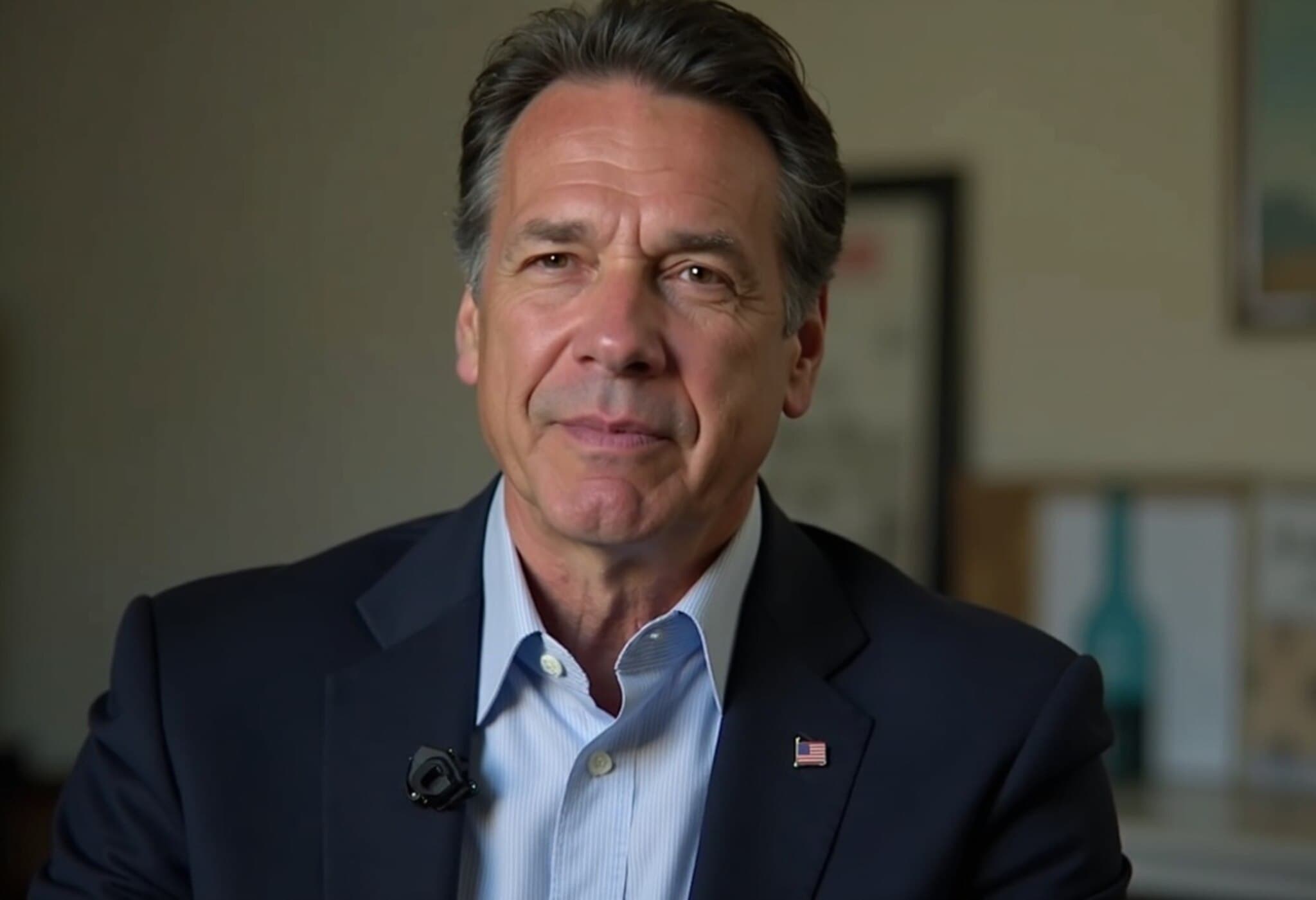

US Senator Lindsey Graham Signals Strong Tariffs on Countries Importing Russian Oil

In a recent Fox News interview, US Senator Lindsey Graham delivered a stark warning to India, China, and Brazil—three of the world's biggest importers of Russian crude. Citing these nations’ continued oil purchases from Russia as a direct lifeline to President Vladimir Putin’s war efforts in Ukraine, Graham revealed plans to propose a 100% tariff on oil-related imports from these countries.

Tackling the Financial Backbone of Putin’s War

These three countries collectively purchase an estimated 80% of Russian crude exports, making them pivotal in Russia’s economic framework to finance the ongoing conflict in Ukraine. Graham emphasized that cutting these financial arteries is essential for undermining Putin’s war machine.

“President Trump will slap a 100 percent tariff on all oil products imported from China, India, and Brazil—punishing them for helping Putin finance this war,” Graham declared, underscoring the bipartisan pressure mounting in the US to isolate Russia economically.

Geopolitical Stakes and Broader Implications

Addressing Putin directly, Graham stated, “You made a major league mistake thinking you can outmaneuver Trump. Your economy faces continued punishment while weapons flow freely to Ukraine to resist your aggression.”

Graham also drew historical parallels, reminding viewers about Ukraine's 1990s denuclearization with a guarantee from Russia to respect its sovereignty—a promise the Kremlin broke when it launched its invasion.

Such commentary reflects ongoing US concerns over Russian aggression and attempts to reignite Soviet-era dominance by invading neighboring sovereign states.

Economic Leverage as a Foreign Policy Tool

Senator Graham’s rhetoric makes clear that economic sanctions and tariffs will be pivotal levers in US foreign policy. By proposing punitive 100% tariffs on oil imports from these nations, the US aims to force a choice: side with the American economy or support Russia’s war.

“If countries like China, India, and Brazil continue buying cheap Russian oil, they're essentially buying blood money,” he warned. “We will crush your economy as a direct response to enabling Putin’s aggression.”

This strategy reflects a broader trend in American diplomacy: leveraging economic dependencies within the global energy markets to effect geopolitical outcomes.

Political Rhetoric and Athletic Metaphors

Graham drew an analogy between Trump’s leadership and that of a champion athlete, calling the former president “the Scotty Scheffler of American politics and foreign diplomacy,” suggesting relentless competitiveness and focus.

The metaphor subtly reinforces the portrayal of US responses as both vigorous and strategic, warning that Trump’s administration would not hesitate to apply maximum pressure on geopolitical rivals and those supporting them.

Critical Questions and Underreported Perspectives

- Economic consequences for India, China, and Brazil: These nations are major players in the global economy; retaliatory tariffs could disrupt trade relations, energy markets, and supply chains.

- Implications for global energy security: With ongoing volatility in oil markets, such sanctions might drive up prices globally, affecting consumers worldwide, including American households.

- The diplomatic tightrope: Balancing sanctions with maintaining strategic partnerships with India, China, and Brazil is a delicate act for US policymakers.

- The role of alternative energy sources: How will this impact the push towards sustainable energy, and will countries hasten diversification to reduce reliance on contentious imports?

Experts suggest that while these tariffs pose a heavy threat, the international community’s response will likely be varied, influenced by economic interests and geopolitical alignments.

Editor’s Note

The announcement of potential 100% tariffs on oil imports from India, China, and Brazil marks a significant escalation in US efforts to isolate Russia economically. However, it opens a complex debate on the balance between geopolitical goals and global economic stability. Will these countries pivot away from Russian oil, or will tensions spiral into broader trade conflicts? As the US leverages economic power in foreign policy, the global repercussions could redefine international alliances and energy strategies for years to come.