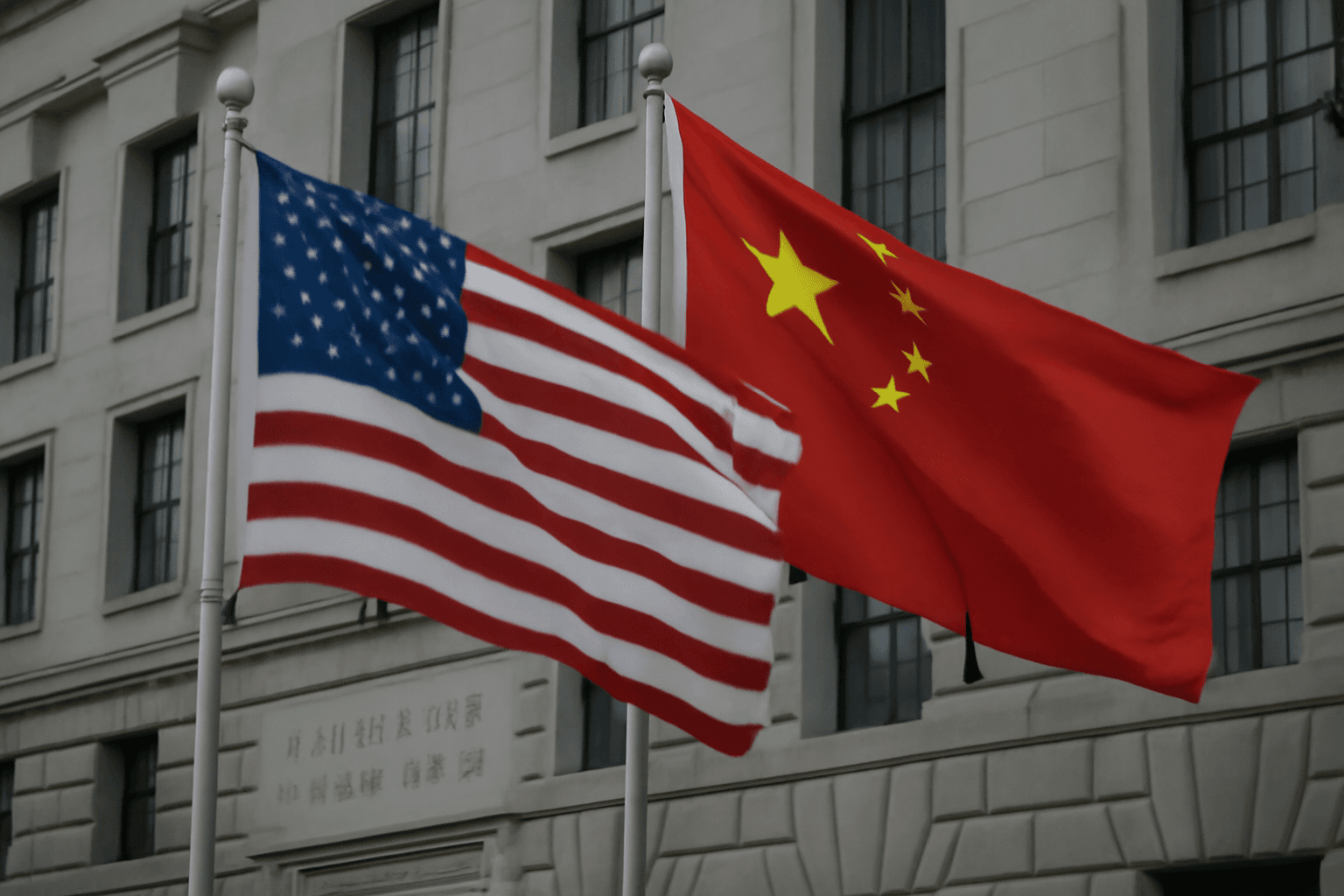

ASML, a vital player in the semiconductor sector, has seen its market valuation decline by over $130 billion within a year due to export restrictions to China and prevailing U.S. tariff uncertainties.

The Dutch company’s shares peaked above €1,000 in July last year, corresponding to a market capitalization of approximately $430 billion. However, by late May 2025, its value dropped to just under $300 billion.

Market volatility in semiconductor stocks has been largely influenced by tightened U.S. export controls targeting China and ongoing tariff discussions since the Trump administration. European chipmakers, including ASML, have notably encountered significant challenges.

Stephane Houri, head of equity research at ODDO BHF, noted, "Equipment manufacturers in this sector have experienced declines as concerns around U.S. restrictions on China intensify." He also pointed to debates on whether the semiconductor industry might be over-investing in artificial intelligence technologies, raising questions about actual demand levels.

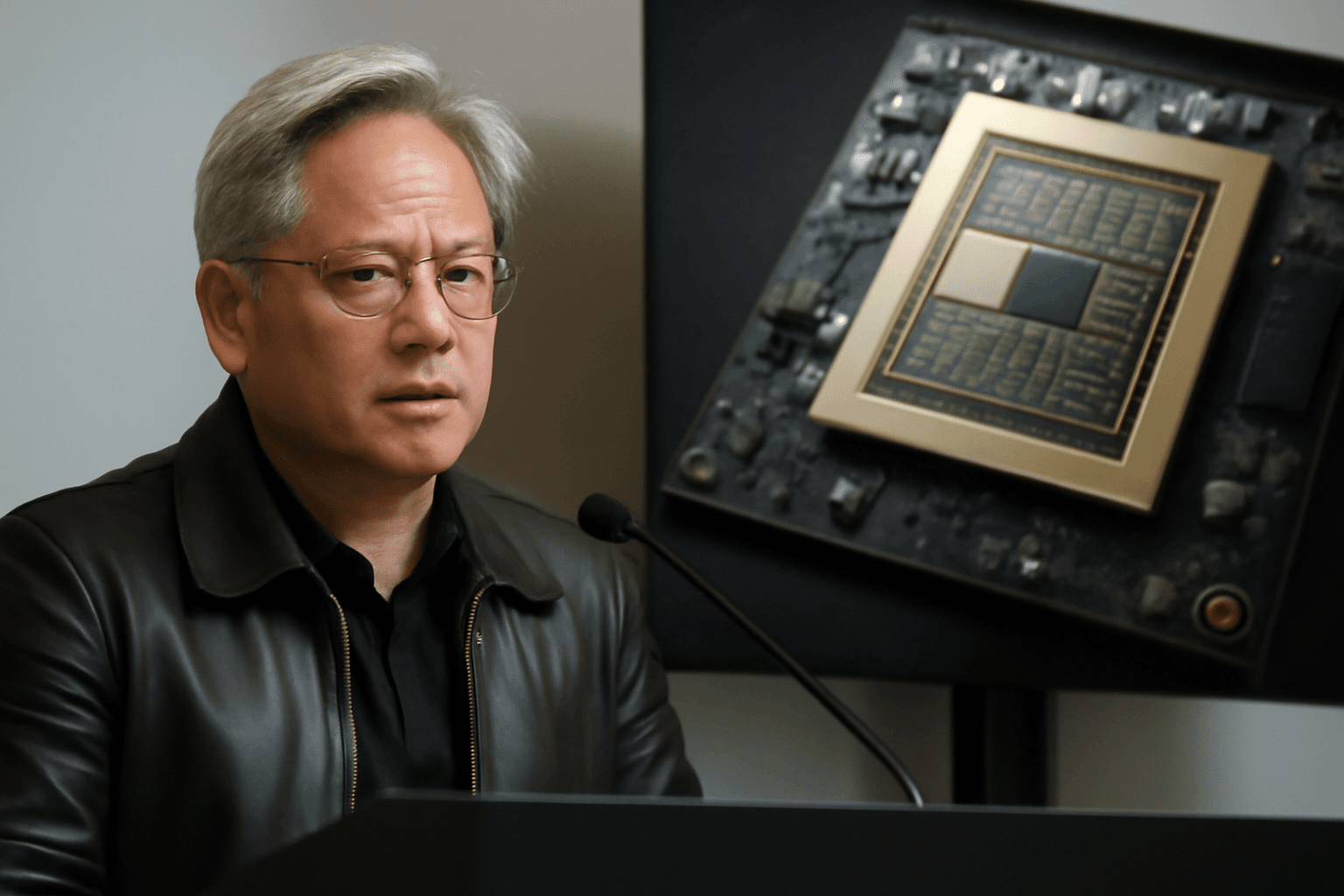

ASML is renowned for its development and manufacture of extreme ultraviolet (EUV) lithography systems, essential tools used by leading chip manufacturers such as TSMC to produce cutting-edge semiconductors. The company recently began delivering its next-generation EUV machines, further solidifying its market position.

Exclusively capable of producing these advanced machines, ASML holds a near-monopoly in this segment. Nevertheless, export bans have prevented the company from supplying its most advanced equipment to China, limiting its sales potential. CEO Christophe Fouquet indicated in January 2025 that the proportion of ASML’s business in China is expected to decrease compared to 2023 and 2024.

Other semiconductor companies have faced similar headwinds amid tariff tensions and trade uncertainties affecting global markets.

Prospects for ASML

A potential trade agreement between the United States, Europe, and other nations could alleviate some of the current market uncertainties. Houri suggested, "If a deal is reached involving President Trump and multiple countries, the semiconductor sector is likely to see market relief and benefit accordingly."

Despite these challenges, analysts maintain a positive outlook on ASML’s stock. The average target price of €779 indicates an approximate 17% upside potential from recent closing prices.

In a recent analysis following discussions with ASML’s management, Wells Fargo highlighted the company’s optimistic growth prospects for 2025 and 2026, citing significant investments by tech giants such as Samsung and Intel in next-generation chip manufacturing equipment.