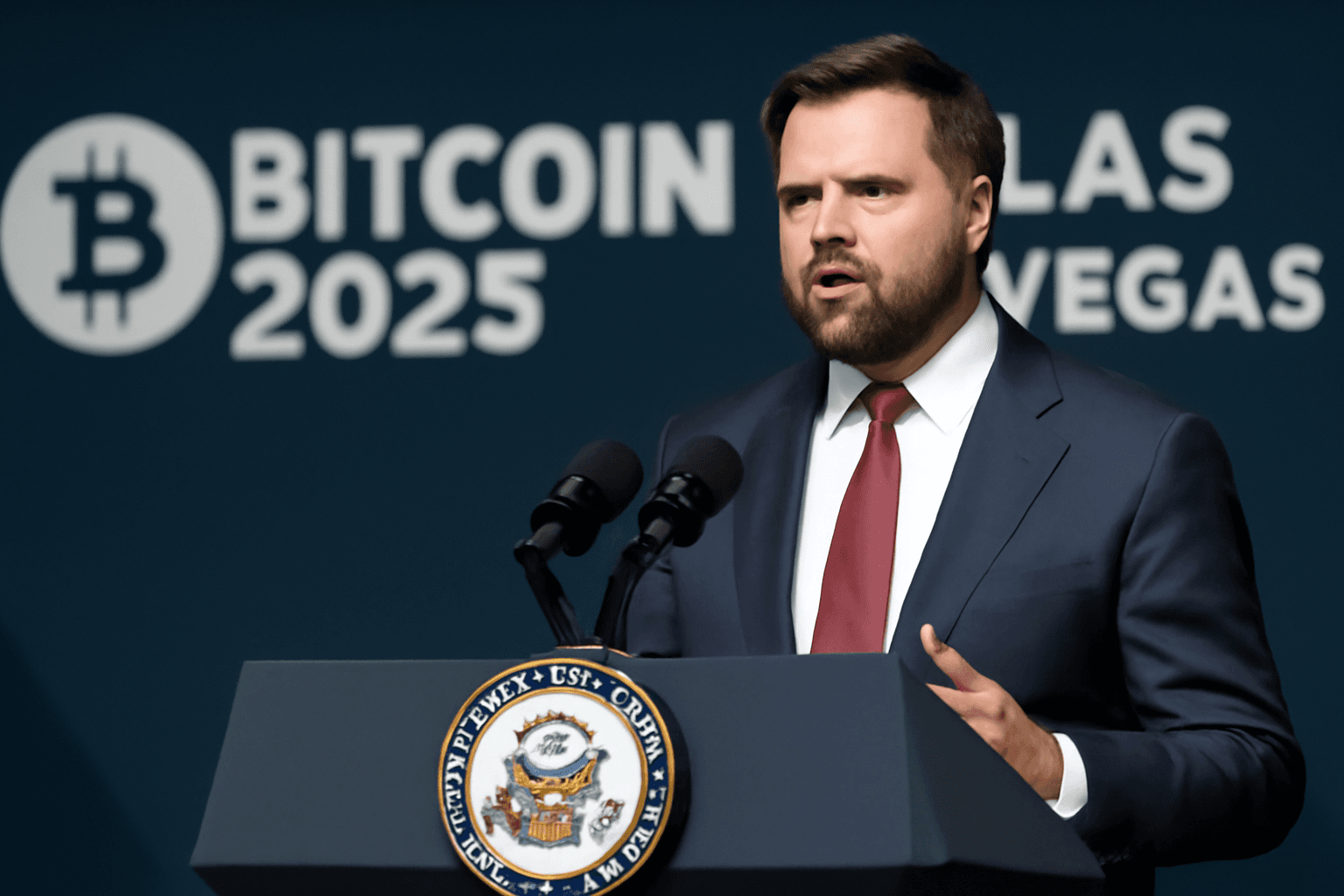

LAS VEGAS — Vice President JD Vance delivered a keynote address at Bitcoin 2025 on May 28, emphasizing the Trump administration’s pro-crypto stance and the benefits of stablecoins to the U.S. economy.

Speaking to an audience of approximately 35,000 attendees at the Venetian in Las Vegas, Vance declared, "In this administration, we do not think that stablecoins threaten the integrity of the U.S. dollar. Quite the opposite. We view them as a force multiplier of our economic might."

Stablecoins—cryptocurrencies pegged to stable assets like the U.S. dollar—have become a focal point amid ongoing legislative efforts. The GENIUS Act, a bill currently progressing in the Senate with bipartisan support, aims to establish a regulatory framework for digital assets. Although the act passed a key procedural vote last week, it faces challenges in the House, where an alternative stablecoin bill has been introduced.

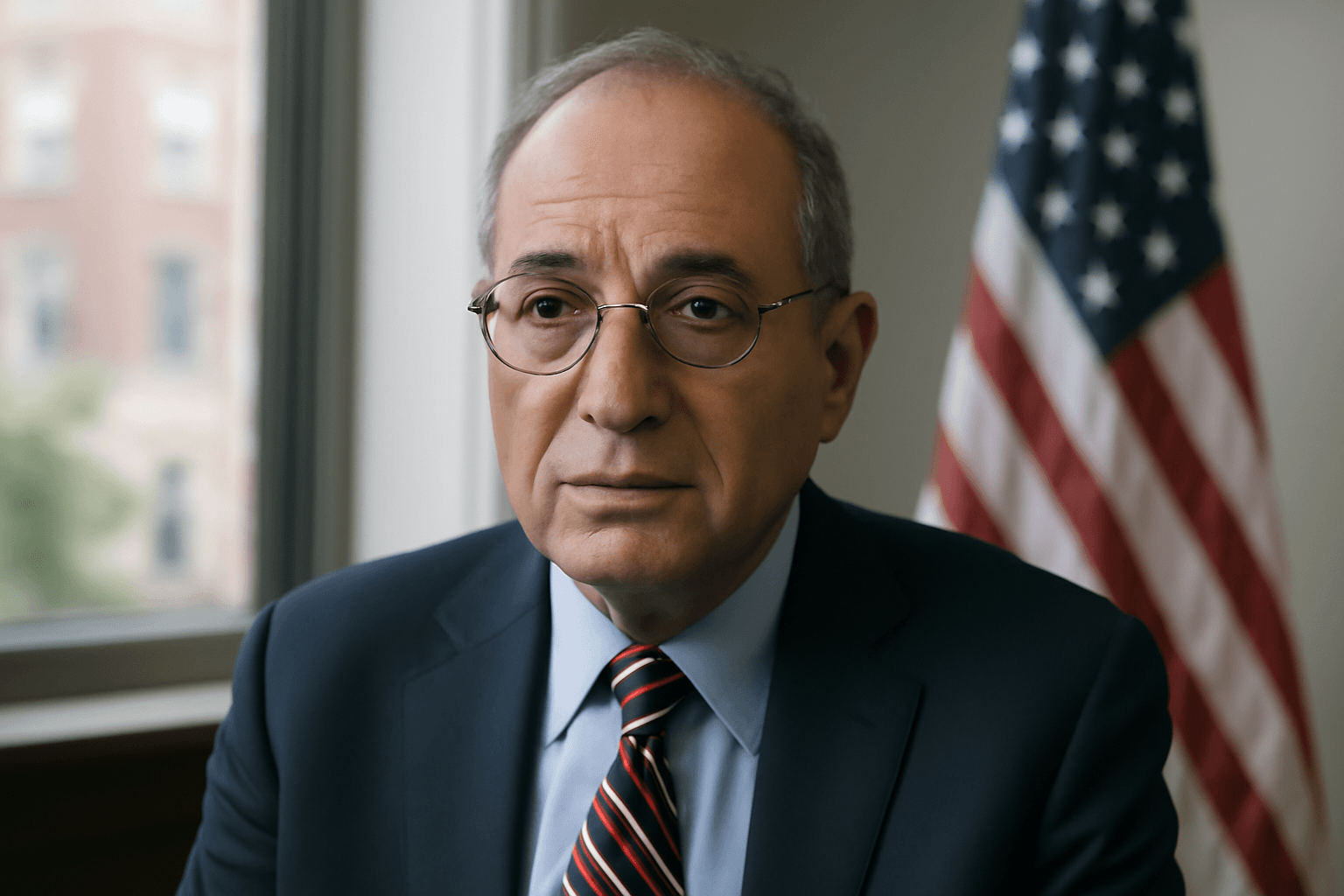

David Sacks, a top cryptocurrency and AI advisor for former President Trump, highlighted the current unregulated stablecoin market exceeds $200 billion. He argued that robust legal oversight could rapidly generate trillions in demand for U.S. Treasury securities.

While Democrats have expressed concerns over potential conflicts of interest involving President Trump’s personal cryptocurrency projects, Vance did not address these controversies during his speech. Instead, he focused on the economic advantages of regulated stablecoins, affirming that their formal recognition would strengthen both the American economy and the dollar.

Vance also celebrated recent regulatory rollbacks benefiting digital assets, including the administration’s establishment of a strategic bitcoin reserve and eased restrictions allowing banks to custody cryptocurrencies. He disclosed personal ownership of bitcoin and criticized former SEC Chairman Gary Gensler, stating, "We fired Gary Gensler — and we're going to fire everyone like him."

In related developments at the conference, Labor Secretary Lori Chavez-DeRemer announced the reversal of prior Labor Department guidance that limited cryptocurrency investment options in retirement plans. She emphasized that fiduciaries—not regulators—should determine crypto’s place in 401(k) offerings, accusing the Biden administration of "putting its thumb on the scale."

This progressive shift in policy reflects broader efforts to integrate digital assets into mainstream financial infrastructure, including updated stances from the FDIC, the Office of the Comptroller of the Currency, and the Federal Reserve.