Indicator Role

Often dubbed "Dr. Copper" for its sensitivity to global economic trends, this metal’s price movements typically mirror industrial demand and overall economic health. However, despite healthy gains, copper’s trajectory is showing signs of strain amid tariff concerns.

Since early May, the front-month copper futures contract has climbed more than 5%, signaling optimism. Yet, it remains below the year’s high set in late March, just before tariff fears rattled markets. Supporting the metal’s positive momentum, copper-related equities such as Freeport-McMoRan and Southern Copper have soared by over 11% and 9%, respectively, in the past month.

Complex Forces at Play: Front-Loading and Market Signals

Despite these encouraging numbers, the picture isn’t so clear-cut. Amy Gower, a commodities strategist, highlights how several factors are clouding the copper outlook. One prominent factor is "front-loading"––U.S. companies are rapidly buying copper ahead of possible new tariffs, creating a temporary boost in demand and prices.

Gower explains, "Copper faces diverging market forces. Inventories at the London Metal Exchange are dropping swiftly as shipments head to the U.S., which pushes prices and time spreads higher. Yet, signals from China’s market are weakening, suggesting potential downside risks ahead."

Government Moves and Supply-Demand Dynamics

The backdrop to this uncertainty includes a February executive order directing an investigation into potential copper tariffs. This levy could come in addition to existing tariffs, further complicating supply dynamics.

The rush to stockpile copper up front is causing an artificial upward squeeze in prices. However, this might be short-lived, as shifts on the supply side and demand in China could reverse the trend.

For instance, China exported 77,000 tonnes of copper in April alone, a trend likely to continue, which may ease pressure on inventories in London. Additionally, the rapid growth in solar installations in China—up by a staggering 70% year-to-date from January to April—is expected to slow as new power tariffs take effect from June.

Meanwhile, U.S. demand could dampen if tariffs on copper imports are formally announced, compounding downward pressure on prices.

What Lies Ahead for the Copper Market?

The interplay of tariff threats, preemptive buying, and shifting demand patterns suggests the copper market is in for a volatile ride. Businesses and investors alike will be watching closely as policy decisions unfold and global supply-demand factors evolve.