Canada Drops Digital Services Tax to Restart U.S. Trade Negotiations

In a significant move to mend trade relations, the Canadian government announced it will rescind the controversial digital services tax (DST) previously imposed on major technology companies. This decision follows pressure from the United States and aims to rejuvenate stalled trade discussions between the two nations.

Background: What Sparked the Dispute?

Canada's digital services tax, introduced in 2020, imposed a 3% levy on revenue generated by large tech companies like Amazon, Google, Meta, Uber, and Airbnb from Canadian users. The tax was designed to address perceived loopholes where these corporations earn profits from Canadian consumers and data but pay little to no tax domestically.

However, the U.S. strongly opposed the DST, arguing it unfairly targeted American companies. The tension escalated when the U.S. threatened to scrap ongoing trade talks and impose tariffs on Canadian goods unless the tax was withdrawn.

Rescinding the Tax: Timing and Implications

On June 30, 2025, Canada officially halted the collection of the digital services tax and announced upcoming legislation to repeal it. Finance Minister Francois-Philippe Champagne emphasized the move would facilitate progress in negotiating a renewed economic and security partnership with the United States.

Prime Minister Mark Carney echoed this sentiment, underscoring the government's commitment to securing agreements that benefit Canadian workers and businesses.

Reactions from Both Sides

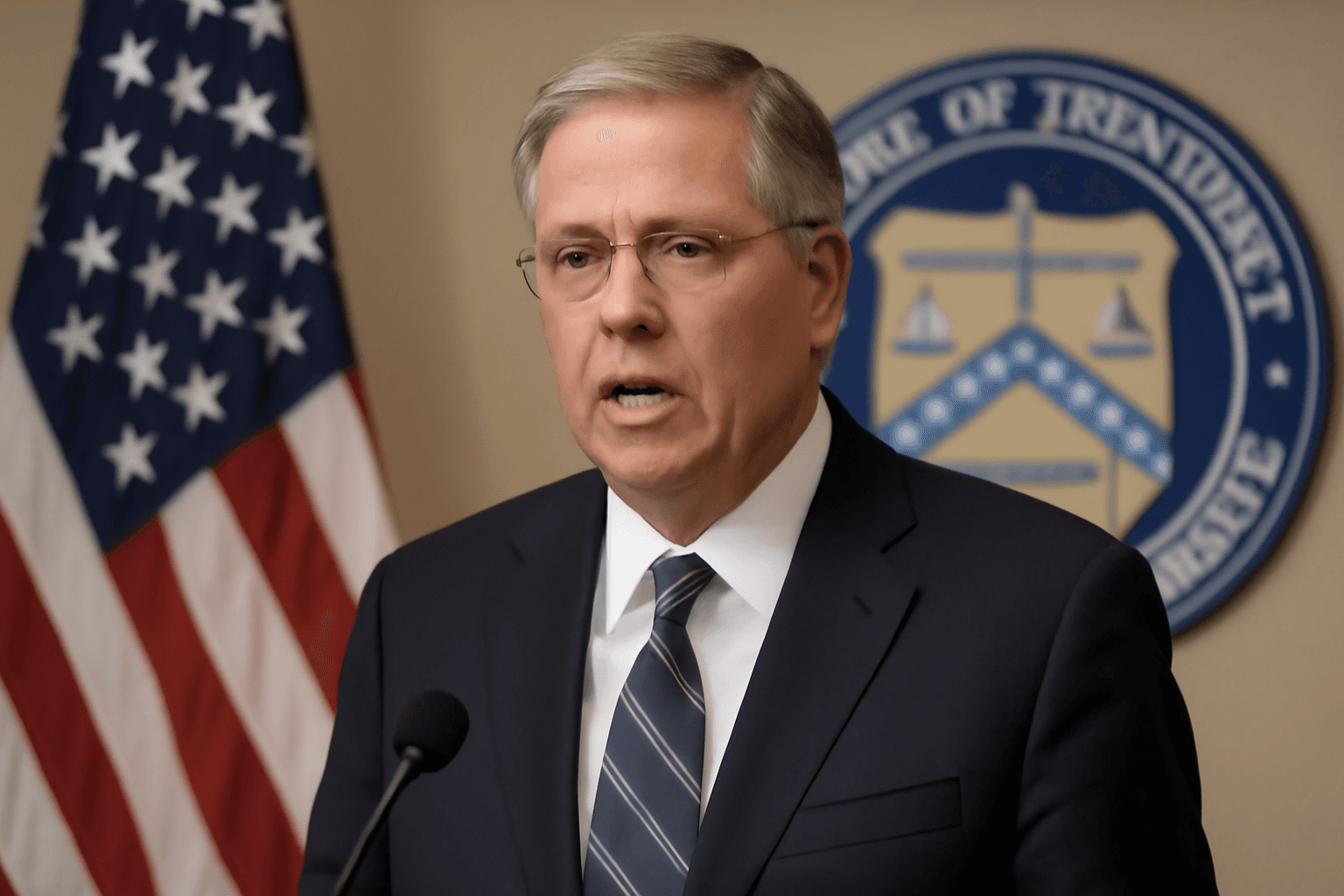

- U.S. Officials: U.S. Commerce Secretary Howard Lutnick praised Canada's decision, noting that the DST was a potential "deal breaker" in trade negotiations. U.S. Ambassador to Canada Pete Hoekstra described the move as "encouraging and constructive."

- Canadian Business Leaders: The Canadian Chamber of Commerce welcomed the repeal, warning that the tax would have increased costs for Canadian consumers and businesses, potentially hurting the economy during a critical period.

Next Steps in Trade Talks

Earlier in June, Prime Minister Carney and U.S. President Trump had agreed to resume trade negotiations with a focus on economic and security cooperation. However, tensions flared when Trump abruptly halted discussions citing the DST as an “egregious tax” affecting American innovation and business.

With the tax now withdrawn, negotiations are expected to advance. This development also signals a shift toward more collaborative economic relations, which many hope will benefit both countries’ industries and consumers.

The Broader Context

This episode underscores the complexities of modern international trade where digital economies challenge traditional tax frameworks. While Canada and other nations implemented digital sales taxes to ensure fairness in the global marketplace, resistance from major economic powers, particularly the U.S., reflects the high stakes for multinational corporations and national tax policies alike.

With the digital services tax behind them, Canada and the U.S. are poised to explore new agreements, balancing competition, innovation, and mutual economic growth in an increasingly interconnected world.