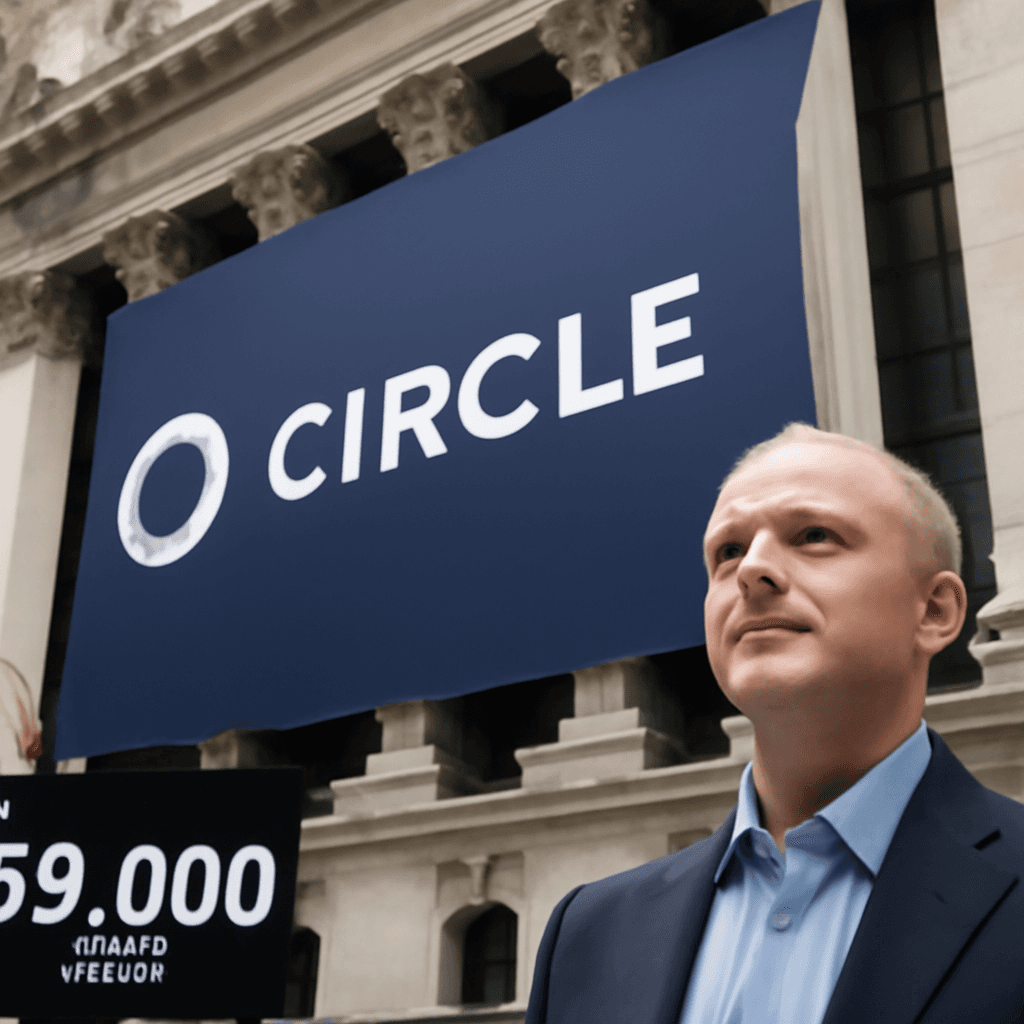

Stablecoin Issuer Circle Experiences Explosive NYSE Debut

Shares of Circle Internet Group surged by an impressive 168% in their New York Stock Exchange debut after the company raised nearly $1.1 billion through its initial public offering (IPO). The stock was priced at $31 but opened at $69, reaching an intraday high of $103.75.

IPO Pricing and Market Response

Circle priced its IPO significantly above earlier expectations, which had set the range between $27 and $28. This valuation positioned the company at approximately $6.8 billion prior to the trading session. Trading volume by the closing bell exceeded 46 million shares, greatly surpassing the quantity of shares freely available for trading.

Positioning Among Cryptocurrency Enterprises

With its listing, Circle joins a select group of primarily cryptocurrency-focused companies including Coinbase, Mara Holdings, and Riot Platforms on U.S. markets. This successful public offering follows Circle’s earlier attempt to go public via a special purpose acquisition company, which was abandoned in 2022 amid regulatory hurdles.

Focused on Compliance and Regulation

Circle’s CEO emphasized the importance of regulatory compliance and collaboration with policymakers, underscoring the company's commitment to operating transparently and within licensing frameworks. The company holds multiple licenses, including New York State’s stringent BitLicense, obtained in 2015, highlighting its leadership in regulation within the crypto space.

Company Background and Market Role

Founded in 2013 and based in Boston, Circle initially concentrated on consumer payments, digital wallets, and crypto exchange services. It later relocated its headquarters to New York to align with regulatory developments.

Circle is notably recognized for launching the U.S. dollar-pegged USDC stablecoin in partnership with Coinbase in 2018 under the Centre consortium. This consortium was dissolved in 2023, with Circle assuming full responsibility for USDC and Coinbase retaining a minority stake.

USDC’s Market Position and Strategic Goals

USDC stands as the second-largest stablecoin globally, trailing only behind Tether. Stablecoins, cryptocurrencies pegged to assets like the U.S. dollar, originally served as transactional bridges for crypto trading but are increasingly adopted in broader financial applications. Circle and Coinbase have agreed to collaborate further, with Coinbase aiming for an extended market reach for USDC.

Growing Demand and Regulatory Landscape

The stablecoin ecosystem benefits from growing political support, particularly amid a U.S. administration more receptive to cryptocurrency innovations. Analysts forecast substantial growth, with some estimates suggesting the stablecoin market could expand into a trillion-dollar opportunity.

Traditional financial entities and non-crypto companies are increasingly exploring stablecoins for use cases including remittances, business payments, and e-commerce. Additionally, stablecoins play a crucial role in tokenized financial markets and may help sustain demand for U.S. government debt, which supports most dollar-backed stablecoins.

Conclusion

Circle’s successful IPO debut reflects both investor confidence in its business model and the broader optimism surrounding stablecoins within the evolving cryptocurrency sector. The company’s strategic focus on regulatory compliance and partnership positions it well among U.S.-listed crypto firms, marking a significant milestone in the mainstream adoption of blockchain-based finance.