Collins and Hawley Join Forces to Advance GOP's Major Tax Legislation

Two influential Republican senators, Susan Collins of Maine and Josh Hawley of Missouri, have declared their support to move forward the Senate version of a sweeping tax bill often referred to as President Trump's "big, beautiful bill." Their backing comes after significant revisions were introduced on Friday, aiming to address concerns raised by critical holdouts.

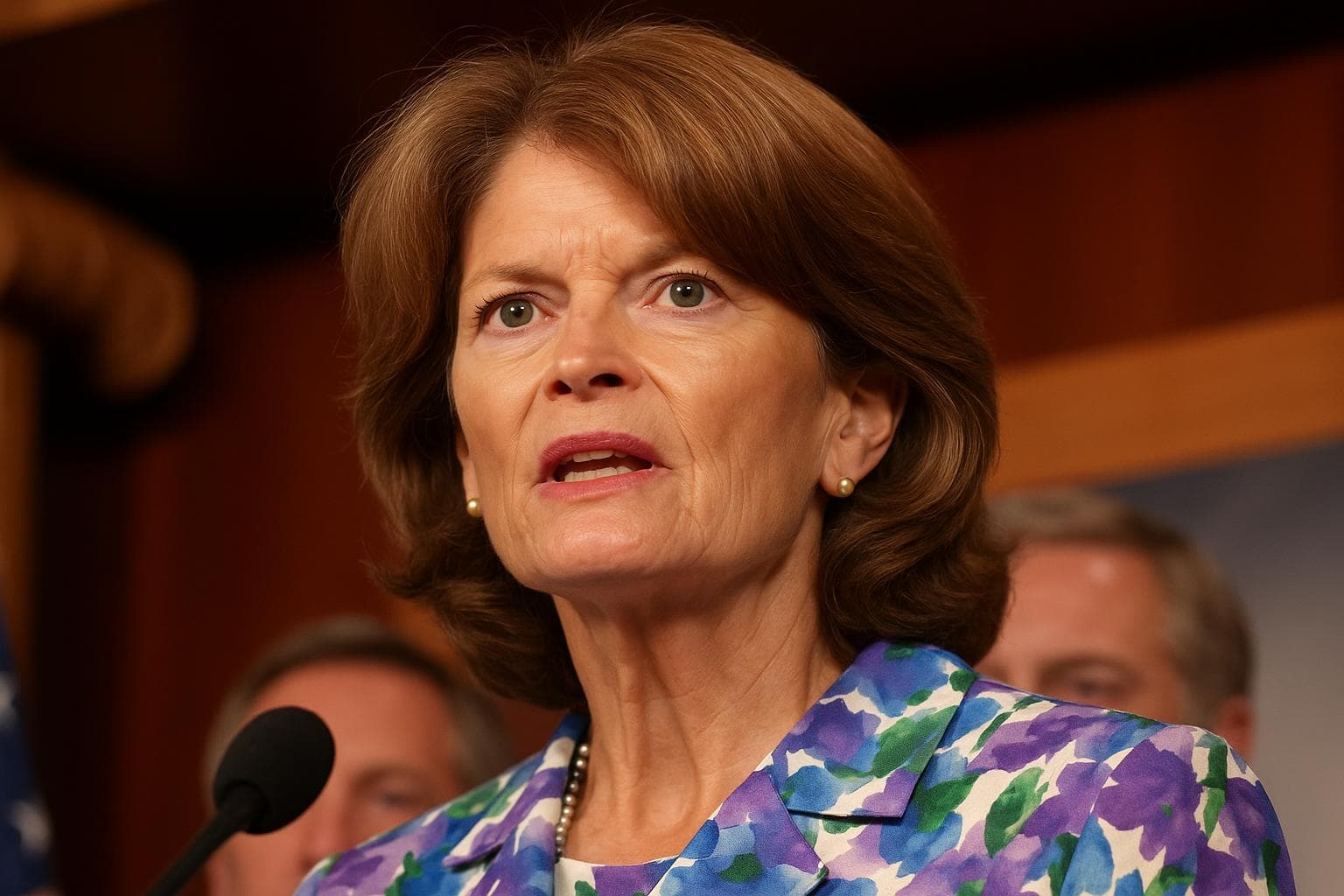

Collins Offers Conditional Support, Seeking Further Amendments

Senator Collins announced she will vote to proceed with the legislation, primarily out of respect for Senate Majority Leader John Thune's authority to schedule bills for floor debate. However, she emphasized her vote on the motion to proceed does not necessarily predict her support for final passage.

"I plan to support the motion to proceed but retain substantial reservations about the bill as it currently stands," Collins said. "There are some positive changes in the latest version, but I intend to propose multiple amendments seeking further improvements."

Crucial Votes Amid Slim GOP Majority

With the Senate GOP holding 53 seats, the party can only afford three defections for the bill to pass. Senators Rand Paul (R-Ky.) and Ron Johnson (R-Wis.) have already indicated opposition, and Senator Thom Tillis (R-N.C.) stated he plans to vote against both the motion to proceed and the final bill.

Hawley Cites Medicaid Funding Boosts as Key Reason for Support

Senator Hawley, previously concerned about substantial Medicaid spending cuts in the legislation, revealed that recent changes would boost federal Medicaid funding for Missouri considerably over the next four years.

He highlighted provisions including the delay in the provider tax framework and an increase of the rural hospital relief fund from $15 billion to $25 billion. The revised funding formula aims to deliver more federal resources to Missouri healthcare providers.

Additionally, Hawley noted a crucial inclusion of $1 billion in funding to assist Missourians affected by radiation exposure linked to 1940s-era nuclear weapons development, a component of the Radiation Exposure Compensation Act that he championed.

"These changes will result in more Medicaid dollars flowing into Missouri through 2030," Hawley said. "On this basis, I am voting yes on the bill."

Next Steps in the Senate

If the motion to proceed passes by a simple majority, the Senate will begin formal debate on the nearly 1,000-page bill. This phase will be followed by a "vote-a-rama," a procedural session allowing senators to offer unlimited amendments before a final vote.

Context: What the Bill Entails and Related Political Dynamics

This legislation aims to extend elements of the 2017 tax cuts while making considerable modifications to federal spending, particularly Medicaid. Advocates express concern over potential Medicaid cuts impacting rural hospitals, though recent adjustments to the rural hospital stabilization fund seek to mitigate such effects.

Collins, a moderate Republican with significant influence, continues pressing for even larger funding increases to support rural healthcare providers, signaling ongoing negotiations ahead.

The bill remains a litmus test for GOP cohesion, with key holdouts weighing the benefits of tax relief against the potential impacts of spending adjustments on their states.