Trump’s Escalating Tariffs on India and the Unintended Consequences for Americans

On July 30, 2025, the United States government, under former President Donald Trump, imposed a 25% tariff on Indian imports, alleging unfair trade practices. Barely a week later, an additional 25% tariff was announced, escalating the total to a staggering 50%. What began as an aggressive trade move against India now threatens not only the longstanding diplomatic ties between the two nations but also risks significant economic repercussions for American consumers and businesses alike.

The Price Americans Might Pay: From Tariffs to Inflation

While tariffs appear as a straightforward mechanism to correct perceived trade imbalances, their ripple effects extend well beyond international borders. American companies that rely heavily on Indian imports—including textiles, gems, seafood, leather products, and handicrafts—are now facing sharply increased costs. These hikes are inevitably passed on to consumers, increasing the price tag for everyday goods.

Research released in July 2025 by Yale University offers a sobering assessment: tariffs of this magnitude on close allies like India translate into an 18.4% effective tariff rate—the highest since the 1930s. This has resulted in an estimated average short-term income loss of approximately $2,400 per American household. For many families, this means a substantial bite out of disposable income, directly impacting household budgets.

Inflationary Pressures Mount on the US Economy

Further compounding the problem, a report from the State Bank of India warns that the US could see a GDP growth slowdown by 40-50 basis points due to the tariffs, alongside rising inflation. Rising input costs coupled with a weakening dollar will likely keep inflation above the Federal Reserve's 2% target well into 2026.

Higher consumer prices and inflation not only stretch household budgets but also put policymakers in a bind as they strive to balance growth with economic stability. The tariffs effectively act as a hidden tax, reducing American purchasing power and potentially slowing broader economic momentum.

Supply Chain Disruptions: The Hidden Cost

India is a linchpin for several critical US industries. It is a dominant supplier in pharmaceuticals—accounting for around 36% of US medicine imports—as well as chemicals and IT services. The tariffs risk disrupting these vital supply chains, leading to shortages or increased costs. This could ripple into healthcare sectors, raising drug prices and straining insurance and public health budgets.

Companies relying on Indian intermediates may find themselves scrambling to source from alternative countries, a transition neither instant nor cost-free. Though some firms are seeking suppliers elsewhere, few nations match India's manufacturing scale or efficiency, potentially driving even higher prices for American consumers.

Industry-Specific Impacts

- Shrimp and seafood: India is a leading exporter, particularly from shrimp farming in Andhra Pradesh. Tariffs are squeezing this sector hard.

- Textiles: Already a significant export industry to the US, tariffs threaten to stifle this market and drive price hikes.

- Pharmaceuticals & Healthcare: While pharma is currently exempted, any tariff expansion to this sector could elevate drug costs substantially.

- Information Technology: India supplies vital software and back-office services; tariffs or retaliations may increase costs for US companies relying on outsourcing.

Geopolitical Repercussions and the Risk of Retaliation

India has condemned the tariffs as unfair, highlighting double standards—particularly since China, which imports more Russian oil, has not been penalized similarly. While New Delhi has so far avoided immediate tariff retaliation, it has notified the World Trade Organization of its intent to respond if necessary, including plans to impose duties on US autos and auto parts worth an estimated $725 million.

More broadly, these trade tensions have stoked concerns about realigning global alliances. India appears to be deepening strategic cooperation with nations like China, Russia, and Brazil—moves that may not align smoothly with US foreign policy goals. This shifting geopolitical landscape underscores the complexity and potential long-term consequences of unilateral trade actions.

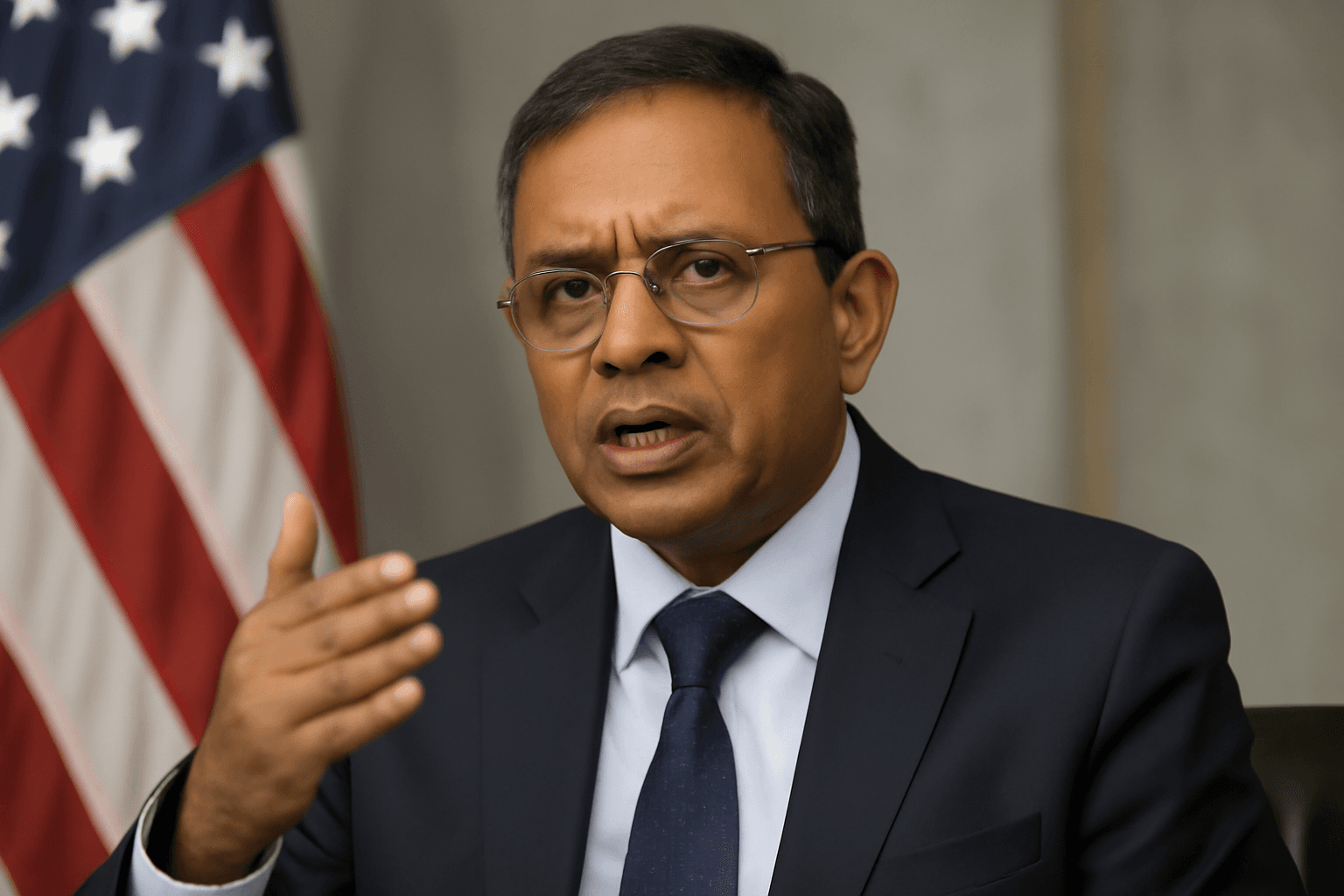

John Bolton, former US National Security Advisor, encapsulates the risks: Trump’s tariffs inadvertently provided China with a unifying message to India, emphasizing shared concerns about US trade policies. This dynamic threatens to destabilize regional balances and challenges America's influence in Asia.

Looking Ahead: Open Doors or Escalated Trade Wars?

US Treasury Secretary Scott Besent maintains that avenues remain open for trade negotiations with India. However, the shadow of these punitive tariffs looms large. For American consumers and businesses, the tariffs risk manifesting as higher prices, inflationary pressures, and disrupted supply chains.

This episode offers a cautionary tale about the complexities of trade policy, where actions intended to protect domestic interests can produce unintended consequences that ripple through the economy and international relations. In an interconnected global marketplace, balancing fair trade with economic wellbeing requires nuanced strategy rather than blunt instruments.

Editor's Note

The unfolding trade friction between the US and India raises pressing questions: How can policymakers craft trade measures that secure national interests without undermining domestic consumers? What strategies can diversify supply chains while preserving vital international partnerships? And as geopolitical alliances shift, how will trade policy intersect with broader diplomatic objectives? Keeping a close eye on these evolving dynamics is crucial for understanding the future trajectory of US-India relations and their global economic impact.