China Issues Rare Earth Export Licenses to Key U.S. Automakers

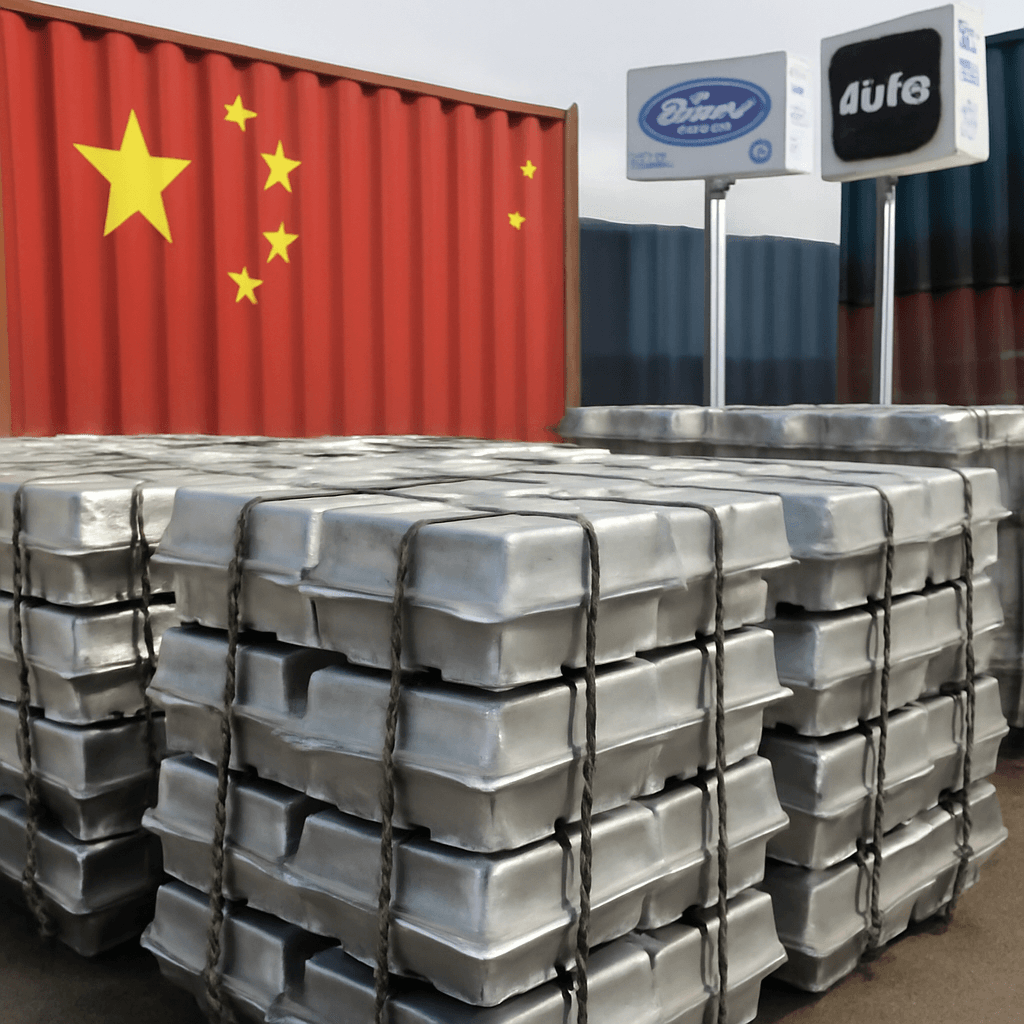

China has awarded temporary export licenses for rare earth materials to suppliers associated with the top three U.S. automakers. These permissions come amid increasing supply chain disruptions triggered by China's recent export controls on these critical materials.

Sources familiar with the matter indicate that some of these licenses are valid for six months, though the exact quantities and specific items authorized remain undisclosed. This development could signal a potential easing of the previously stringent licensing process that industry experts have described as burdensome and a source of supply bottlenecks.

Strategic Importance of Rare Earths

China's decision in April to impose export restrictions on various rare earth elements and related magnets has significant implications for the global manufacturing sector. These materials are vital for automakers, aerospace companies, semiconductor manufacturers, and defense contractors worldwide.

As the dominant global supplier of rare earth minerals, China holds a strategic advantage, especially amid heightened trade tensions. The rare earth sector is crucial for the green energy transition and advanced technologies, amplifying the impact of Beijing's trade policies.

Details on License Recipients and Industry Impact

Suppliers to major U.S. automakers—including companies producing vehicles under the GM, Ford, and Jeep brands—received export licenses earlier this week. Both GM and Ford declined to comment on the matter, while Stellantis stated it is collaborating closely with suppliers to streamline the licensing process and has so far managed to minimize production interruptions.

These export controls have already affected production schedules. For example, Ford temporarily halted the production of its Explorer SUV at the Chicago plant in May due to rare earth shortages.

Government Responses and Ongoing Trade Discussions

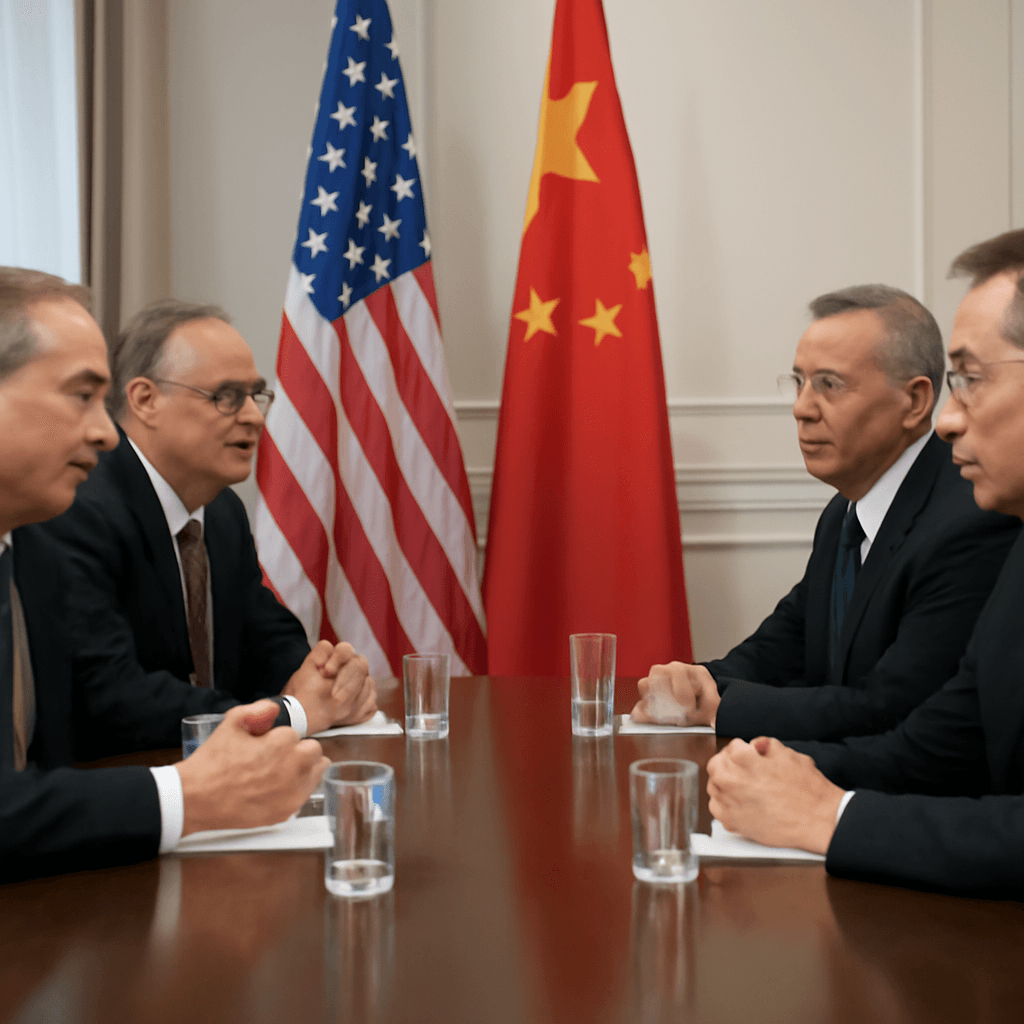

China’s Ministry of Commerce has not provided immediate comment on the export licenses. However, these restrictions have become a focal point in the broader trade dynamics between China and the United States.

Recently, high-level talks between U.S. and Chinese presidents aimed to address trade challenges, including those surrounding rare earth products. Both parties agreed to continue negotiations with specialized teams to resolve outstanding issues.

Future Outlook and Industry Reactions

The phased approval of rare earth export licenses, including recent authorizations for U.S. electronics firms and non-automotive companies, suggests that China may be cautiously managing its export control measures. Observers emphasize the importance of transparency to ensure these controls are not used as a tool for political leverage.

In addition, China has introduced a tracking system for rare earth magnets to enhance regulatory oversight and combat smuggling within this critical sector.

Key Takeaways

- China has granted six-month rare earth export licenses to suppliers of the top three U.S. automakers.

- These materials are essential for automotive production, aerospace, semiconductors, and defense industries.

- Supply disruptions have already led to production halts, such as Ford’s temporary shutdown of SUV assembly.

- Ongoing U.S.-China talks are focusing on easing trade tensions and rare earth supply issues.

- China has implemented a tracking system to better regulate rare earth magnet exports and reduce smuggling.