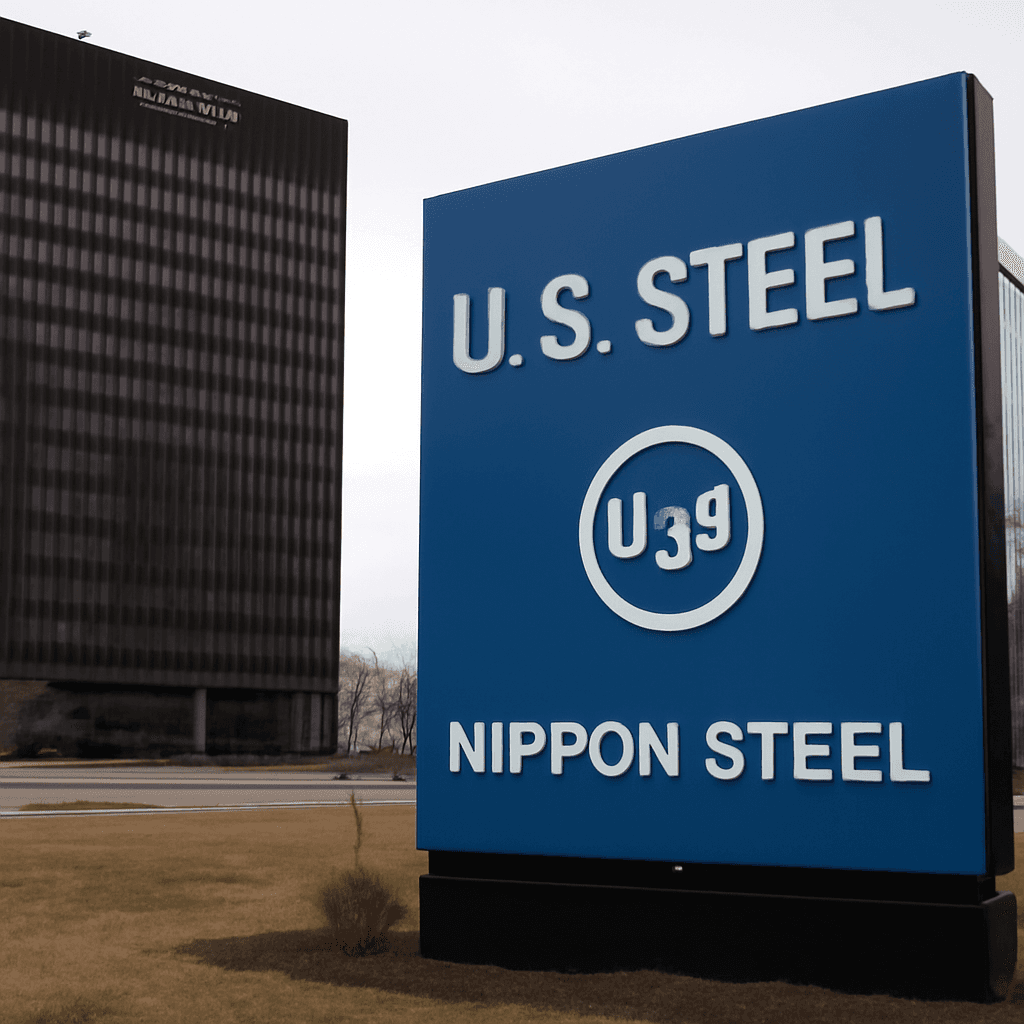

U.S. Steel Shares Halt Trading Following Nippon Steel Acquisition

Shares of U.S. Steel ceased trading on the New York Stock Exchange (NYSE) early Wednesday after Japan's Nippon Steel officially completed its acquisition of the iconic American steelmaker. This move marks a significant shift as U.S. Steel transitions to a wholly owned subsidiary of Nippon Steel North America.

Trump's Shifting Stance and the Controversy Over Ownership

For weeks, former President Donald Trump asserted that the acquisition would result in a “partnership”, ensuring U.S. Steel remained under American ownership. However, NYSE formally notified the Securities and Exchange Commission that U.S. Steel’s stock would be delisted after the full transfer of ownership to Nippon.

Trading for U.S. Steel shares officially ended at 8:30 a.m. ET on the day of the takeover's completion.

Interestingly, Trump initially opposed Nippon Steel’s bid ahead of the 2024 presidential election. Yet, after taking office, he reversed course and ordered a fresh review of the deal in April, following a prior block of the acquisition by President Joe Biden in January over national security fears.

Clarifying the “Partnership” - Reality vs. Perception

On May 23, Trump publicly announced what he called a “partnership” between U.S. and Nippon Steel through a post on his social media platform, sparking confusion among union members and investors. Many wondered if the terms of the original merger had shifted.

Despite adopting the language of partnership, both companies never amended their filings with the SEC, sticking to the initial merger agreement finalized in December 2023.

What This Means for U.S. Steel and the American Steel Industry

This acquisition signifies a major step in Nippon Steel’s expansion into the North American market, while marking an end to U.S. Steel’s independent public trading status. With full ownership transferred, the future strategic decisions, operations, and identity of U.S. Steel are poised to reflect Nippon's corporate agenda.

Key Takeaways:

- U.S. Steel is now a fully owned subsidiary of Nippon Steel North America.

- NYSE removed U.S. Steel shares from its listing as of June 18, 2025, 8:30 a.m. ET.

- Former President Trump initially opposed but later supported the acquisition, framing it as a partnership.

- Despite partnership claims, the merger terms from December 2023 remain unchanged.

The integration illustrates the complex interplay between industry, politics, and national security concerns, underscoring the challenges involved when a storied American giant moves under foreign ownership.