Trump-Xi Trade Talks Signal Potential Progress

U.S. President Donald Trump reported a productive 90-minute call with Chinese President Xi Jinping focused primarily on trade matters. Both nations are scheduled to dispatch officials for further negotiations aimed at resolving ongoing disputes. The positive tone of the interaction marks a notable shift from previous tensions.

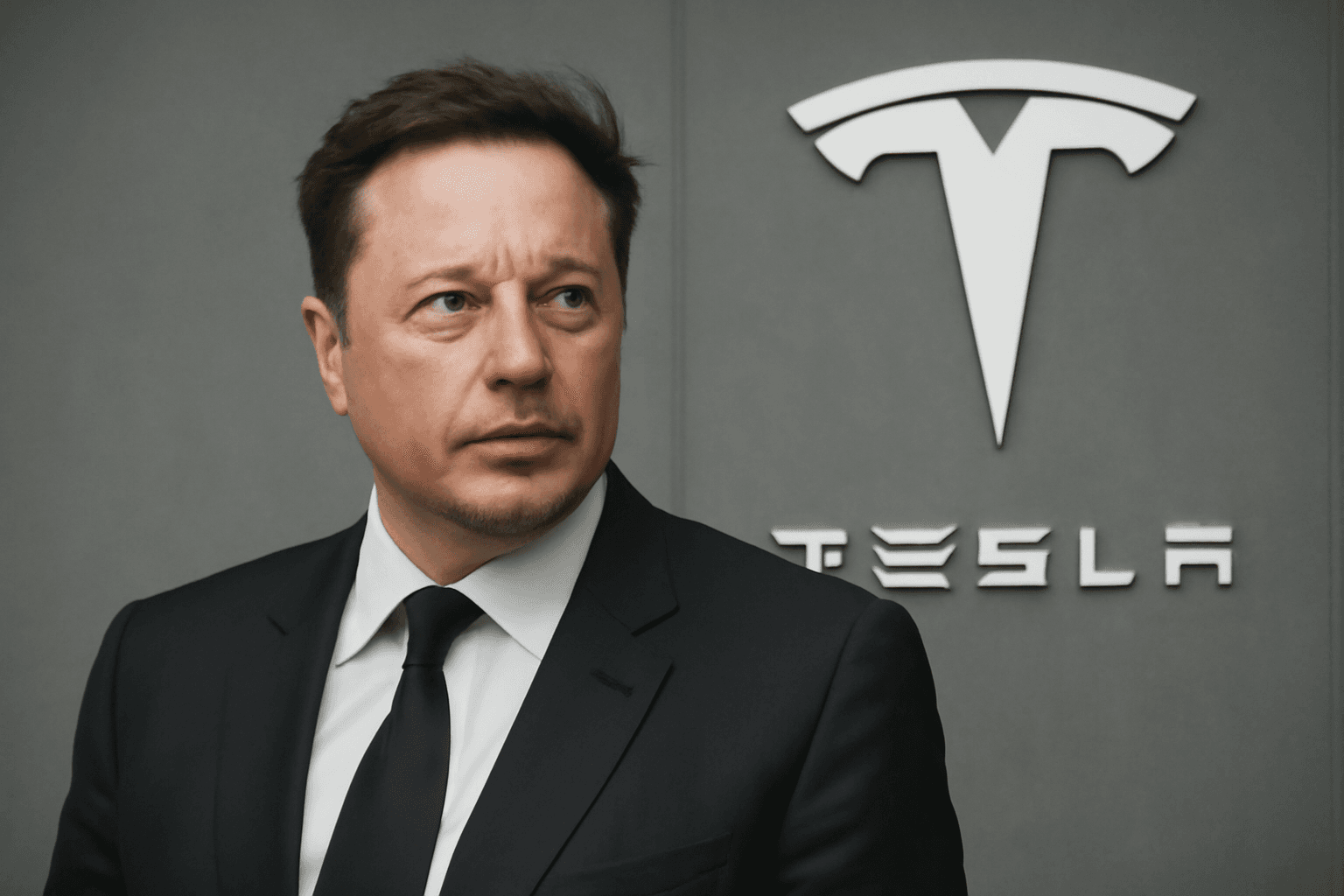

Public Rift Between Trump and Elon Musk Intensifies

The cordial rapport between President Trump and Tesla CEO Elon Musk has deteriorated sharply. On Thursday, Trump labeled Musk as "crazy" amidst disagreements related to a recent major tax bill, while Musk responded by announcing an immediate pause on Tesla-related engagements with the administration. The tension has had tangible market consequences, with Tesla shares plunging 14% in a single day.

European Central Bank Implements Interest Rate Cut

The European Central Bank (ECB) reduced its key interest rate from 2.25% to 2%, coupled with a downward revision of inflation projections from 2.3% to 2%. This decision follows reduced energy costs and the appreciation of the euro. Despite the rate cut, the ECB maintained its 2025 growth forecast at 0.9%, reflecting resilience in early-year economic performance against a dimmer outlook.

US Stock Market Reacts to Mixed Signals

- The U.S. stock market experienced a downward trajectory, largely influenced by Tesla's sharp decline.

- The Dow Jones Industrial Average decreased by 0.53%, the S&P 500 by 0.25%, and the Nasdaq Composite by 0.83%.

- Conversely, Microsoft shares surged 0.8%, reaching a record high, further cementing its position as the largest company by market capitalization.

- European markets showed cautious optimism, with the broad Stoxx Europe 600 index edging higher.

Circle Internet Group Shares Soar After IPO

Circle Internet Group made a remarkable debut on the New York Stock Exchange, with shares climbing 168% on their first trading day. Priced initially at $31, shares opened at $69 and peaked at $103.75. The IPO raised approximately $1.1 billion, adding Circle to the exclusive list of publicly traded crypto-focused enterprises in the U.S.

Market Outlook: Seeking a Balanced Jobs Report

Market strategists advocate for a May jobs report that reflects a moderate labor market status. Neither excessively strong nor weak job numbers are preferable, as extremes could upset equities or bonds. A balanced employment report would signal economic stability and possibly sustain investor confidence.

Corporate Cost-Cutting Amid Economic Uncertainty

Amid global economic uncertainties exacerbated by tariff policies and volatile markets, companies face increasing pressure to reduce expenses. Many organizations have launched cost-control initiatives, including workforce reductions, although many attribute such measures to strategic growth or efficiency plans. However, headcount trimming is increasingly viewed as a direct response to the challenging economic environment.