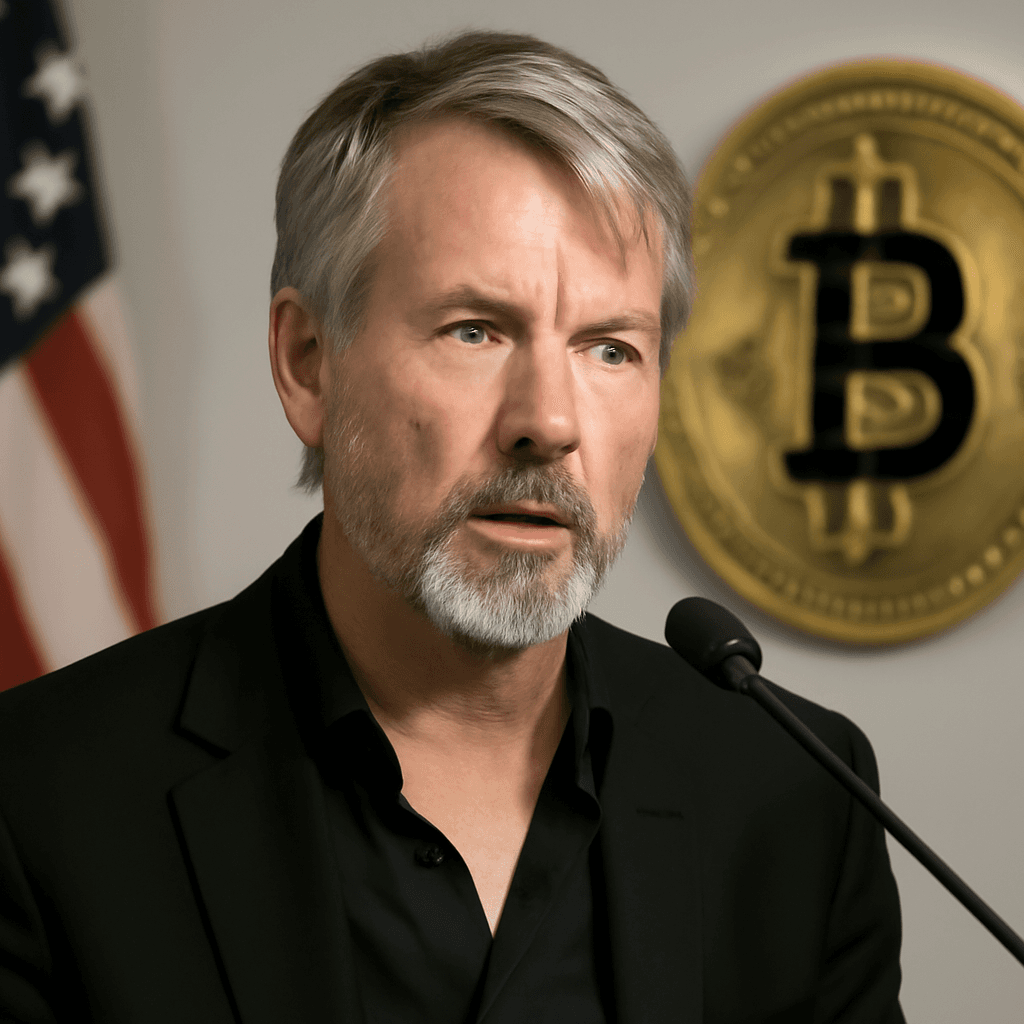

Michael Saylor’s bitcoin purchase strategy is gaining traction worldwide as various companies scrutinize the asset as a treasury option. Despite this growing trend, some Wall Street investors remain skeptical about bitcoin's immediate market impact.

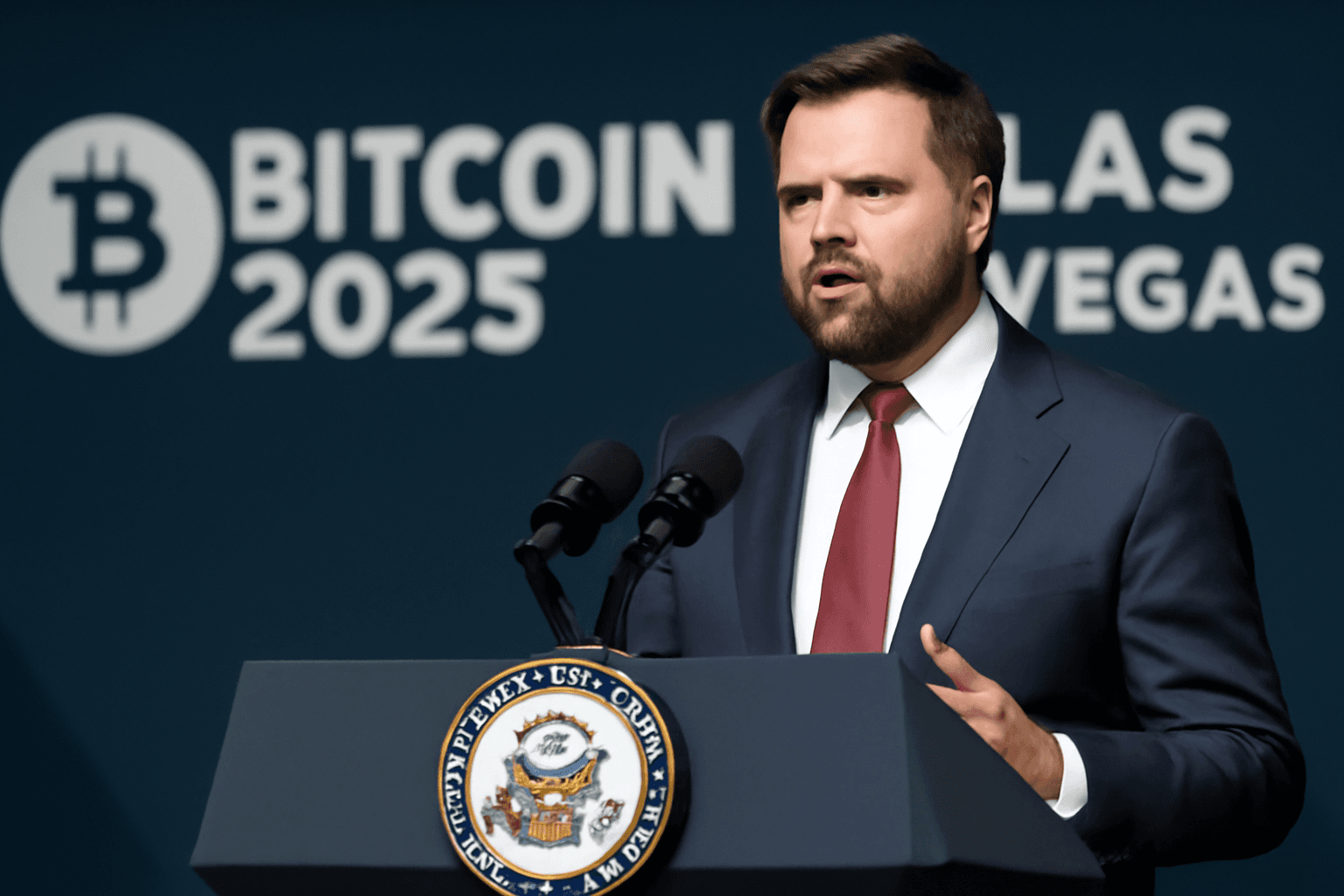

Several firms including GameStop and Trump Media have recently announced plans to buy bitcoin, attempting to emulate Saylor’s successful approach. Saylor, whose company Strategy (formerly MicroStrategy) boasts a cryptocurrency stake valued above $60 billion, described an "explosion of interest" across continents at the Bitcoin 2025 conference in Las Vegas.

“Everywhere I go, companies in Hong Kong, Korea, Abu Dhabi, the Middle East, and the U.K. are exploring bitcoin treasury initiatives,” Saylor remarked. He praised Trump Media’s bitcoin acquisition as "courageous, aggressive, and intelligent," though noted the immediate market reaction to such announcements has been muted or negative, citing share price declines in those companies shortly after their disclosures.

Under the current U.S. administration, bitcoin has found new governmental support. An executive order established a U.S. Strategic Bitcoin Reserve, mandating that seized bitcoin be held permanently as a sovereign digital asset. This order also empowers federal agencies to identify additional ways, budget-neutral, to acquire bitcoin, marking a significant policy shift.

The government will undertake a complete audit of its estimated 200,000 bitcoin holdings for the first time, reinforcing bitcoin’s role as a long-term store of value within public strategy.

Adding to the momentum, the acting vice president addressed the bitcoin community directly, highlighting crypto’s attributes as a hedge against inflation and censorship. Additionally, eroded Department of Labor guidelines now permit broader bitcoin investment opportunities in retirement accounts.

Saylor emphasized bitcoin as "digital capital" and an "explosive idea" that cannot be stopped once its time has arrived. However, resistance remains in some sectors; a notable example is a major software company’s shareholder rejection of a bitcoin purchase proposal last year.

Despite short-term investor hesitance in companies newly entering the bitcoin space, Saylor remains confident in the long-term advantages. He indicated that sizeable capital raises using convertible bonds, as seen with GameStop and Trump Media, may temporarily pressure stock prices but ultimately lay the groundwork for sustained growth.

Strategy has no upper limit on bitcoin acquisitions, with Saylor anticipating rising prices and increasing difficulty sourcing bitcoin. He pledged to enhance the company’s efficiency in accumulating the asset continuously.

Addressing concerns about the influx of governmental and media entities into bitcoin, Saylor argued that this diversity strengthens the network’s robustness, incorruptibility, and trustworthiness. According to him, expanded participation makes the protocol more resilient, encouraging adoption by larger economic players.

As corporate bitcoin treasury management evolves from a niche approach to a widespread strategy, Saylor’s pioneering role and the federal government’s engagement underscore the asset’s growing legitimacy on the global financial stage.