China's Dominance in Rare Earths Supply Shows No Signs of Weakening

China continues to wield strong control over the global rare earth elements market, even as it hints at approving more export licenses to key partners in Europe and the United States. Earlier this month, three Shenzhen-listed Chinese companies revealed that Beijing had sanctioned their export of magnets containing rare earths—vital components in electric vehicles, defense technologies, semiconductors, and various industrial applications.

However, these approvals appear limited and cautious. For instance, Baotou INST Magnetic New Materials reported last month that their export licenses were not granted, highlighting the selective nature of China's export strategy. Across Europe, automotive groups have noted that China’s long-term export licenses for magnets and heavy rare earths last only around six months, underscoring ongoing uncertainties.

A Daunting Challenge to Source Elsewhere

Experts warn that reducing reliance on Chinese rare earths will be an uphill battle. According to senior economists, China controls approximately 60% of the global rare earths supply and dominates refining processes for nearly 90% of these metals worldwide. Europe produces no rare earths domestically, while the U.S. has only recently scaled up minimal production of materials like neodymium and praseodymium.

This limited production capability constrains alternative supply development. Consequently, European automakers and U.S. tech companies operating in China are reconsidering their sourcing strategies amid these challenges.

Recent Moves and Market Volatility

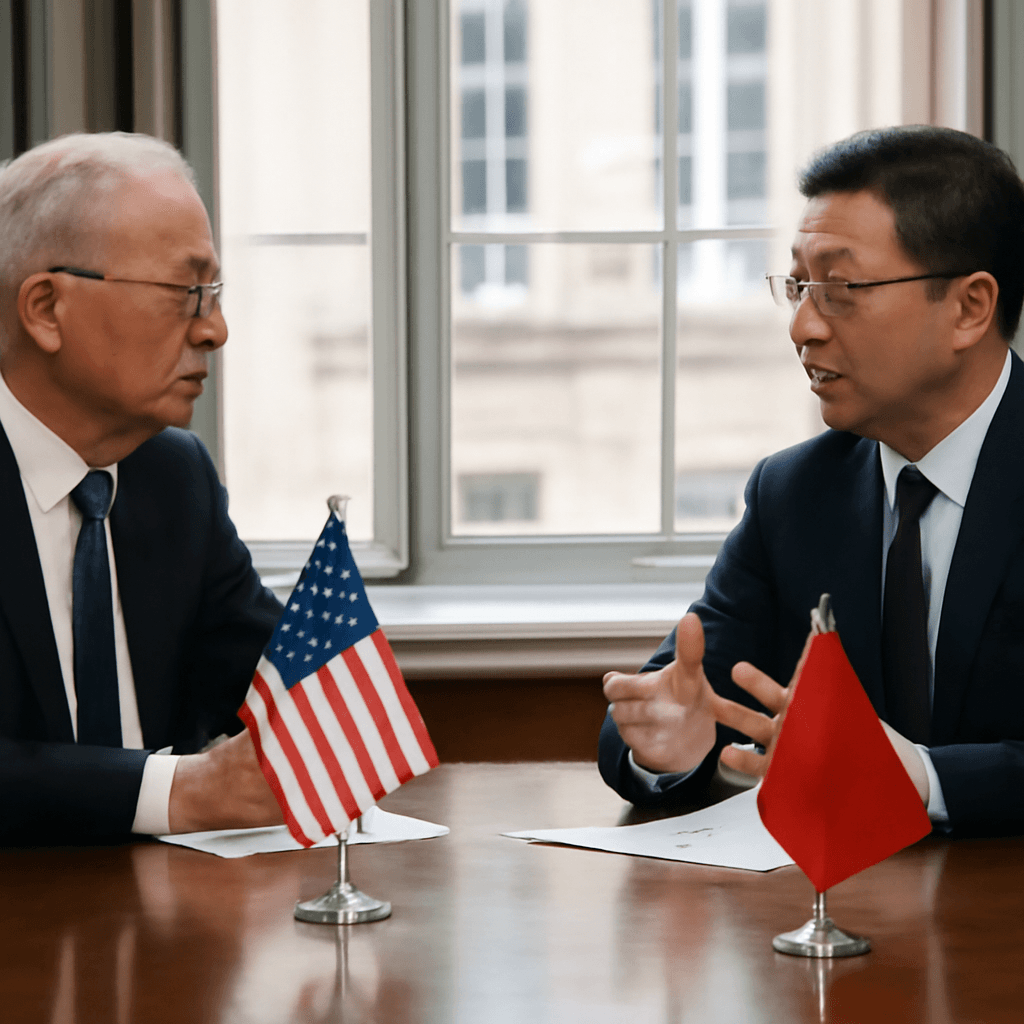

China recently intensified export controls on multiple critical minerals following tighter restrictions over the past two years. Negotiations between the U.S. and China in May offered a brief tariff reprieve, fueling hopes for easing tensions. After trade talks in London, U.S. officials suggested that Beijing might soon ease some rare earth export constraints.

Indeed, Chinese authorities have approved a limited number of export permits for rare earth elements and related items, with plans to continue careful examination of future applications. Still, industry leaders characterize the business environment as volatile. Philippe Kehren, CEO of a leading chemical group operating Europe's largest rare earth processing plant, emphasizes the unpredictable market climate, prompting his company to rely more on recycling and to explore alternatives to Chinese supply.

Beijing's Strategic Export Controls

Despite appearing to relax export restrictions, Beijing is expected to maintain controls to safeguard its leverage against potential U.S. export restrictions on advanced technologies. Former intelligence officials and industry analysts caution that any new U.S. measures could trigger China to further restrict rare earth exports.

The current licensing system is permanent, serving as both a deterrent against stockpiling by foreign firms and a tool for keeping China’s negotiating advantage intact. This precarious balance means the risk of supply cutoffs remains a constant concern.

The Long Road to Diversification

There is a growing recognition among companies that they must pursue alternative sources, develop substitutes, and adopt recycling strategies to mitigate supply risks. Still, the entrenched dominance of Chinese supply chains is formidable. For example, China refines around 60% of the world’s lithium and 72% of the global cobalt market, key materials for batteries.

Several automakers and suppliers have started designing electric vehicles requiring minimal or no rare earth elements, but widespread adoption and cost reduction remain a work in progress. Industry analysts predict that manufacturers may end up maintaining two parallel ecosystems—one serving the Chinese market domestically and another focused on global markets.

Simultaneously, mining companies note that replacing China’s rare earth supply will take significant time. Despite China’s aggressive pricing strategies, which pushed many competitors out of business and discouraged investment, efforts continue to revive alternative mines and advance recycling.

Critical Impacts Beyond Rare Earths

China’s controls extend beyond rare earths to other strategic metals like tungsten. Recent export restrictions have already caused disruptions, including temporary production halts in Europe due to tungsten powder shortages. Companies involved in tungsten mining and recycling are accelerating projects to meet defense and industrial demands outside China, but global supply constraints persist.

Industry leaders see these developments as a structural shift, highlighting the urgent need for Western firms to innovate and secure supply chains to avoid losing market share to Chinese competitors.

Conclusion

While China appears willing to authorize more exports of rare earths in specific instances, its grip on the market remains firm and strategic. The complexities of building alternative supply chains and the geopolitical stakes involved mean Beijing’s dominance will likely persist for years to come, compelling global industries to adapt their sourcing and production models accordingly.