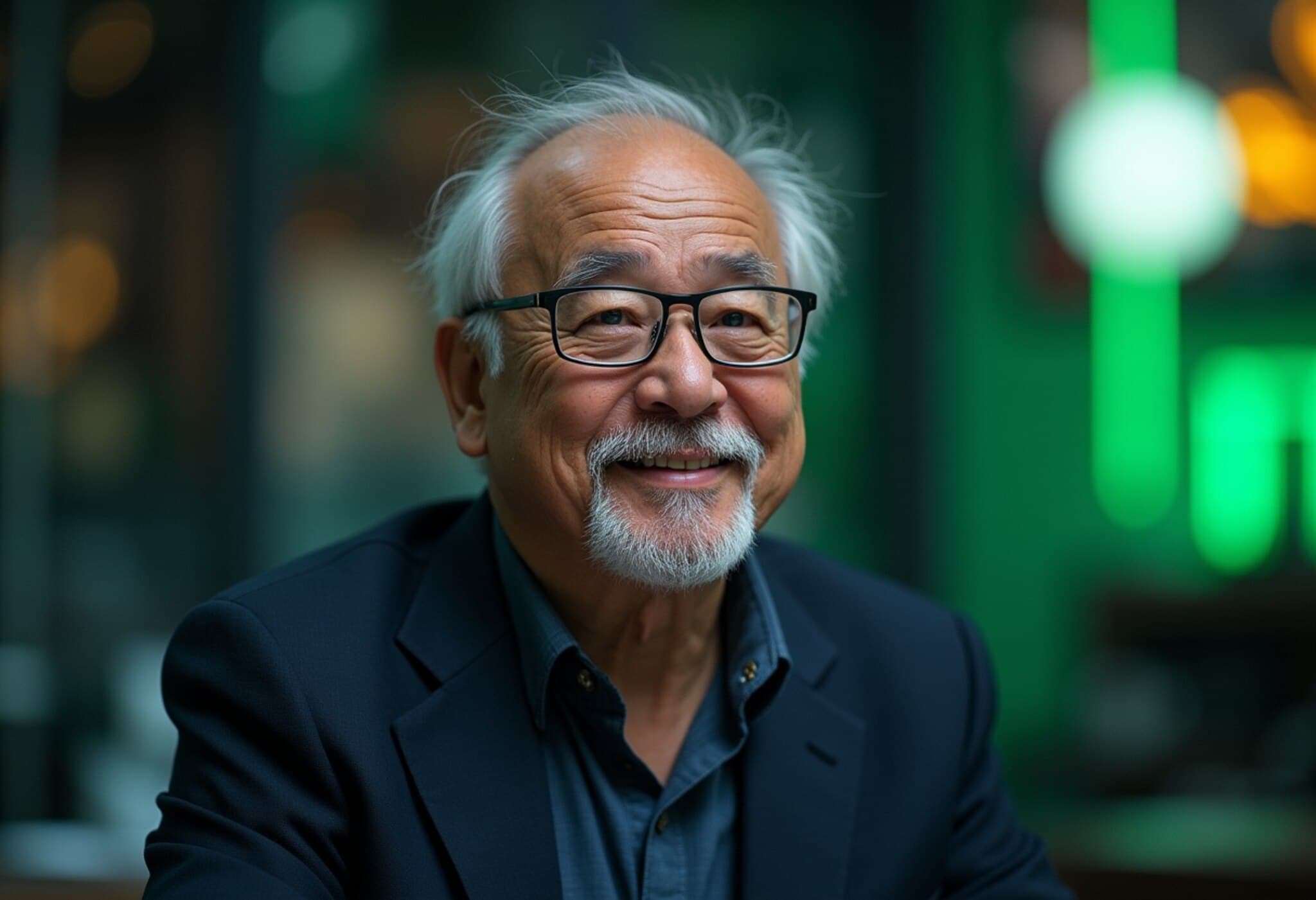

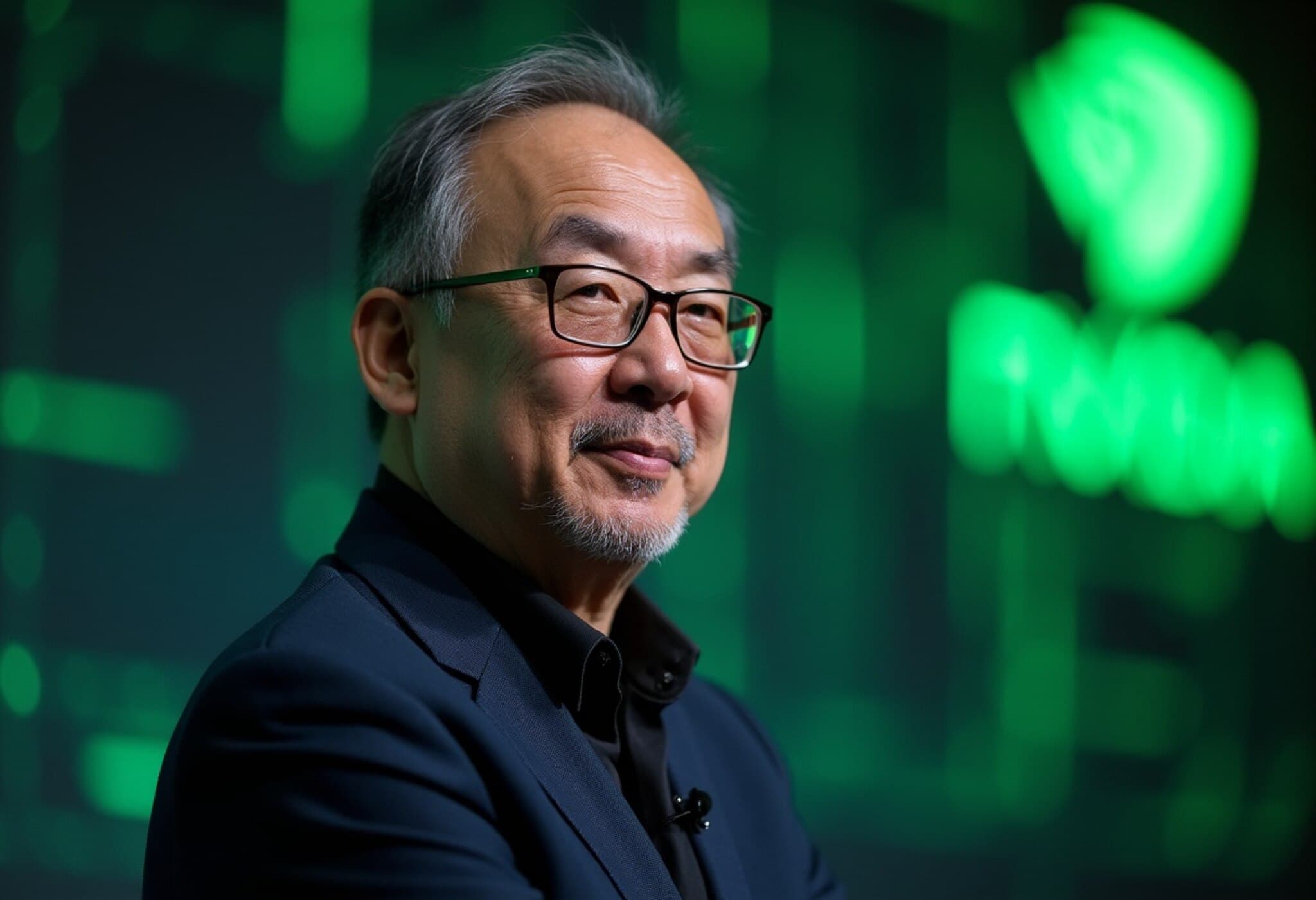

Nvidia CEO Jensen Huang Offloads $36.4 Million in Shares Amid Soaring Wealth

In a bold move that underscores both confidence and strategic financial planning, Nvidia CEO Jensen Huang recently sold approximately $36.4 million worth of Nvidia stock, equating to 225,000 shares, as revealed by a recent SEC filing. This transaction forms part of a pre-established plan Huang adopted in March to gradually divest up to 6 million shares through the end of 2025.

Steady Share Sales Amidst Nvidia’s Market Momentum

Huang's sale follows an earlier batch in June, where he liquidated shares valued at nearly $15 million. Notably, last year he sold shares exceeding $700 million under a similar arrangement, signaling a consistent approach to managing his stake in the company.

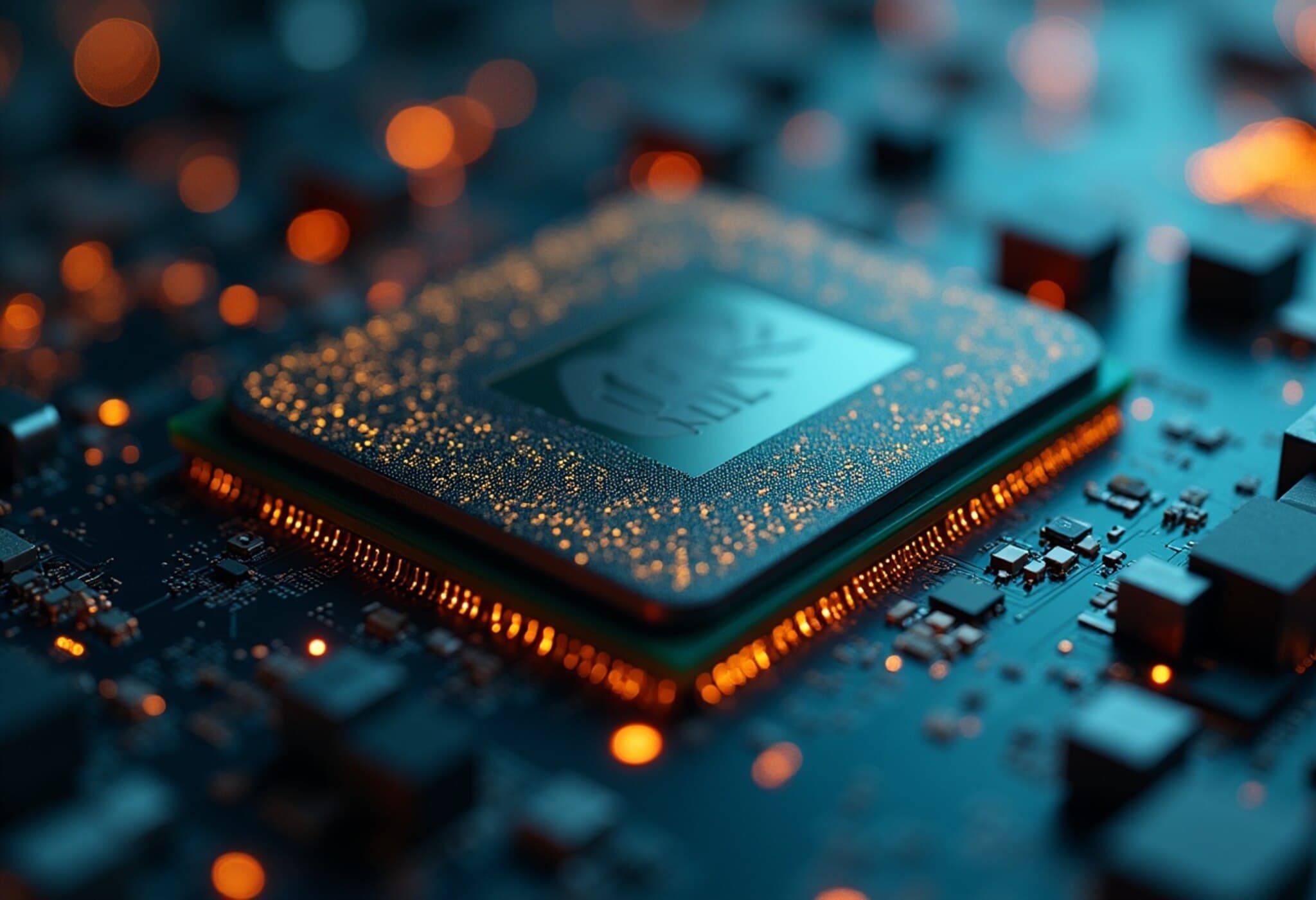

Despite the stock sales, Nvidia's shares continue to demonstrate resilience, with a modest increase of about 1% reported on the Friday following Huang's transaction. This reflects sustained investor optimism, particularly fueled by Nvidia’s leadership in artificial intelligence (AI) technology and its pivotal role in powering graphics processing units (GPUs) essential for training large language models.

Jensen Huang’s Wealth Skyrockets, Rivaling Warren Buffett

Perhaps most striking is Huang’s sharp rise in net worth in 2025. According to analyses from Fortune and Bloomberg, his wealth has surged by over 25%—an increase of roughly $29 billion since the year’s start.

Currently, Huang’s net worth is estimated at a staggering $143 billion, placing him virtually tied with the legendary investor Warren Buffett, whose net worth stands at around $144 billion. Intriguingly, in the moments after market opening on that Friday, Huang briefly eclipsed Buffett with an estimated $143.7 billion versus Buffett’s $142.1 billion.

The Bigger Picture: Nvidia’s Unprecedented Market Impact

This colossal personal fortune mirrors Nvidia’s remarkable corporate milestones, as the Santa Clara-based chipmaker became the first U.S. company to surpass a $4 trillion market valuation earlier this week, a feat that has set new benchmarks in the semiconductor and AI industries. Nvidia’s ascent has pushed past technology giants like Apple and Microsoft, signaling a paradigm shift where chipmakers are at the forefront of innovation.

Additionally, Nvidia’s technology caught the attention of no less than President Biden, reflecting the broader geopolitical and economic significance of semiconductor dominance in the current global arena, especially amid concerns over chip export regulations.

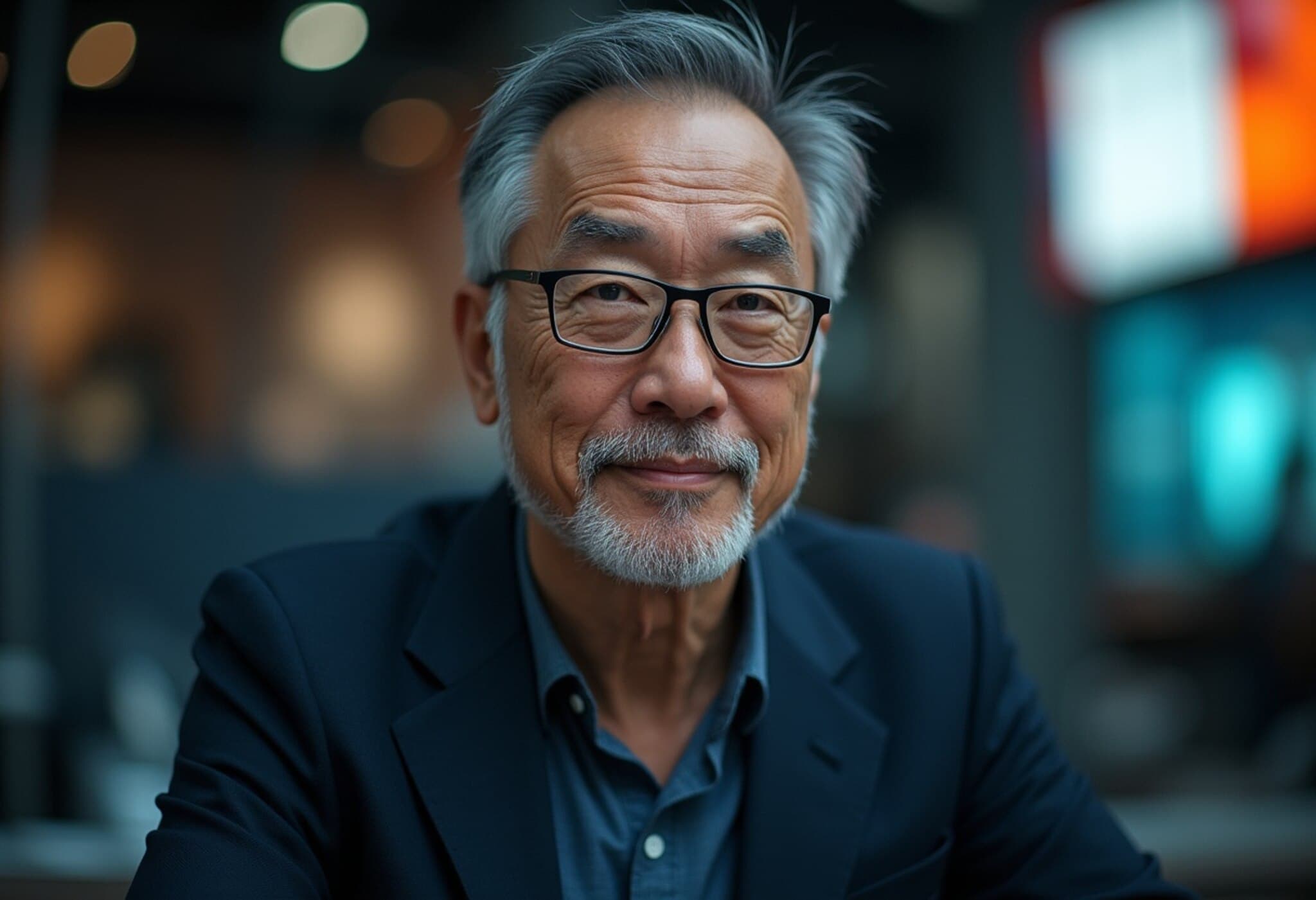

Other Key Stakeholder Moves and Shareholdings

Beyond Huang, other board members also capitalized on Nvidia's strong share performance. Notably, venture partner Rajeev Seawell, who has been on Nvidia's board since 1997, sold shares worth approximately $24 million, according to SEC filings.

Despite divesting some shares, Huang remains Nvidia's largest individual shareholder, holding over 858 million shares through various direct and indirect means, including partnerships and trusts, which reflects sustained confidence in the company's long-term prospects.

Expert Analysis: What This Means for Investors and the Market

Huang’s stock sales highlight a mature wealth management strategy often employed by billionaires to balance liquidity and portfolio diversification without signaling a lack of faith in their company’s growth. For investors, the ongoing bullishness around Nvidia underscores the expanding role of AI technologies in shaping global economies and technological ecosystems.

From a policy perspective, Nvidia’s unprecedented market cap and strategic importance bring to light the critical need for comprehensive U.S. semiconductor policies that support innovation while addressing security and supply chain vulnerabilities amid rising global competition.

Conclusion

Jensen Huang’s recent stock sales and soaring net worth are emblematic of Nvidia’s transformative impact on technology and markets in 2025. As the AI wave continues to swell, Nvidia’s leadership and strategic positioning remain central to discussions around technological progress, economic influence, and even geopolitical dynamics in the semiconductor arena.

Editor's Note

Jensen Huang’s financial moves and Nvidia’s market triumphs raise intriguing questions: How will Nvidia navigate increasing regulatory scrutiny while maintaining innovation dominance? What risks accompany the soaring valuations in the AI chip sector? And ultimately, what does Huang’s near parity with Warren Buffett signal about shifting dynamics among the world’s wealthiest and most influential business leaders? As Nvidia charts this remarkable course, these are critical considerations for investors, policymakers, and industry watchers alike.