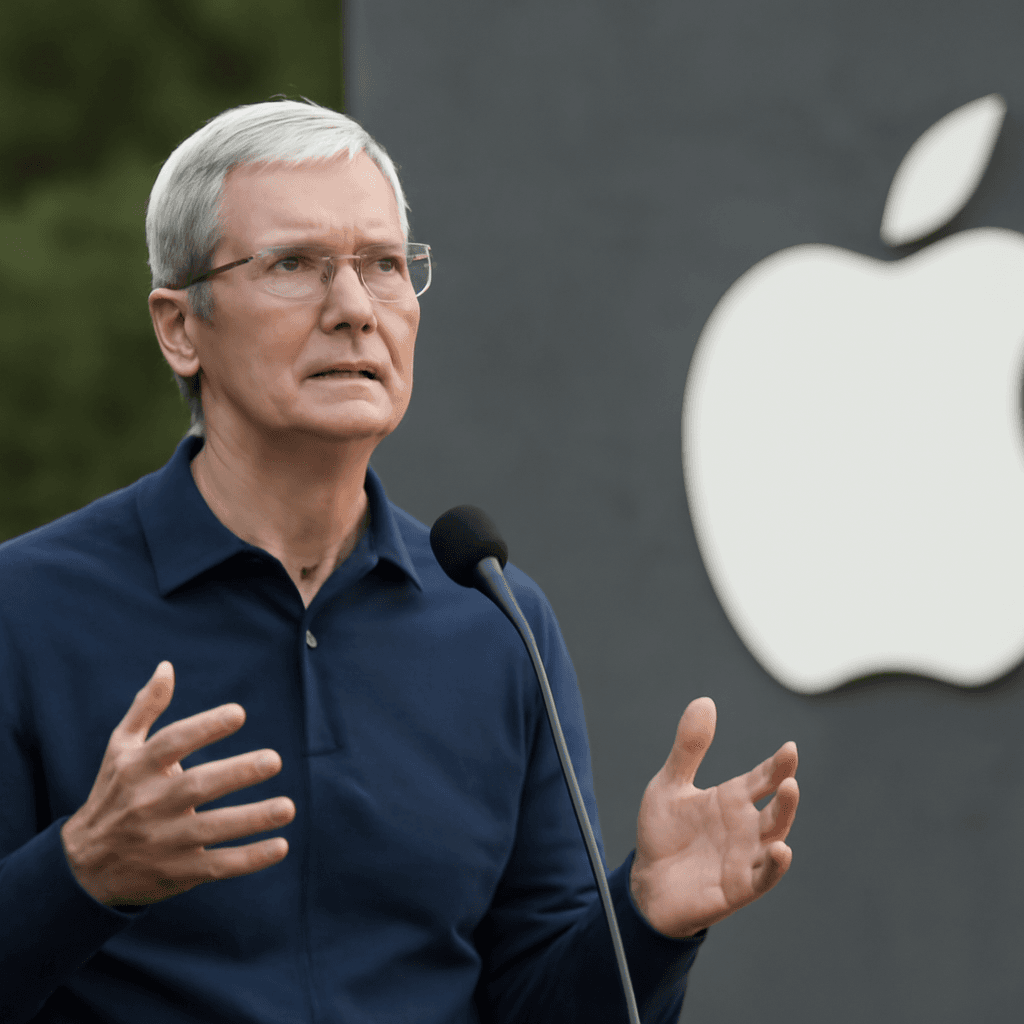

Apple Faces High Expectations at WWDC Amid Stock Challenges

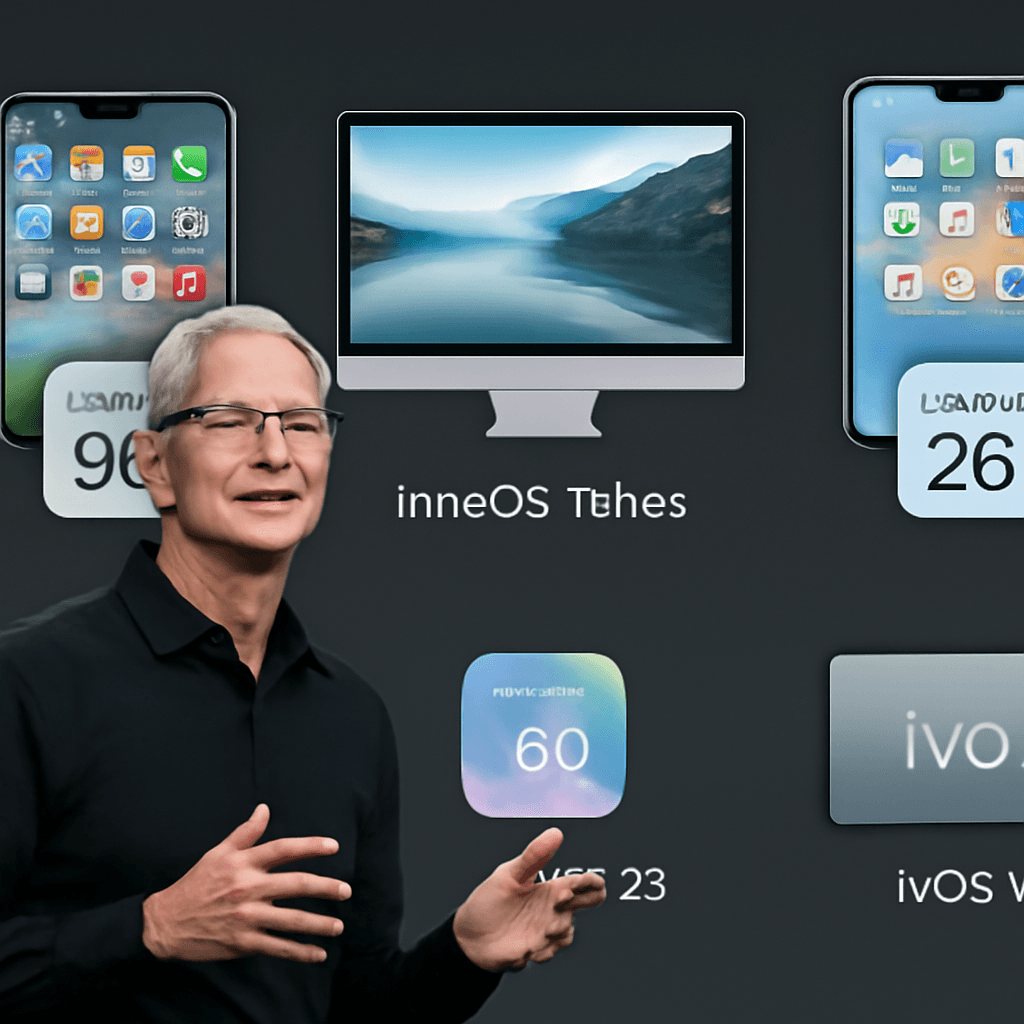

As Apple gears up for its annual Worldwide Developers Conference (WWDC) in Cupertino, California, investors are watching closely. The spotlight will be on CEO Tim Cook’s keynote, set to unveil the company’s artificial intelligence (AI) strategy — a move that many hope will reignite enthusiasm around the iPhone and potentially kick off a new upgrade cycle. This comes at a crucial time, as Apple’s stock has struggled this year, losing its spot as the world's most valuable public company and dropping more than 20% from its December peak.

Why This WWDC Is More Critical Than Ever

Experts highlight the significance of this year’s conference. Art Hogan, chief market strategist at B. Riley Wealth Management, called it perhaps "as important as it's ever been." Apple has been one of the biggest underperformers among large-cap tech stocks, trailing behind rivals like Microsoft and Nvidia. The pressure is on to deliver a compelling vision, especially around AI, to regain investor confidence.

Apple’s AI Journey: Playing Catch-Up

Apple’s AI offerings have lagged compared to competitors like Google, Meta, and OpenAI. Its current generative AI features have yet to captivate users or analysts alike, sparking concern about the company’s longer-term competitiveness in this rapidly evolving space.

Still, Apple’s loyal user base and proven track record offer hope. "When users think about AI tools, they have many options, but typically only one go-to device ecosystem," Hogan explained. "People rely on their iPhones, iPads, and MacBooks. Apple’s ability to integrate AI seamlessly across its devices may become a unique advantage." This week’s announcements could finally offer the AI breakthroughs Apple fans have been waiting for.

Stock Outlook: Hope for a Turnaround?

A successful WWDC could serve as the catalyst for Apple’s stock to recover and catch up with other technology giants collectively known as the 'Magnificent Seven.' Despite a recent 8% decline this quarter, Apple remains a market mover; a strong product rollout could help lift not just its own shares, but the broader tech market.

Mixed Sentiment from Analysts

Not all experts are optimistic. Needham analyst Laura Martin recently downgraded Apple to "hold" from "buy," citing the company’s high valuation and slower growth trajectory. She expressed skepticism about the impact of the upcoming WWDC features, suggesting that without groundbreaking announcements, the stock might lack a meaningful catalyst to spur upgrades.

Conversely, JPMorgan’s Samik Chatterjee noted that the summer months historically signal a strong period for Apple, buoyed by anticipation around new iPhone launches. The latest data shows Apple’s stock climbing steadily, up 1.5% over the past five days, hinting at cautious optimism ahead of the conference.

What to Watch for at WWDC

- Detailed AI integrations across Apple’s device lineup

- Fresh features for the iPhone 17 and possibly new hardware announcements

- Evidence of a revitalized software ecosystem that could drive user upgrades

Investors and users alike will be tuning in to see if Apple can deliver on its promise, reversing the narrative to regain its innovative edge and potentially jumpstart a new phase of growth.