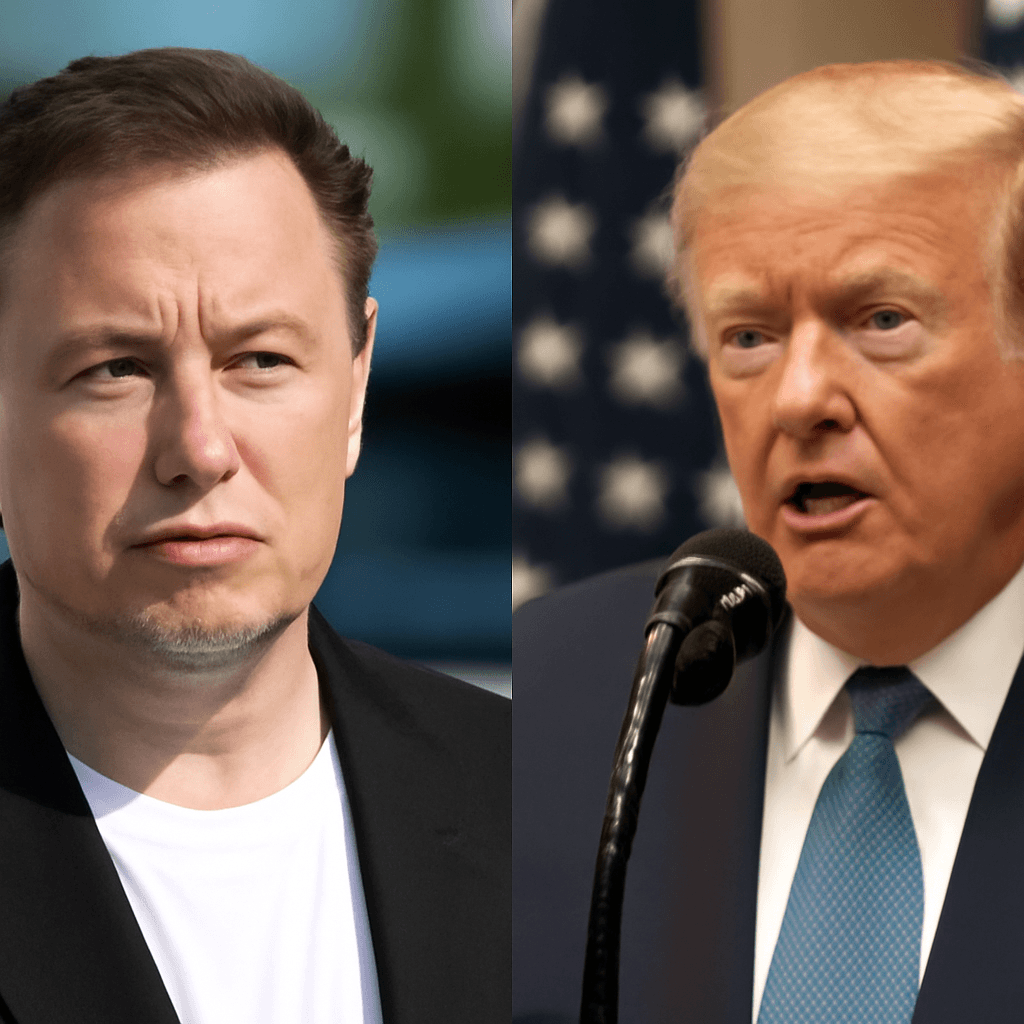

Trump-Musk Dispute Shakes Market Confidence

The public feud between U.S. President Donald Trump and Tesla CEO Elon Musk intensified on Thursday, influencing the financial markets significantly. Tesla's stock plummeted by 14% following a series of public criticisms exchanged between the two leaders concerning a major tax bill. Trump's earlier praise for Musk gave way to sharp rebukes, with Musk responding by announcing immediate adjustments to SpaceX operations.

U.S.-China Trade Dialogue Advances

In a constructive development, President Trump held a 90-minute phone call with Chinese President Xi Jinping, focusing nearly entirely on trade matters. Both leaders agreed to further discussions by their respective officials to address ongoing trade tensions. This positive engagement contrasts with previous strained relations and underscores a potential thaw in bilateral negotiations.

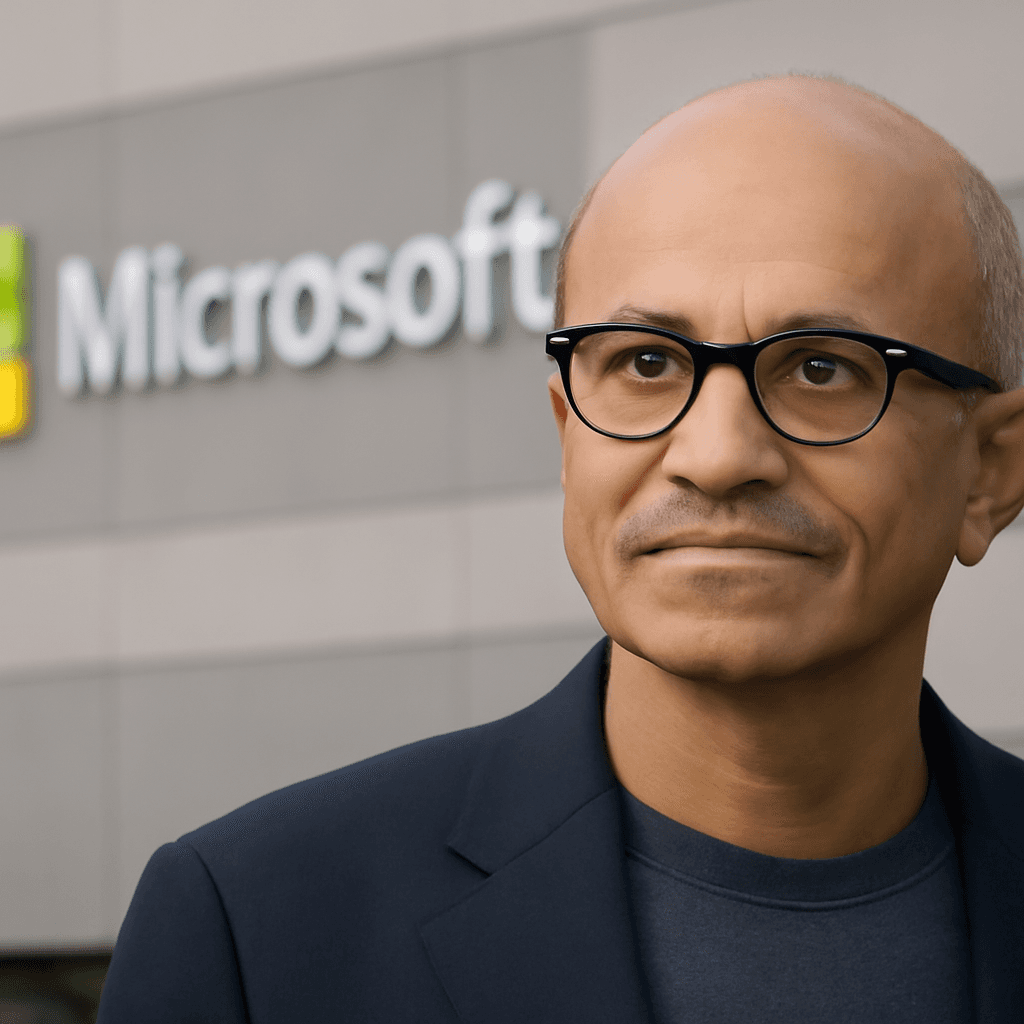

Market Movements Amid Mixed Signals

U.S. stock indices fell moderately on Thursday, dragged down in particular by Tesla’s steep decline. The S&P 500 dropped by 0.53%, Dow Jones Industrial Average was down 0.25%, and Nasdaq Composite decreased by 0.83%. Despite this, Microsoft’s shares gained 0.8%, reaching an all-time high by market capitalization.

Internationally, India's financial markets advanced, buoyed by the Reserve Bank of India’s (RBI) monetary policy adjustments, while Hong Kong’s index retreated slightly by 0.4%.

Reserve Bank of India Cuts Benchmark Rate Aggressively

The RBI reduced its benchmark policy rate by 50 basis points, lowering it to 5.5%, the lowest since August 2022. This move exceeded economists' expectations, who had widely anticipated a 25 basis point cut. The rate reduction comes in the wake of India’s fiscal fourth quarter economic data, with the GDP growth forecast for the current fiscal year maintained at 6.5%, signaling a slowdown compared to the previous year’s 9.2% growth.

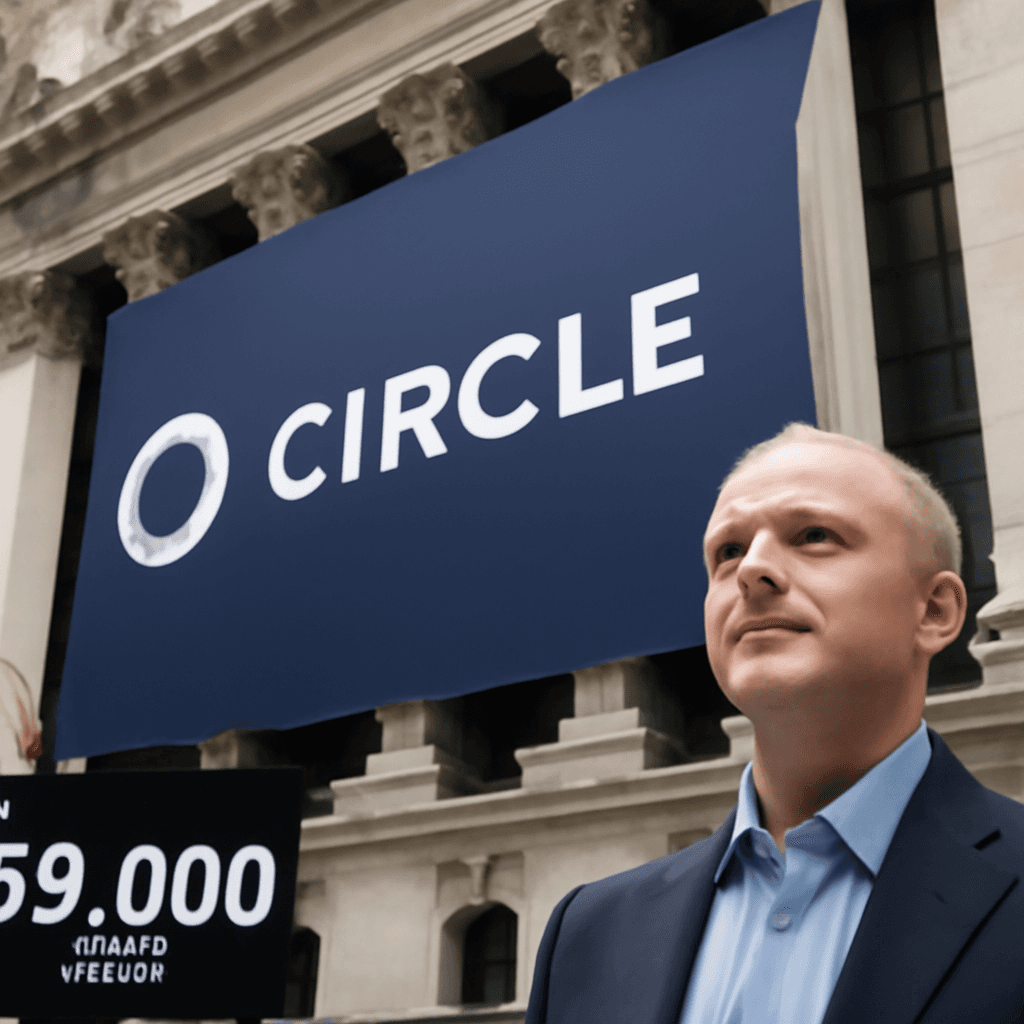

Circle Internet Group's IPO Surges on Inaugural Trading Day

Circle Internet Group experienced a remarkable surge of 168% in its share price on Thursday, debuting on the New York Stock Exchange. The stock opened at $69, more than doubling its IPO price of $31, and trading peaked at $103.75 during the day. Circle's successful entry highlights growing investor appetite for publicly traded cryptocurrency-related companies.

Market Insights and Outlook

- Investors are cautiously watching the May jobs report, hoping for balanced data to stabilize policy outlooks, as suggested by trading analytics.

- The London Stock Exchange is potentially poised to benefit from diversification trends prompted by tariff policies affecting U.S. markets.

Calls for Reconciliation between Trump and Musk

Following the public discord, prominent financial figures have urged the two influential leaders to reconcile for the nation's benefit. Critics highlight the risks of internal disputes spilling over into policymaking and market stability. Musk faces criticism from various quarters for opposing political figures he previously supported, with some suggesting more assertive governmental intervention in his business ventures.