At the Bitcoin 2025 conference held in Las Vegas, stablecoins emerged as the focal point, overshadowing bitcoin itself. Thousands of investors, developers, and crypto enthusiasts gathered to explore the future of digital currency, with stablecoins driving significant momentum in legislative and market reforms.

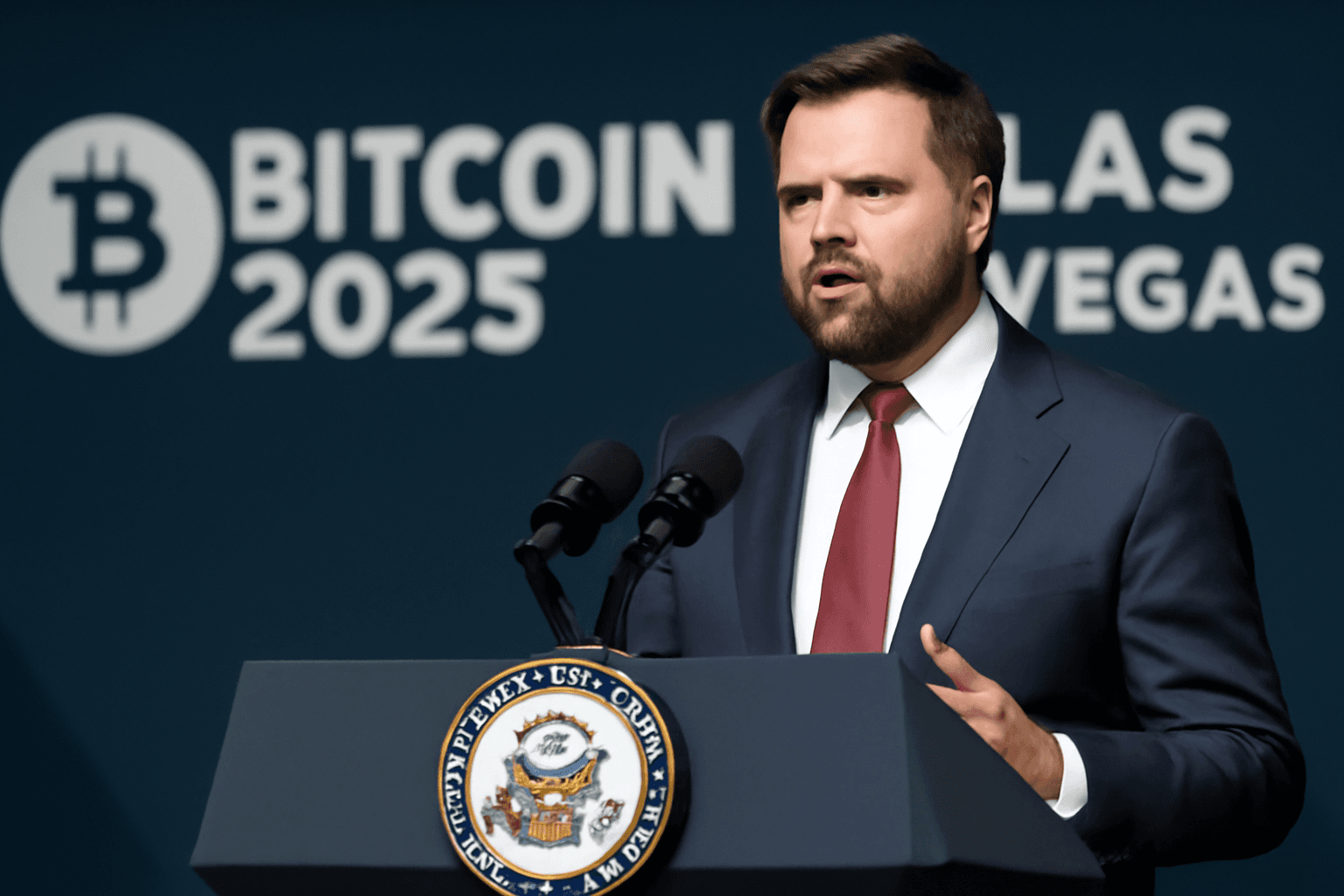

Vice President JD Vance delivered a landmark address at the event, marking the first time a sitting U.S. vice president has spoken at the conference. Vance emphatically endorsed stablecoins, describing them as a "force multiplier" for U.S. economic strength rather than a threat to the dollar’s integrity. He underscored the administration’s vision of stablecoins streamlining payment systems to bolster the U.S. dollar's global dominance for years to come.

White House Digital Assets Council official Bo Hines highlighted the potential of incorporating stablecoins within the U.S. financial framework, suggesting that this integration could unleash trillions of dollars in global demand for American debt instruments.

Central to this development is the proposed GENIUS Act, a Senate bill designed to establish the first comprehensive regulatory structure for stablecoin issuers. Senator Cynthia Lummis, a key proponent of the legislation, indicated that a final agreement with Democrats is imminent, with a cloture vote scheduled soon. The House of Representatives is also advancing similar measures, aiming to finalize stablecoin and broader crypto market legislation before the August recess.

House Majority Whip Tom Emmer applauded Senate initiatives pushing for rapid legislative progress and emphasized the administration's commitment to securing stablecoin regulation promptly. Representative Bryan Steil, chair of the House Subcommittee on Digital Assets, anticipates the companion bill’s consideration by the Financial Services Committee this summer. He highlighted stablecoins’ role in bolstering the U.S. dollar's status as the world’s reserve currency, particularly through the mandated purchase of U.S. Treasuries by issuers.

Tether’s CEO Paolo Ardoino, representing the largest stablecoin issuer (accounting for over 60% of the market), noted that commodity trading firms will significantly drive stablecoin adoption in the coming years. Ardoino warned that traditional financial institutions entering this space may be limited by their existing high-fee customer models, while Tether aims to reach the global population underserved by traditional banking systems. He accentuated the vast opportunity presented by the estimated half of the world’s population lacking sufficient banking access.

Meanwhile, regulatory dynamics appear to be shifting. The Securities and Exchange Commission (SEC), under the current administration, is moving away from aggressive enforcement measures. SEC Commissioner Hester Peirce acknowledged this as a necessary evolution to provide clearer regulatory guidance, facilitating wider institutional involvement in digital assets.

Robinhood CEO Vlad Tenev, engaged in dialogue with SEC officials, expressed optimism that tokenization of assets—digital representation of both public and private markets—could be realized without additional legislation, relying instead on regulatory flexibility.

Overall, Bitcoin 2025 conveyed a clear message: stablecoins are poised to become a foundational element in America’s economic and financial strategy, supported by significant legislative momentum and broadened institutional acceptance.