The Elephant and the Dragon: A Complex Dance of Diplomacy

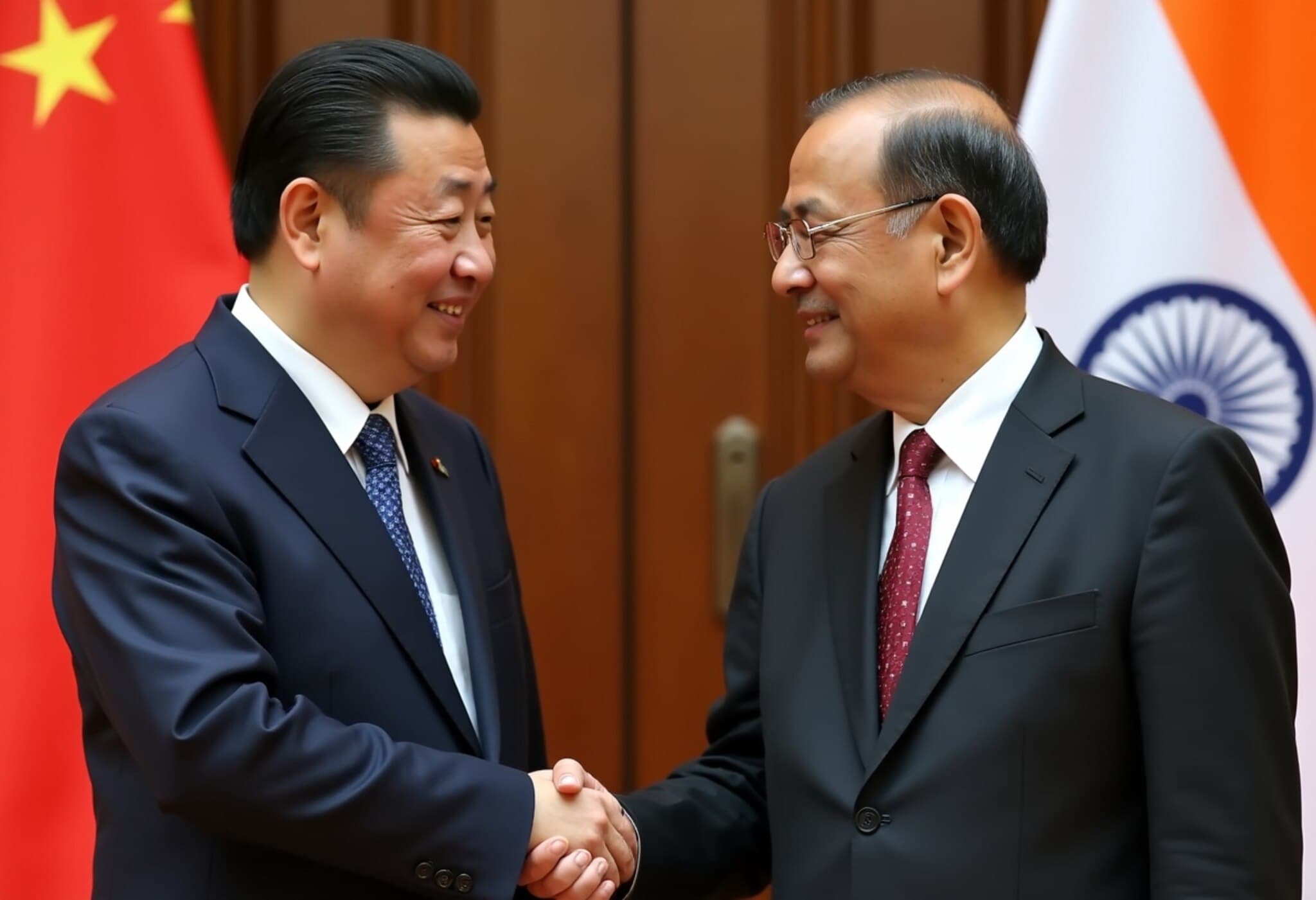

After a seven-year hiatus, Indian Prime Minister Narendra Modi is set to visit China during the 25th Shanghai Cooperation Organization (SCO) summit in Tianjin. This meeting, his first since the grim Galwan Valley clash in 2020, comes at a critical juncture where the world's two largest Asian economies face mounting pressure from U.S. tariffs and shifting global trade dynamics. As Modi and President Xi Jinping prepare to engage, the question on everyone's mind is whether this encounter signals a thaw in relations or underlines persistent mistrust.

Economic Necessity Trumps Historical Skepticism

The India-China relationship is fraught with historical grievances and strategic suspicions. The border dispute and India’s concerns around China’s close ties with Pakistan remain deep fissures that are not easily bridged. Yet, dwelled beneath the surface is a pragmatic narrative shaped by economic imperatives. With both nations feeling the heat of U.S. tariffs, an unspoken incentive exists to explore cooperative avenues that might mitigate economic losses.

As Amit Bhandari, senior fellow at Gateway House, aptly summarizes, "The suspicion of China runs deep in India," yet the shifting supply chain landscape nudges them closer. Indeed, Chinese Foreign Minister Wang Yi’s recent statements urging both countries to see each other as “partners rather than threats” underscores a diplomatic softening, if not complete reconciliation.

Trade Deficits and Strategic Dependencies

- India-China Trade Deficit: India’s trade deficit with China hit an alarming $99.2 billion in the fiscal year ending March 2025, up from $85 billion the previous year, driven by a record $113.45 billion in imports from Beijing.

- U.S. Trade Surplus: In contrast, India enjoys a robust goods trade surplus with the U.S. at $45.8 billion as of 2024.

- Market Access Barriers: India continues to push China to alleviate market access issues, yet progress is slow amid geopolitical strains.

Despite India's push to emerge as a manufacturing hub for global brands seeking alternatives to China, certain industries remain heavily reliant on Chinese inputs. For instance, China supplies 70% of active pharmaceutical ingredients (APIs) for India’s generic medicine sector, and nearly 90% for biosimilar APIs. Similarly, the electric vehicle (EV) industry in India depends significantly on China for critical components like rare earth magnets, lithium, and cobalt.

Electric Vehicles: The Battleground and Opportunity

India’s aggressive goal to have EVs account for 30% of new vehicle sales by 2030 highlights both ambition and vulnerability. Currently, just 7.6% of new vehicle sales are electric, and the overwhelming dependency on Chinese raw materials exposes a strategic weakness. According to Bhandari, “The Indian government has inadvertently positioned a key manufacturing sector to be vulnerable to supply chain disruptions from China.”

However, China is not immune to benefiting from this relationship. With its own domestic consumption slowing, access to India’s emerging EV market and manufacturing ecosystem presents lucrative opportunities for Chinese firms like BYD. The reopening of direct flights and border trade points signals tangible steps towards easing economic friction.

Geopolitical Undercurrents and Strategic Calculations

Beyond trade, the geopolitical landscape shapes interactions. China’s arms exports to Pakistan, which constitute 63% of its global arms sales from 2020 to 2024, remains a thorny issue for India. This dynamic complicates any diplomatic rapprochement, coloring talks with underlying vigilance.

Moreover, India’s bans on several Chinese companies such as Shein and TikTok reflect deep-rooted security and political concerns, which often clash with economic cooperation efforts.

Is Lasting Partnership Within Reach?

Experts remain cautious about interpreting Modi’s visit as a prelude to long-term friendship. Priyanka Kishore, principal economist at Asia Decoded, points out that while India aspires to be a “China Plus One” manufacturing alternative, it must overcome intermediate supply challenges dependent on China. Meanwhile, Chinese industries are grappling with excess capacity, looking to expand abroad.

The upcoming SCO summit will reveal how much each side is willing to compromise — or whether the “elephant and dragon” will continue their cautious dance marked by cooperation laced with competition.

Editor’s Note: Navigating Between Competition and Collaboration

The Modi-Xi summit offers a nuanced portrait of two economic giants balancing rivalry and the pragmatic need for cooperation. While historical grievances and strategic mistrust remain substantial hurdles, the economic logic—particularly against the backdrop of U.S.-imposed tariffs and shifting global supply chains—creates pressure for dialogue.

For policymakers and industry stakeholders, the key takeaway lies in recognizing that neither isolation nor blind rapprochement is viable. Instead, measured, issue-specific engagement coupled with safeguarding strategic sectors might chart the most realistic path forward.

Questions for the future: Can India successfully reduce its vulnerabilities in critical manufacturing sectors without alienating China completely? Will China adjust its geopolitical strategies to foster better trust with India? The answers will significantly shape Asia’s economic and political landscape in the years to come.