A U.S. federal appeals court has temporarily suspended a lower court ruling that invalidated most of former President Donald Trump's "reciprocal" tariffs on multiple countries. This pause allows the Trump administration to respond and potentially reinstate its robust trade policies, prolonging uncertainty in global markets.

The initial court ruling was expected to reduce tariffs, lower consumer costs, and boost corporate revenues, which typically benefits stock prices. However, the appeals court decision to halt this ruling on Thursday injected volatility, as investors grapple with potential back-and-forth trade restrictions.

Trump trade advisor Peter Navarro emphasized that even if the administration loses the legal battle, they would seek alternative ways to impose tariffs. This stance complicates trade negotiations and investor confidence as the possibility of tariffs fluctuating based on judicial and policy decisions undermines market predictability.

Reflecting this uncertainty, the S&P 500 initially rose nearly 0.9% but later trimmed gains after news that the administration might appeal to the Supreme Court to maintain tariffs.

Current Trade Dynamics

Treasury Secretary Scott Bessent acknowledged that U.S.-China trade discussions are stalled, though a potential call between President Joe Biden and Chinese President Xi Jinping may occur. Despite agreements in principle, restrictive tariffs and export controls on sensitive materials remain, signaling ongoing tensions.

U.S. markets showed mixed performance amid the tariff ambiguity. While Nvidia surged 3.3% following strong earnings, the broader NASDAQ Composite gained only 0.4%, with the Dow Jones up 0.28% and the S&P 500 rising 0.39%. Contrastingly, Japan’s Nikkei retreated 1.15% amid weaker-than-expected inflation data.

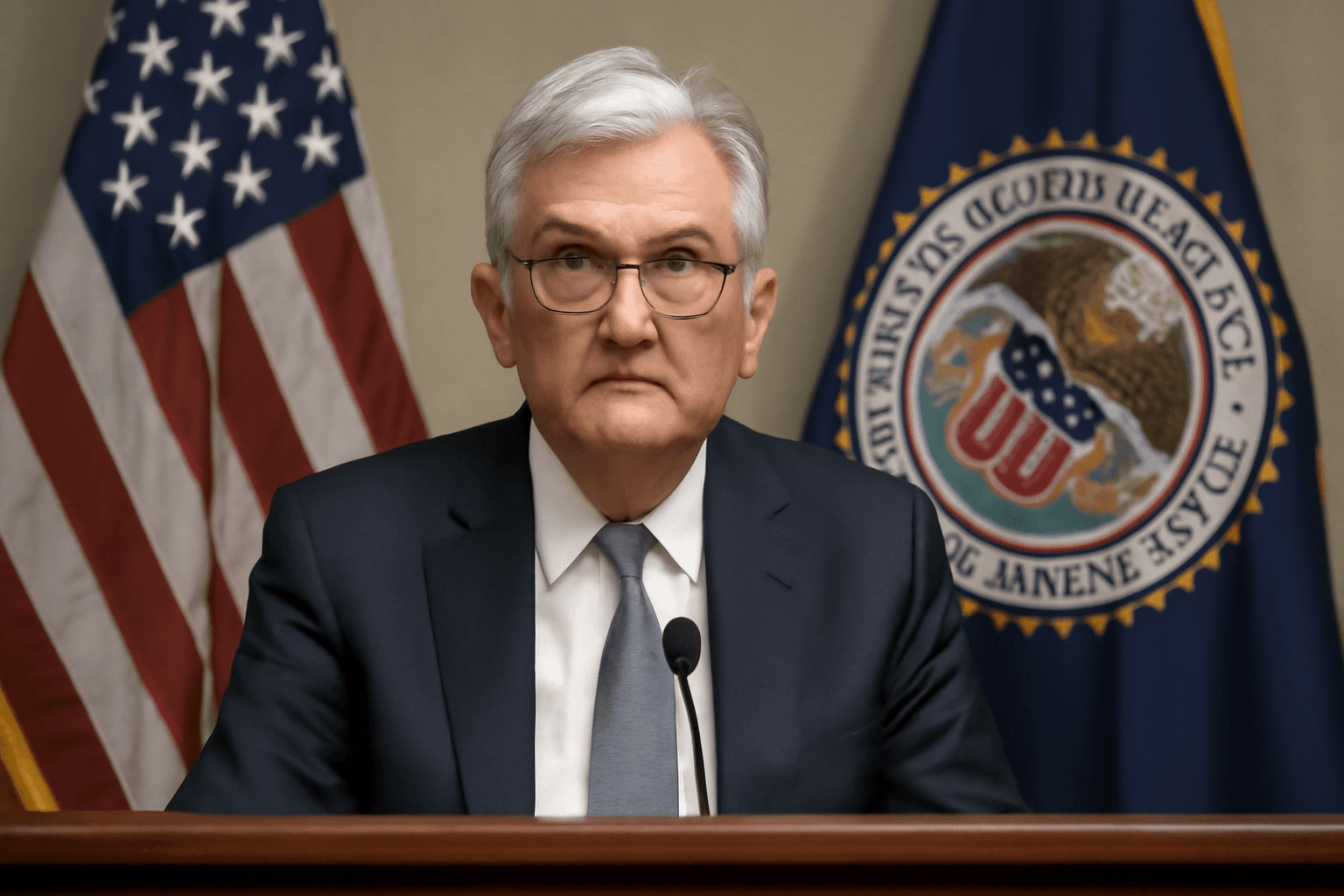

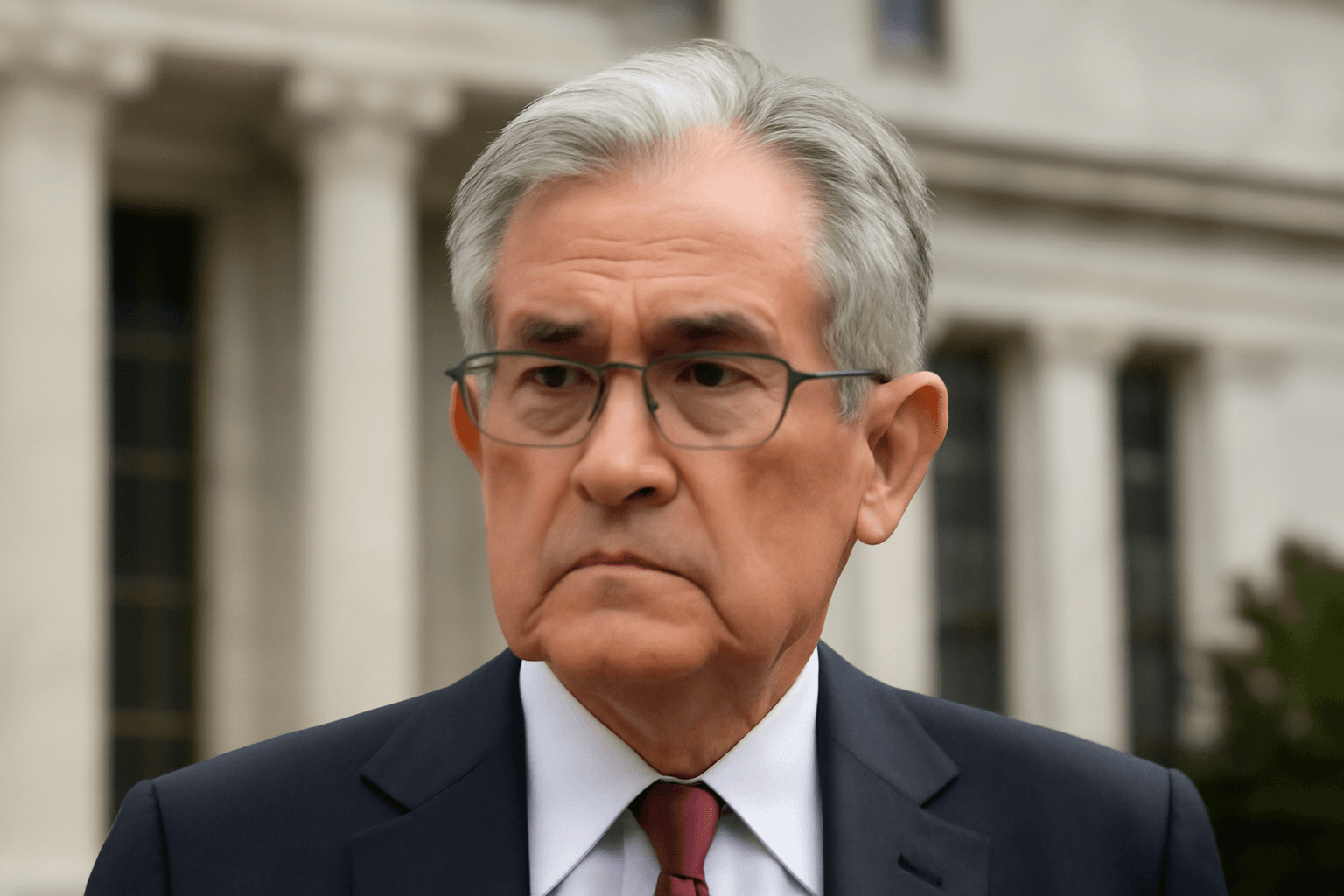

Monetary Policy and Regulatory Updates

Federal Reserve Chair Jerome Powell met with President Biden and reiterated that future interest rate decisions will rely solely on economic data, not political factors. This underscores the Fed’s commitment to data-driven policy amid economic uncertainties.

In regulatory news, the U.S. Securities and Exchange Commission (SEC) officially dropped its lawsuit against Binance and its founder Changpeng Zhao, marking a significant development in the agency’s approach toward cryptocurrency oversight. The suit, initiated in June 2023, had accused Binance of illegal practices involving U.S. customers.

Market Outlook

JPMorgan analysts project European equities may outperform U.S. stocks over the next 12 to 18 months, citing stronger fundamentals and favorable market conditions overseas.

Additional Insights: K-Pop Expansion into China

South Korea’s major entertainment agency Hybe has launched its first office in China, signaling a thaw in cultural and trade relations between the two countries. Beijing's recent easing of restrictions on K-pop and reciprocal visa waivers between China and South Korea further support improving ties.

Unlike industries like semiconductors or automotive manufacturing, the K-pop sector is less sensitive to protectionist trade policies, allowing smoother market entry.

For ongoing updates on market trends and trade policy developments, subscribe to CNBC’s Daily Open newsletter.