David Kudla, founder and CEO of Mainstay Capital Management, recently shared his investment insights on CNBC's "Power Lunch," emphasizing the promising outlook for Palantir Technologies and Constellation Energy in the context of rising artificial intelligence (AI) integration. He also addressed the challenges facing Salesforce amid intensifying competition in the workflow software sector.

Palantir: A Strong Buy Despite High Valuation

Palantir Technologies has seen its stock soar by 64% in 2025, outperforming many of its industry peers. Kudla maintains that Palantir remains a valuable buy opportunity, particularly during price dips. He disclosed purchasing shares in June 2023 at approximately $15, while the stock currently trades near $124.

Palantir's strength lies in its effective utilization of AI, especially in government applications such as counterterrorism. Additionally, the company is expanding its footprint in the private sector through commercial contracts. Kudla believes these factors justify Palantir’s premium valuation and suggest considerable growth potential ahead.

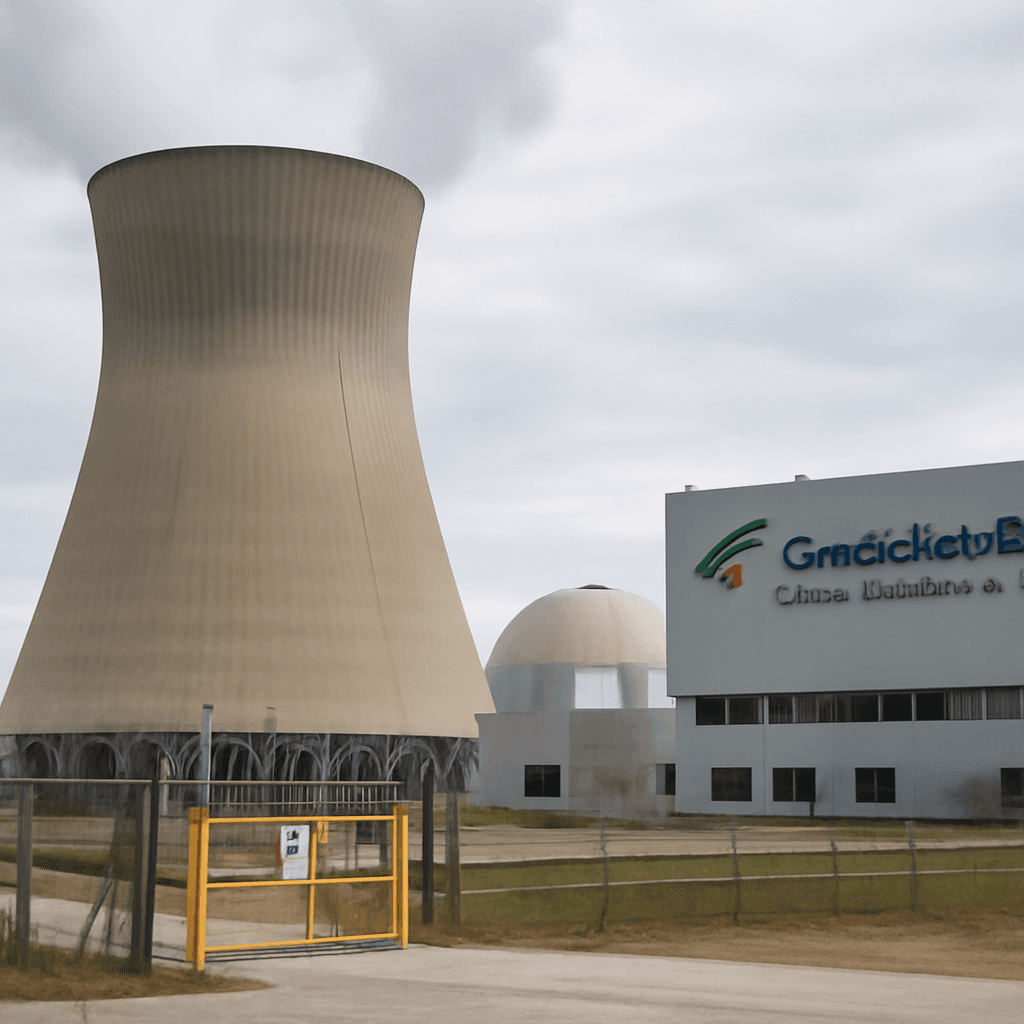

Constellation Energy Benefits from Government Support for Nuclear Power

As the largest nuclear operator in the United States, Constellation Energy is well positioned to capitalize on recent government measures favoring nuclear energy development. President Donald Trump's recent executive orders aim to streamline the Nuclear Regulatory Commission's operations, facilitating deregulation and expediting nuclear plant construction, which currently can take nearly a decade.

Kudla views these changes as catalysts enabling nuclear power to meet the growing energy demands of AI data centers and broader American energy needs. He noted acquiring shares at the end of March, with the stock experiencing a 38% surge in May alone.

Salesforce Faces Competitive Pressures in AI-Driven Workflow Software

Kudla considers Salesforce a hold due to increased competition, notably from Microsoft. Despite maintaining approximately 7% year-over-year growth and leading its market segment, Salesforce confronts significant challenges integrating AI into its customer relationship management (CRM) and workflow offerings.

The ongoing rivalry between Microsoft’s Copilot and Salesforce’s Agentforce highlights the critical importance of AI integration for future market dominance. Salesforce’s stock has declined over 17% year-to-date, although it showed a modest postmarket gain following solid fiscal first-quarter results and improved guidance.

In summary, Kudla’s analysis underscores the investment potential in companies effectively leveraging AI technology and supported by favorable regulatory environments, such as Palantir and Constellation Energy, while advising caution with Salesforce amid heightened competition.