Shift in Global Energy Security: From Oil to Critical Minerals

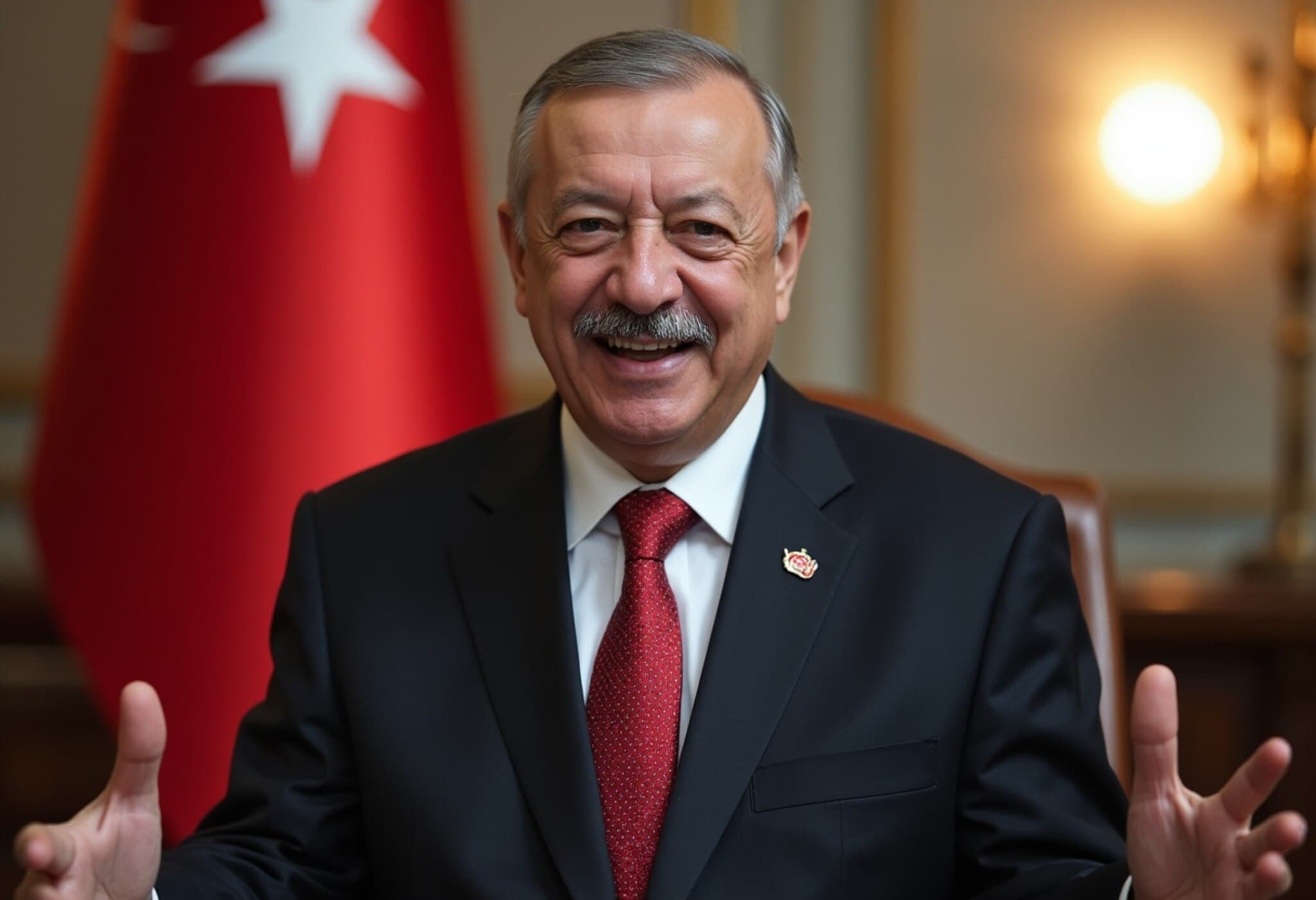

The landscape of global energy security is undergoing a profound transformation, with critical minerals now eclipsing oil and gas as the central concern. This stark shift, highlighted by International Energy Agency (IEA) Executive Director Fatih Birol, underscores emerging vulnerabilities amid an accelerating transition toward cleaner technologies and increased electrification worldwide.

The Rising Importance of Critical Minerals

In remarks delivered in Paris, Birol emphasized that traditional worries about oil supply are waning due to softening demand driven by widespread electrification and the growing dominance of electric vehicles (EVs), renewable energy sources, and artificial intelligence (AI) technologies. Instead, the need for critical minerals like cobalt, nickel, graphite, and rare earth elements has surged dramatically, positioning them as the new linchpins of energy infrastructure and digital advancement.

“A single medium-sized data center can consume as much electricity as 100,000 homes,” Birol illustrated, shedding light on the staggering energy footprint of contemporary technology and the indispensable demand for reliable, clean power to sustain this momentum.

Geopolitical and Supply Chain Risks

One of the most pressing concerns spotlighted in the IEA’s latest Global Critical Minerals Outlook is the concentration of mineral refining capacity in China. The country currently controls about 70 percent of the refining capacity across 19 of the 20 vital minerals integral to clean energy and technological devices. This entrenched monopoly raises serious questions about global supply chain resilience and diplomatic tension ramifications.

Birol warned that any supply disruption—stemming from geopolitical frictions, export curbs, or logistical bottlenecks—could trigger price surges of 40 to 50 percent for battery metals, with cascading effects on the global energy transition and economic stability.

Policy Recommendations and the Call for Global Cooperation

To mitigate these risks, Birol urged decisive government action, including:

- Public investments aimed at diversifying mineral sources and refining capabilities

- Implementation of price-stabilization tools to buffer markets from shocks

- Promotion of globalization and multilateral cooperation to prevent isolated supply disruptions

- Leveraging advanced technologies like AI for smarter resource management and supply chain transparency

“In an era marked by high geopolitical tension, critical minerals have moved to the frontline of global economic and energy security,” Birol stated. His message was clear: securing and diversifying supply chains is crucial for enabling affordable, reliable, and sustainable energy access in the 21st century.

The Broader Context: Why This Matters to America and the World

This mineral-centric energy paradigm carries significant implications for the United States and other economies striving for technological leadership and climate goals. As the U.S. government pursues ambitious targets for EV adoption and renewables integration, access to stable, ethically sourced critical minerals becomes a paramount strategic priority.

Experts stress that this challenge necessitates a multi-faceted approach involving:

- Strengthening domestic mining and refining industries

- Establishing strategic reserves of key minerals

- Enhancing recycling technologies to reclaim minerals from spent batteries and electronics

- Building partnerships with allied nations to foster secure and transparent supply chains

Failing to address these supply vulnerabilities risks hindering not only energy transition objectives but also broader economic competitiveness in a rapidly digitizing world.

Looking Forward: Navigating an Uncertain Energy Future

The dawn of a mineral-powered energy era brings promising opportunities tempered by complex risks. While reducing reliance on fossil fuels offers climate benefits, the geopolitical fragility and environmental impacts of mineral extraction and refining cannot be ignored.

Birol’s insights compel policymakers, industry leaders, and consumers alike to rethink energy security in a holistic manner, balancing innovation with sustainability and geopolitical prudence. The energy battlefront has indeed shifted, and with it, the urgency to develop resilient, diversified, and ethical mineral supply chains has become a defining challenge of our time.

Editor’s Note

As we witness this pivotal shift from hydrocarbon dominance to mineral criticality, a key question emerges: How prepared are global economies to manage these new dependencies without replicating the geopolitical vulnerabilities of the past? The path forward will demand unprecedented coordination, transparency, and innovation to safeguard the intertwined futures of energy security, economic stability, and environmental stewardship.