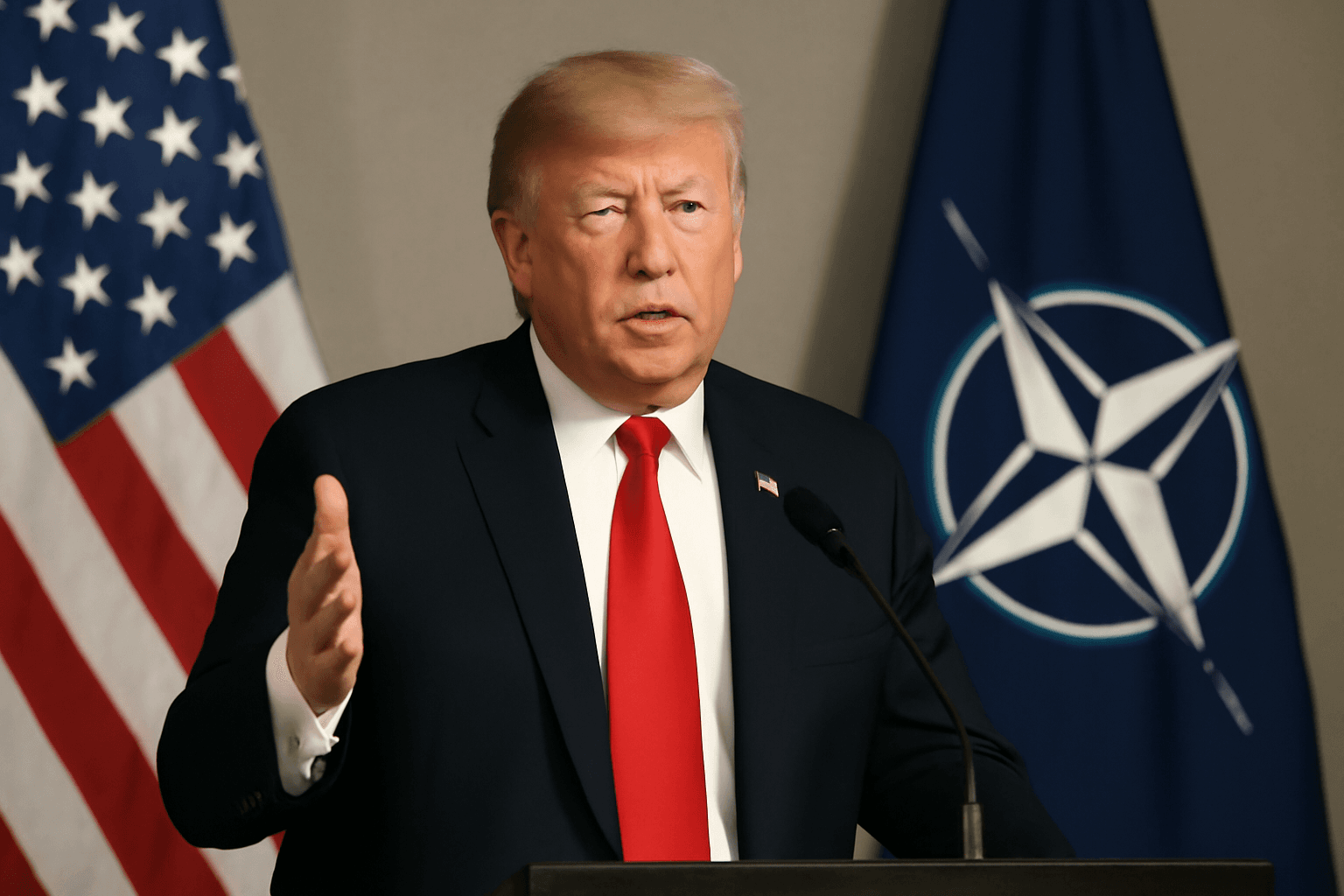

Trump’s Late-Night Trade Announcement Rocks Global Markets

On the eve of the August 1 deadline, President Donald Trump once again stunned the global trade community by unveiling a series of new tariffs and escalating duties — some hitting as high as 40% on transshipped goods. This unexpected move, announced just hours before the clock struck midnight, is yet another twist in a pattern of last-minute trade decisions that have kept markets and policymakers perpetually on edge.

The Unpredictable Art of Trump’s Trade Strategy

If this scenario sounds familiar, it’s because it has become a hallmark of Trump’s approach to trade negotiations. From blanket tariff hikes to surprise deadline extensions, businesses and governments have been forced to scramble repeatedly, recalibrating forecasts and supply chains with little warning.

Economist and former U.S. trade negotiator Stephen Olson commented, “Trump has fundamentally rewritten the rules of global trade. By stepping away from the free trade architecture the U.S. helped build, the stability of the system is in question.” Olson warns that this ongoing ‘geopolitical reality show’ is far from over, with more tariffs or deals on the horizon.

Historical Context: From NAFTA to ‘Liberation Day’ Tariffs

This modus operandi is not without precedent. Recall how Trump leveraged the threat to scrap NAFTA, pushing Canada and Mexico into last-minute concessions that resulted in the USMCA agreement, which tightened automotive, labor, and digital trade rules. Just before rolling out broad trade barriers, the president framed the shift as a 'very big and exciting day,' underscoring a clear message: comply swiftly or face steep tariffs.

Last-Minute Tariff Recalculations: Winners and Losers

This week’s announcement was no different. Countries like Thailand and Malaysia saw sudden rate hikes, while longstanding U.S. trading partners such as Canada experienced harsher penalties. Even Switzerland, historically neutral in these disputes, faced a surprising 39% tariff spike.

The timing is especially significant, as U.S.-China trade negotiations continue amidst this turbulent backdrop. The 40% tariff on transshipped goods may signal strategic pressure tactics designed to tilt negotiations.

Market Response and Broader Implications

Disruption from such policies reverberates across global markets. CEOs from semiconductor to automotive industries now find their annual forecasts upended. Investors generally dislike uncertainty, and supply chains painstakingly optimized over years face challenging adjustments amid sudden policy shifts.

Holger Schmieding, chief economist at Berenberg, noted, “Much of the high tariffs on countries yet to reach deals may function as scare tactics. Trump's deadlines are notoriously flexible, so reductions are likely post-negotiations.”

The Bigger Picture: Trust and Stability in Global Trade at Stake

The more profound question remains: can the global economy thrive if a dominant player recalibrates rules with little notice and mounting unpredictability? For countries, companies, and markets, Trump’s last-minute decisions have become a constant variable, injecting volatility and complicating long-term strategies.

While the “Art of the Deal” has defiantly reshaped geopolitics, it comes with a cost—raising uncertainty and complicating the very foundations of the interconnected global economy.

What to Watch Next

- Negotiations between the U.S. and affected countries over the next weeks

- Potential tariff reductions or extensions as pressure tactics evolve

- Market reactions to ongoing unpredictability

- Impacts on supply chain realignments and corporate earnings forecasts

Editor's Note

Trump’s penchant for late-night tariff announcements isn’t merely a quirky leadership style—it represents a strategic recalibration of how trade diplomacy is conducted in the 21st century. While these moves may achieve short-term leverage, they sow uncertainty that ripples across economies and industries worldwide. As the global community grapples with this new normal, a central question emerges: how can trust and stability be restored to international trade systems under such unpredictable leadership dynamics?