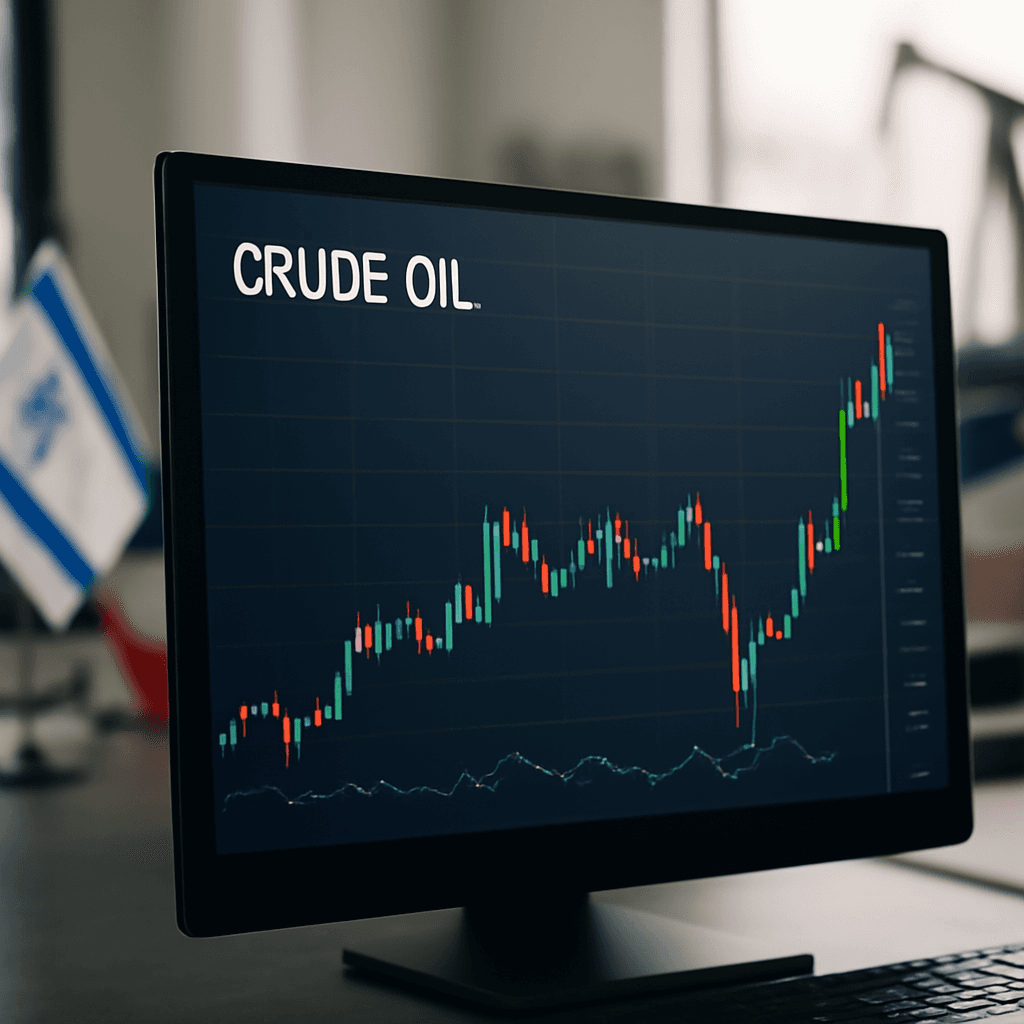

Israel's Strikes on Iran Trigger Sharp Rise in Global Oil Prices

In the early hours of Friday, a series of Israeli attacks targeted Iran’s nuclear and military facilities, sending shockwaves through global markets. As a direct consequence, crude oil prices soared, with Brent crude futures surging by 12.86% to $78.31 per barrel, while West Texas Intermediate (WTI) crude futures climbed nearly 11% to $75.49.

Details of the Targeted Strikes

The Israeli operations reportedly focused on key installations tied to Iran’s nuclear program and military infrastructure. Additionally, residences of senior Iranian commanders and officials were struck, suggesting a strategic attempt to eliminate high-ranking figures. These developments have intensified concerns over the possibility of a full-blown conflict erupting in West Asia.

Why This Matters: Impact on Global Energy and Trade

West Asia plays a pivotal role in the global energy landscape, accounting for roughly 40% of the world’s oil supply. Furthermore, approximately one-third of global maritime cargo travels through this volatile region. Any military escalation threatens to disrupt these essential energy and trade routes, potentially triggering significant supply chain disturbances.

Potential for Broader Regional Fallout

The recent surge in prices recalls the aftermath of the Israel-Hamas conflict, where Iran-backed groups like Yemen’s Houthis played a role in destabilizing maritime traffic. Continued hostilities risk further interference in shipping lanes, likely pushing oil prices even higher amid heightened geopolitical risk.

Outlook

With tensions running high and the situation evolving rapidly, markets remain on edge. Stakeholders worldwide are closely monitoring developments as further updates unfold.