A recent U.S. federal appeals court decision temporarily halted a lower court ruling that invalidated the majority of former President Donald Trump's reciprocal tariffs. This development introduces significant uncertainty in trade policies and market dynamics.

Initially, the removal of tariffs promised more affordable goods, increased consumer spending, and higher corporate earnings—factors that typically support stock prices. However, the appeals court's intervention means these tariffs could be reinstated, complicating trade negotiations and investor confidence.

Market reactions were mixed: while Nvidia's shares surged 3.3%, buoying the Nasdaq, broader indices like the S&P 500 and Dow Jones Industrial Average saw modest gains constrained by tariff-related concerns. European markets, meanwhile, experienced slight declines, though some analysts predict European equities may outperform U.S. stocks over the next 12 to 18 months.

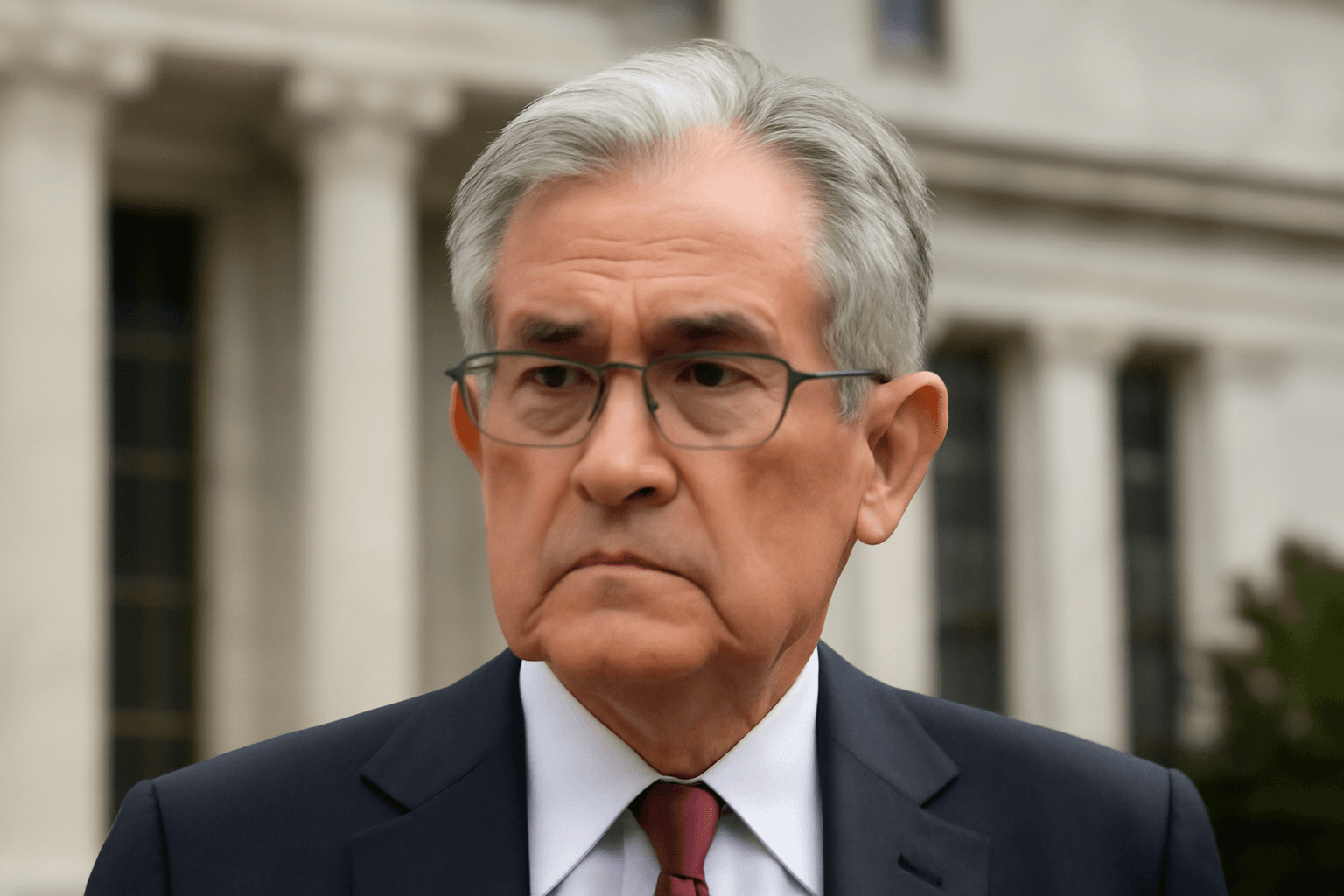

Federal Reserve Chair Jerome Powell met with President Joe Biden, emphasizing that monetary policy decisions will be driven solely by economic data, underscoring the Federal Reserve's commitment to non-political decision-making.

In regulatory news, the Securities and Exchange Commission (SEC) formally dismissed its lawsuit against crypto exchange Binance and its founder Changpeng Zhao. The lawsuit, initially filed in June 2023, alleged illegal dealings and mismanagement of customer funds. The dismissal signifies a potential easing of regulatory pressure on the crypto sector amid evolving governmental perspectives.

Separately, tensions emerged in the artificial intelligence sector. Elon Musk reportedly attempted to disrupt a major AI infrastructure initiative in the Middle East after his company, xAI, was excluded. The partnership, involving OpenAI, other tech giants, and Emirati firm G42, aims to establish extensive AI infrastructure in the United Arab Emirates. Musk's intervention resulted in delays and raised concerns among key stakeholders.

Overall, the fluctuating status of tariffs and regulatory shifts continue to inject volatility and uncertainty into global markets, emphasizing the importance of clear, consistent policies for sustained economic stability.