U.S. Stocks Dip Despite Encouraging Inflation and Trade News

On Wednesday, U.S. equities edged lower even as fresh data indicated easing inflation and some advancement in trade relations. The S&P 500 declined by 0.27%, halting a three-day winning run, while the Dow Jones and Nasdaq mirrored the cautious sentiment. Meanwhile, Europe showed mixed results, with the FTSE 100 inching up to a new record, demonstrating varied investor responses across regions.

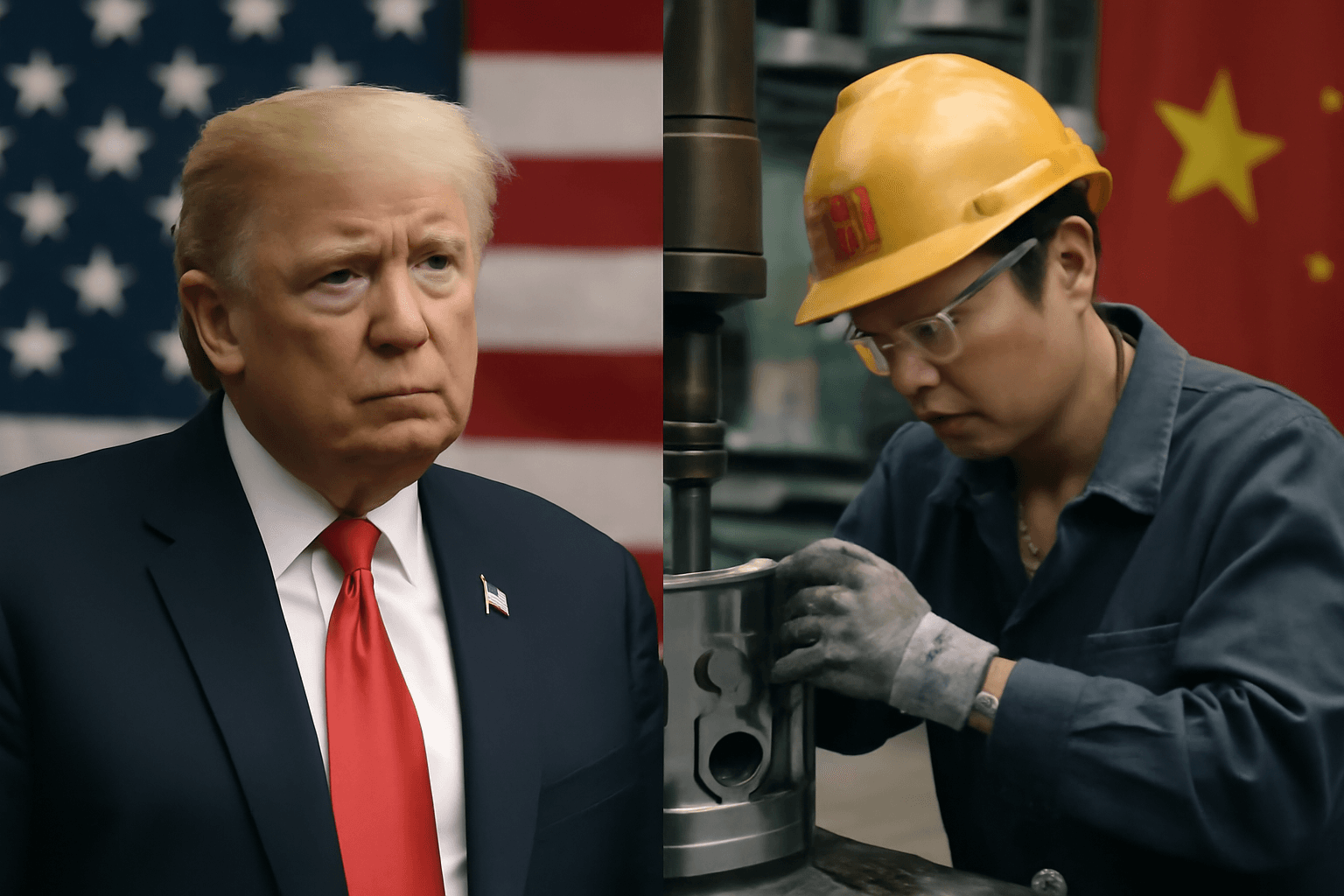

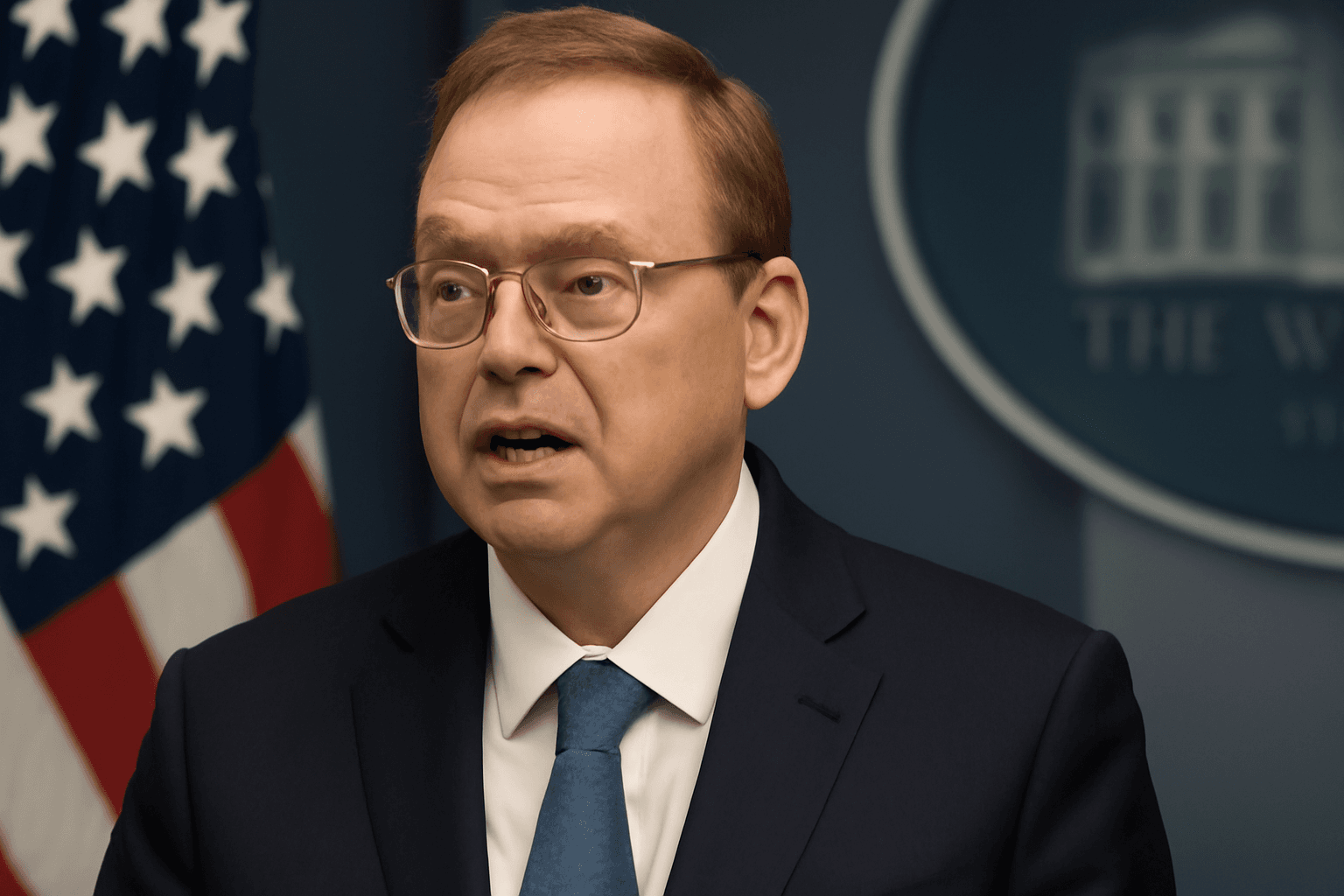

Stable Tariffs Signal No Immediate Change in U.S.-China Trade Policy

Commerce Secretary Howard Lutnick confirmed there will be no changes to current U.S. tariffs on Chinese goods, despite ongoing trade negotiations. The existing tariffs, including a blanket 30% and an additional 25% on select items, remain firmly in place. This announcement came despite earlier optimism over a reinvigorated trade agreement reached in Geneva, reflecting persistent uncertainties that continue to weigh on market confidence.

Inflation in May Shows Signs of Cooling But Caution Remains

The latest U.S. Consumer Price Index (CPI) report revealed a modest rise of just 0.1% for May, coming in below economists' expectations of 0.2%. On an annual basis, the CPI climbed by 2.3%, slightly under the forecasted 2.4%. Core inflation, which excludes food and energy, also moderated, growing at 0.1% for the month and 2.8% yearly.

Though this tempered inflation reading brings some relief, experts urge caution. The effects of tariffs imposed during the ongoing trade tensions may take longer to fully reflect in price statistics. Chief global strategist Seema Shah warns that inflationary pressures driven by tariffs could yet reemerge, complicating the outlook.

Economic Outlook: Mixed Signals and Growing Concerns

Jamie Dimon, CEO of JPMorgan Chase, expressed concerns that the U.S. economy might be on the brink of deterioration. Citing the waning impact of past pandemic-driven stimulus measures, Dimon hinted at possible economic weakness ahead, underscoring the fragile nature of the recovery.

Adding to the complex environment, social media tensions recently flared between Elon Musk and President Trump, although Musk later retracted some of his critical comments. Meanwhile, speculation continues about potential shifts in key leadership positions, including the possibility of a 'shadow' Federal Reserve chair intended to influence monetary policy ahead of the current chair’s term conclusion in 2026.

Asia Accelerates Shift Away from U.S. Dollar

In a notable global development, Asian economies are increasingly moving towards de-dollarization, driven by geopolitical factors and monetary strategy shifts. The Association of Southeast Asian Nations (ASEAN) recently unveiled its Economic Community Strategic Plan for 2026-2030, emphasizing local currency usage to mitigate exchange rate volatility and bolster regional economic resilience.

This trend reflects a broader decline in the U.S. dollar's dominance, with its share in global foreign exchange reserves dropping from over 70% in 2000 to a significantly lower proportion today.

What to Watch Moving Forward

- Will inflation remain subdued or will tariff-driven costs push prices higher in the coming months?

- How will market sentiment evolve amid lingering trade uncertainties?

- What impact will potential Fed leadership changes have on monetary policy and investor confidence?

As investors navigate these mixed signals, staying informed and prepared for volatility remains crucial in an uncertain global economic landscape.