US-China Trade Deal Offers Short-Term Relief on Rare Earths

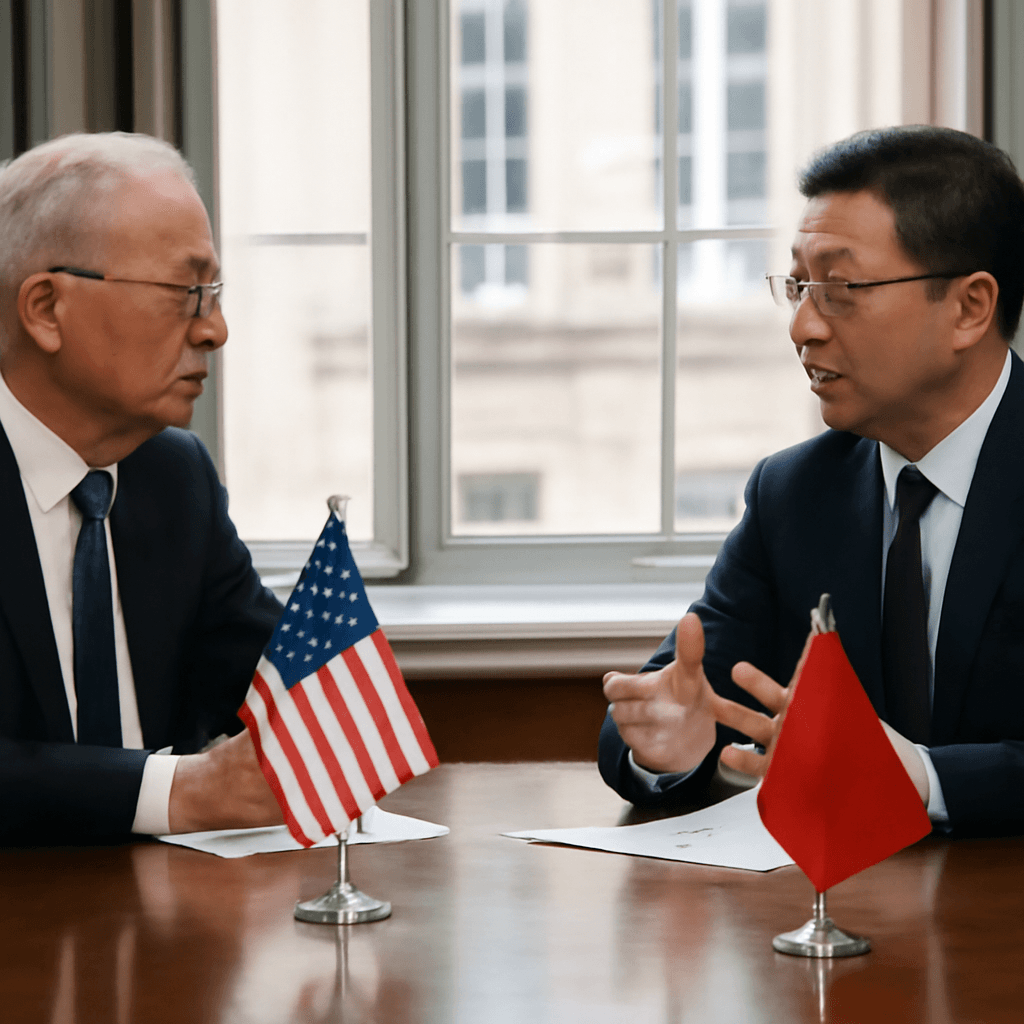

The United States and China have struck a trade agreement aimed at easing China's export restrictions on rare earth minerals—essential ingredients for industries like automotive, semiconductors, and smartphones. This comes as a critical breath of fresh air for US manufacturers facing supply shortages. However, the pact carries a caveat: China retains the authority to reinstate export curbs, preserving its strategic leverage for the future.

Details of the Agreement: Temporary Gains Amid Long-Term Ambiguity

Following talks in London, the two nations agreed to a truce, with the US securing access to rare-earth magnets. These magnets, though small, power electric vehicle motors, industrial robots, and military technology. The export licenses granted will be valid for just six months, allowing China to cut supplies again should relations deteriorate. This conditional approach raises questions about the pact's durability.

Background: Export Controls Sparked by Tariff Tensions

The situation escalated when China imposed export limitations on rare earths in April after the US slapped a 34% tariff on Chinese imports. Given China's dominant position—controlling about 90% of the world's rare-earth magnet production—it wielded significant influence to pressure the US into negotiations. This maneuver disrupted global supply chains, forcing industries from automakers to defense contractors to scramble for alternative sources.

Export License Structure and Its Implications

- Licenses valid for six-month periods.

- Allows China to respond swiftly by reinstating restrictions amid rising tensions.

- Creates uncertainty for US manufacturers dependent on stable rare earth supplies.

Mutual Tariff Reductions Included

The pact also outlines tariff adjustments: the US will reduce tariffs on Chinese goods from 145% to 55%, encompassing a complex blend of existing duties, including a contentious 10% baseline tariff. Conversely, China commits to lowering tariffs on American imports from 125% to 10%. Though a positive development, the new rates still reflect significant trade frictions.

Business Community Reacts: Cautious Optimism Amid Ongoing Struggles

While industry leaders appreciate the easing of immediate supply constraints, challenges remain. Retail giants have warned of inevitable price hikes due to tariff-related costs, which act as hidden taxes on consumers. Small businesses express grave concern, with many describing the tariff environment as a "death sentence" threatening their viability and growth prospects.

A Precarious Truce with Future Risks

The US-China agreement presents a momentary de-escalation but underscores the fragile nature of their trade relationship. With China maintaining control over critical rare earth exports, the pact leaves open the possibility of renewed pressure in future diplomatic or economic disputes. For US industries reliant on these materials, the path forward remains uncertain.