Microsoft Shares Reach New Peak Despite Broader Market Decline

Microsoft's shares soared to a fresh record closing price, marking their highest level since July 2024. On a day when major tech stocks experienced broad declines, the software giant's stock rose by 0.8%, closing at $467.68. This uptick reestablished Microsoft as the world's most valuable company by market capitalization, currently valued at approximately $3.48 trillion.

Microsoft Leads Market Capitalization Rankings

Microsoft's market cap now surpasses major competitors, with its closest rivals valued at significantly lower levels. The company holds a clear lead with $3.48 trillion, while other leading technology giants are valued around $3.42 trillion and $3 trillion respectively.

Year-to-date, Microsoft's stock has appreciated by 11%, in contrast to the flat performance of the Nasdaq index over the same period.

Market Context: Tech Sector Volatility Amid Corporate Disputes

While Microsoft experienced gains, the technology sector broadly faced selling pressure on this trading day. The decline was notably pronounced in certain companies entangled in high-profile public disputes between their chief executives, which contributed to market turbulence.

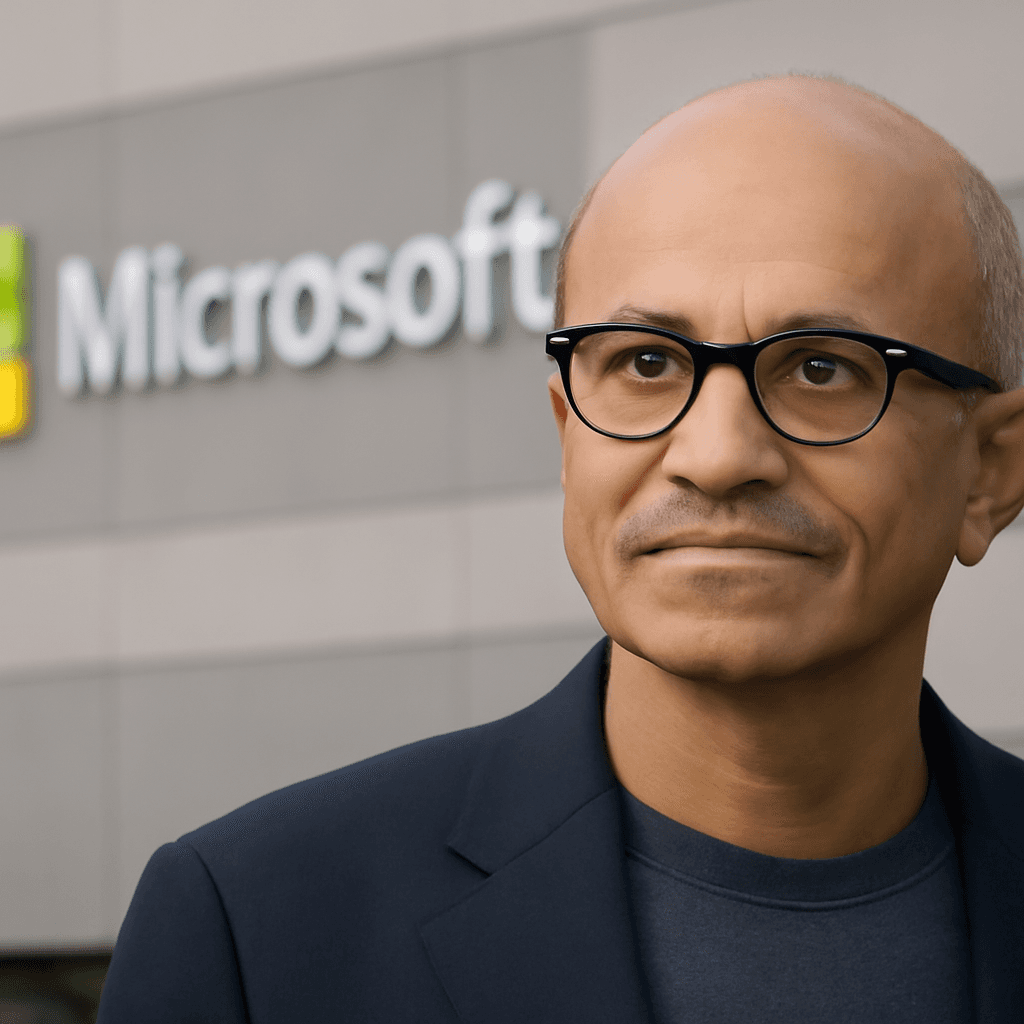

Investor Focus Remains on Microsoft’s Strategic AI Partnership

Investors appear to be overlooking sector uncertainties, focusing instead on Microsoft's strategic positioning in artificial intelligence (AI). CEO Satya Nadella emphasized the company’s close collaboration with AI startup OpenAI during a recent interview.

Microsoft's ongoing partnership with OpenAI, underpinned by a total investment nearing $14 billion, remains a core driver of investor confidence. Earlier this year, OpenAI made a significant new commitment involving Microsoft’s Azure cloud platform, further strengthening their alliance.

In his remarks, Nadella highlighted the mutual benefits of this relationship, hinting at continued innovation and integration of AI capabilities within Microsoft's ecosystem.

Outlook and Investor Confidence

Microsoft's resilience in the face of a volatile market underscores its strong fundamentals and strategic focus on emerging technologies like AI. The company’s ability to maintain growth and investor interest amid sector challenges positions it favorably for the future.

As the tech sector continues to navigate executive conflicts and shifting market dynamics, Microsoft's performance illustrates how innovation partnerships can sustain momentum and shareholder value.