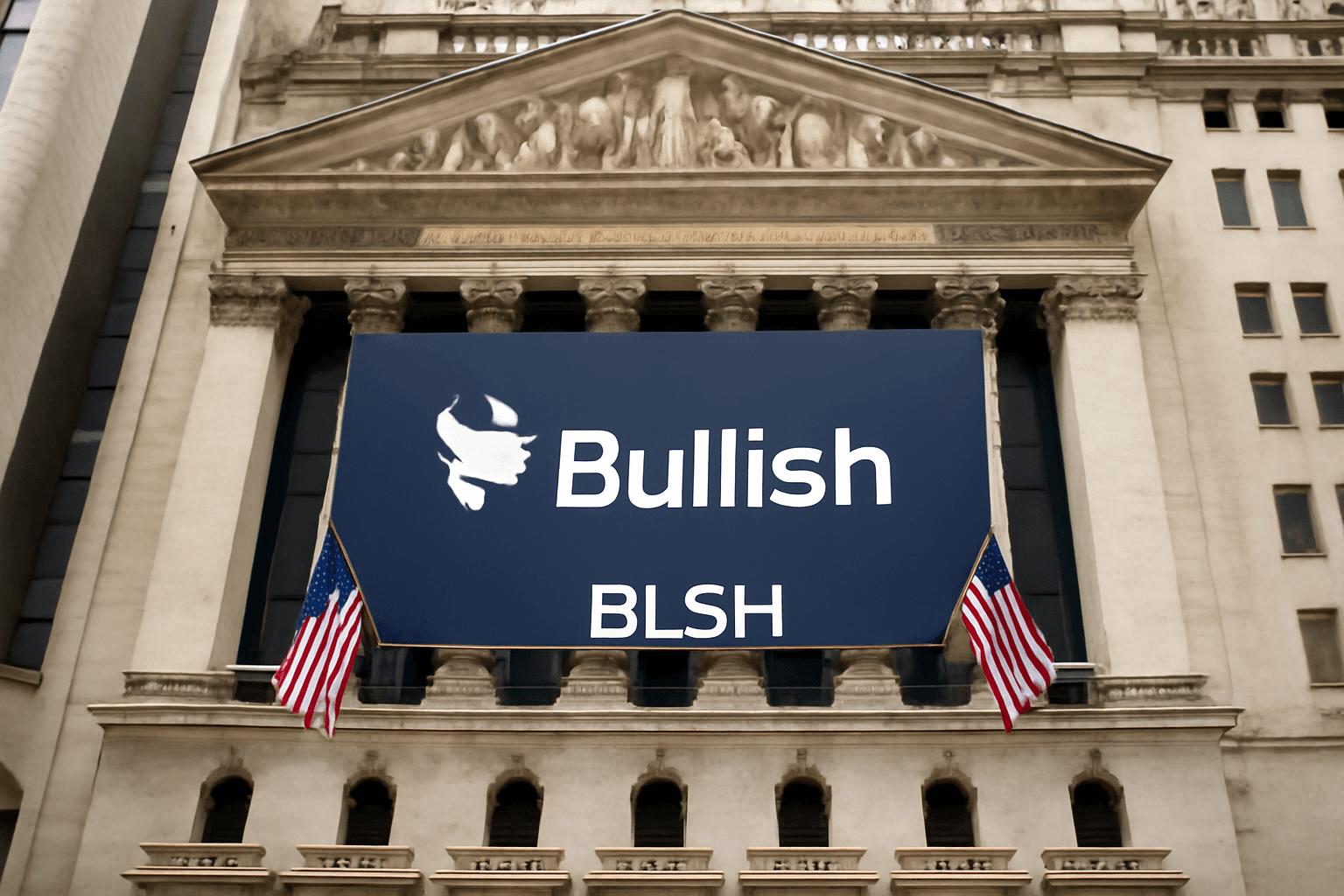

Peter Thiel-Backed Crypto Exchange Bullish Prepares to Debut on NYSE

In a major move signaling growing institutional confidence in digital assets, Bullish, a cryptocurrency exchange backed by venture capitalist Peter Thiel, officially filed to go public on the New York Stock Exchange (NYSE) under the ticker symbol "BLSH". The announcement on July 18, 2025, spotlights Bullish’s ambition to carve a distinct space amid fierce competition and regulatory uncertainties facing the crypto market.

Trading Milestones and Market Position

Founded as a spinout from blockchain technology company Block.one, Bullish launched with initial funding from Thiel’s Founders Fund and Thiel Capital, alongside strategic investors like Nomura and crypto veteran Mike Novogratz. Notably, Bullish acquired the influential crypto media platform CoinDesk in 2023, signaling its intent to influence both markets and narratives.

The company’s initial public offering (IPO) registration reveals encouraging metrics: as of March 31, 2025, Bullish reports that total trading volume since inception has surpassed an impressive $1.25 trillion. Moreover, the exchange claims an average daily trading volume exceeding $2.5 billion in the first quarter alone, consistently ranking within the top five global exchanges for spot trading of Bitcoin and Ethereum.

Leadership Backed by Wall Street Experience

At the helm is CEO Tom Farley, who brings deep financial market expertise as a former president of the NYSE. His leadership could prove critical in positioning Bullish as a compliant, credible alternative in a crypto ecosystem historically marred by controversies and regulatory roadblocks.

Crypto Industry’s Push for Mainstream Acceptance

Bullish’s IPO filing underscores a broader industry trend: the relentless pursuit of legitimization and broad adoption of digital assets. With heavy hitters like Peter Thiel advocating for innovation, crypto exchanges are navigating complex legal, economic, and technology challenges to meet stringent U.S. regulatory standards.

2025 has already seen several landmark crypto-related public listings, including Circle’s blockbuster IPO in June, which saw its stablecoin-linked shares surge over sevenfold. Other significant players, like Vancouver-based Wealthsimple and the Winklevoss twins’ Gemini exchange, have taken tangible steps toward U.S. public markets, hinting at a maturing marketplace.

Regulation and Investor Confidence

Investor enthusiasm toward cryptocurrencies, particularly leading assets like Bitcoin—currently trading above $117,000—reflects growing confidence alongside mounting regulatory clarity. Recently, President Biden signed the GENIUS Act, a pivotal regulatory framework that offers consumer protections around stablecoins tethered to the U.S. dollar, aiming to reduce cryptocurrency volatility and promote market stability.

Bullish explicitly cites in its SEC filing its mission to advance the adoption of stablecoins, digital assets, and blockchain technology, aligning with public policy trends seeking to balance innovation with investor safeguards.

Political and Financial Backing Fuels Growth

Behind the scenes, crypto industry titans—among them Peter Thiel and David Sacks, an AI and crypto advisor to former President Trump—have actively lobbied for policies that strengthen digital asset infrastructures and drive regulatory acceptance. Their efforts, coupled with substantial campaign contributions, underscore the interconnected influence of finance, politics, and technology shaping crypto’s future.

What Lies Ahead for Bullish and the Crypto Market?

As Bullish embarks on the challenging journey toward becoming a publicly traded company, it enters an arena where scrutiny will intensify. Success depends not only on trading volume or technological innovation but also on navigating U.S. regulations, managing market volatility, and earning investor trust amid ongoing debates about crypto’s sustainability and security.

Industry observers will be watching closely to see if Bullish’s blend of legacy market expertise and digital asset innovation can set new standards for crypto exchanges and potentially accelerate mainstream adoption.

Editor’s Note

Bullish’s public offering highlights a pivotal moment for the cryptocurrency sector—merging cutting-edge technology with traditional financial markets. Yet, questions remain about how well these new entrants can reconcile the rapid pace of crypto innovation with the cautious scrutiny of public investors and regulators. As digital assets continue their transformation from fringe investments to mainstream financial instruments, the stakes for market stability and consumer protection have never been higher.