Ongoing Rare Earth Mineral Shortage Despite US-China Presidential Discussion

A recent high-level conversation between the US and Chinese presidents has not resolved the pressing issue of a global shortage in rare earth mineral exports. This shortage threatens to disrupt production lines for automobiles and various industrial components throughout the summer.

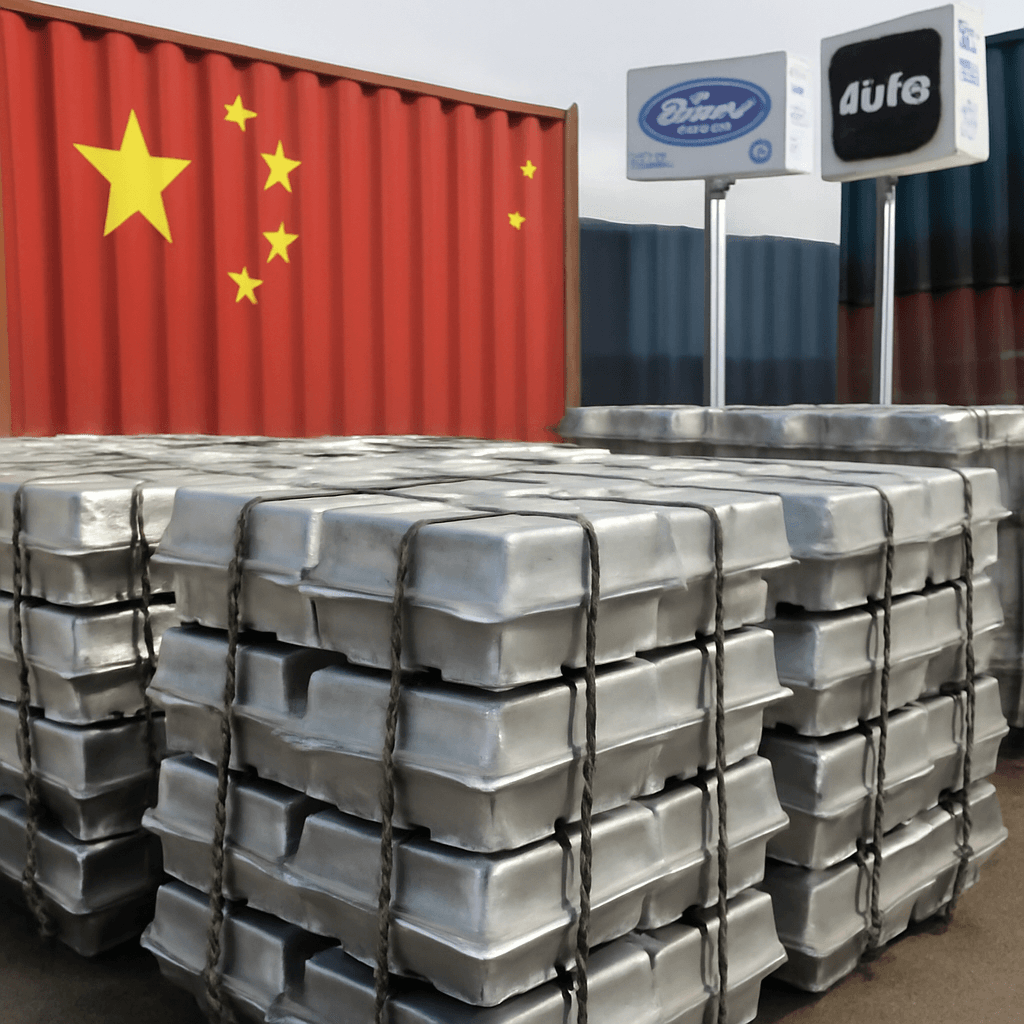

China's Dominance and Export Restrictions

China dominates the mining and production of rare earth elements, critical for sectors such as defense, automotive manufacturing, and technology. Over the past two years, China has incrementally imposed export restrictions on these minerals. In early April 2025, it enacted new controls on seven rare earth elements, escalating tensions with the US.

Following the May 12, 2025 breakout of a significant trade agreement, China's Commerce Ministry met to discuss export policies but did not reverse the restrictions on these seven rare earth elements. This outcome surprised many US stakeholders who anticipated easing due to the agreement’s stipulation of tariff suspensions and countermeasure rollbacks for 90 days.

Impact on US Companies and Export Licensing

According to a survey conducted by the American Chamber of Commerce in China from May 23 to 28, only select Chinese suppliers have received six-month export licenses for rare earth metals. Among respondents facing these restrictions, 75% indicated their current supplies would deplete within three months. The restrictions primarily impact research, development, industrial, and technology sectors rather than consumer or service industries.

While the recent US-China presidential call did not explicitly address rare earths, it underscored a commitment to ongoing discussions. The US administration highlighted continued negotiations involving senior officials in Treasury, Commerce, and Trade departments to clarify unresolved points concerning rare earth magnets and similar issues.

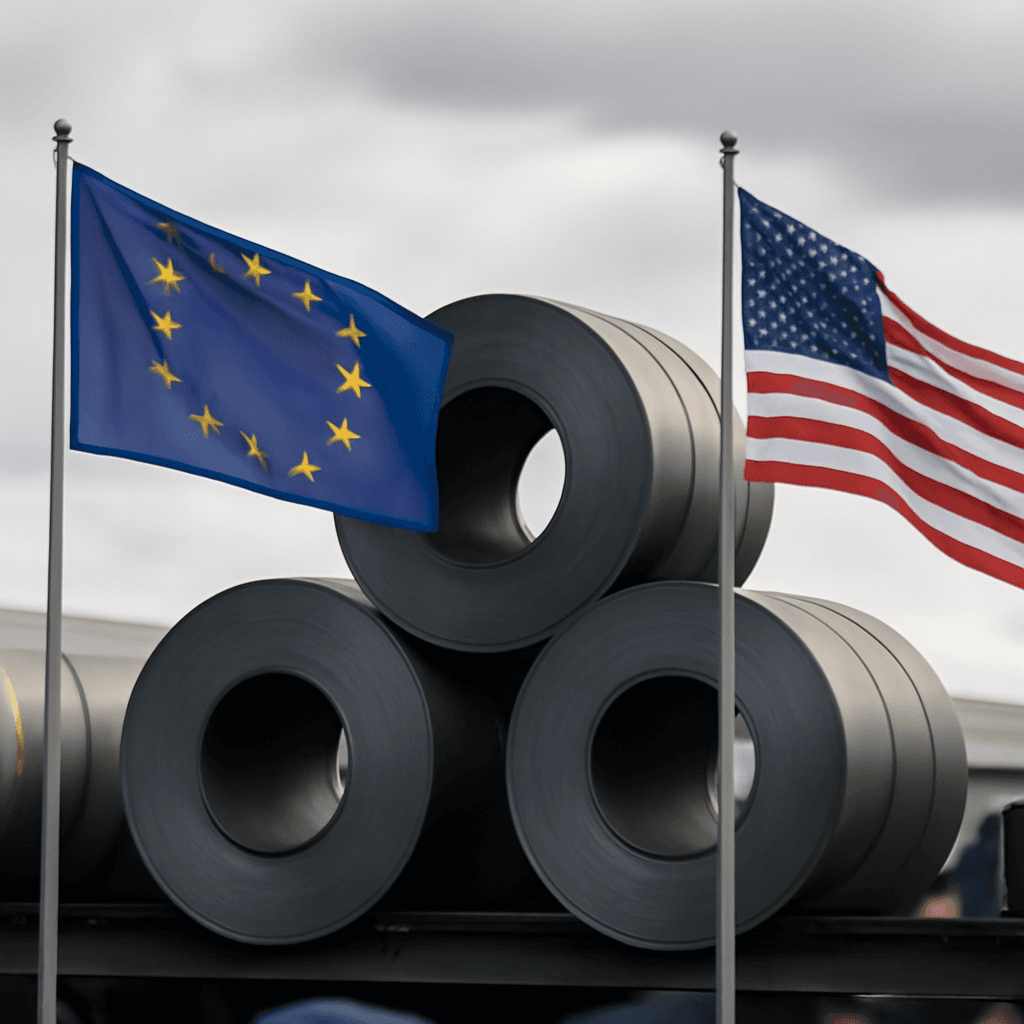

Broader Global Effects Beyond the US

China’s export restrictions have repercussions beyond American firms. European automotive parts manufacturers have also experienced supply disruptions.

The European Union Chamber of Commerce in China reported that only approximately 25% of hundreds of submitted export license applications have been approved, leading to significant operational challenges.

Despite minor easing of controls for some European companies, the chamber warned these measures are insufficient to prevent widespread supply chain breakdowns. The approval process remains slow and lacks transparency, adversely affecting production lines across Europe and other regions.

Japanese automaker Suzuki briefly halted production of its Swift model due to these export curbs, with partial resumption anticipated in mid-June.

China’s Official Position on Export Controls

Chinese authorities maintain that their export controls align with global standard practices, emphasizing non-discrimination and the absence of targeting any country. Officials reaffirmed their commitment to approving export licenses in accordance with regulations to facilitate compliant trade and mitigate disruptions.

Escalation of Export Restrictions on Critical Minerals

China has intensified export controls on vital minerals over recent months:

- August 2023: Restrictions introduced on gallium and germanium, essential for semiconductor manufacturing.

- Early 2025: Controls extended to bismuth, a metal used in ammunition, nuclear weapon production, and batteries.

- Additional tightened restrictions target minerals with dual civilian and military uses.

Tungsten, widely used in weaponry, semiconductors, and industrial cutting tools, is another critical element affected. An average automobile contains about 300 grams of tungsten, but supply reductions are expected to cause scarcity by late summer. Experts anticipate this will disrupt production in Western companies reliant on this resource.

Conclusion and Outlook

The ongoing rare earth mineral shortage illustrates the complex entanglement of trade, technology, and geopolitics between the US, China, and other global markets. While diplomatic engagements signal willingness to negotiate, substantial challenges remain in securing steady supply chains essential for industrial and technological advancement worldwide.