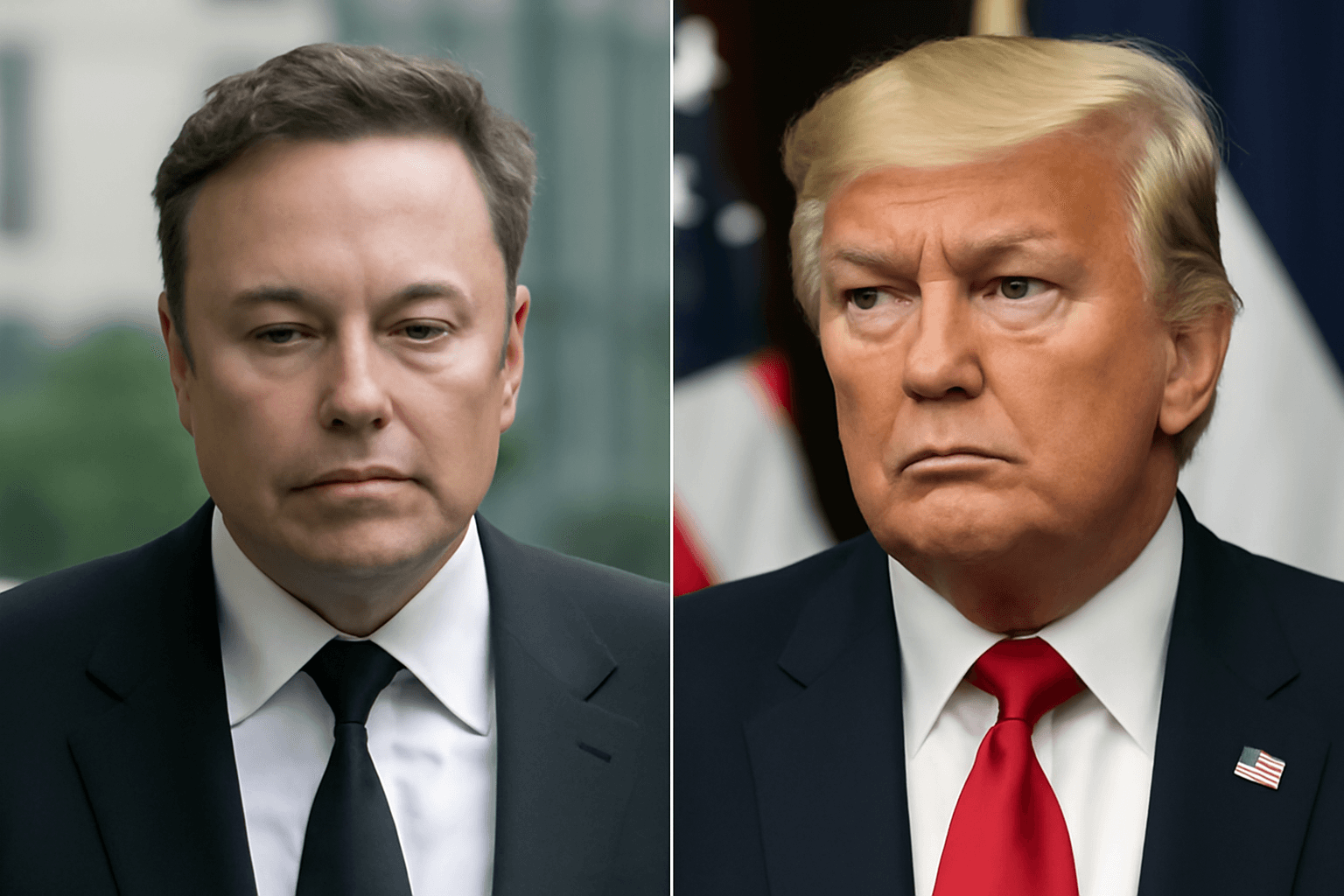

Tesla Stock Rebounds Following Public Dispute

Tesla's stock surged approximately 5% after experiencing a sharp decline triggered by a public conflict between CEO Elon Musk and former President Donald Trump. The recent feud led to a loss of about $152 billion in Tesla's market capitalization.

Background of the Dispute

The clash originated from Musk's harsh criticism of a significant tax and spending bill championed by Trump, which Musk described as a "disgusting abomination." The bill involved a mixture of tax cuts and increased government spending but notably excluded electric vehicle (EV) tax credits, an exclusion that frustrated Musk.

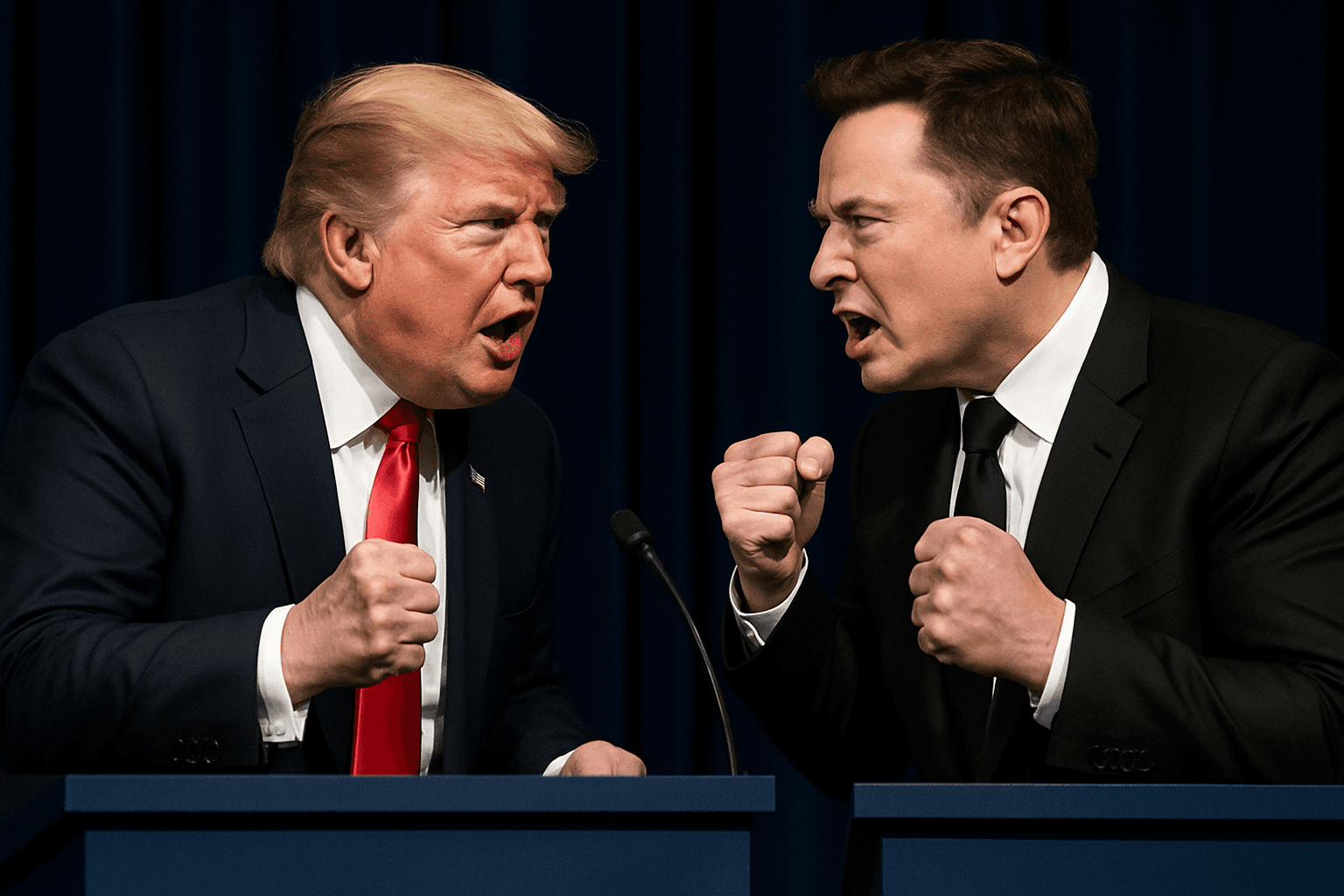

Following Musk’s vocal disapproval, Trump publicly addressed the Tesla CEO’s comments, expressing disappointment and highlighting the assistance he claimed to have provided Musk previously. This exchange fueled a heated war of words between the two personalities.

Escalation of Hostilities on Social Media

The disagreement intensified on social media platforms, with Musk asserting that without his involvement, Trump's political outcomes would have been significantly different. He referenced the 2024 U.S. election, suggesting his influence prevented a Democratic majority in the House and limited the Republican Senate majority.

Musk further called for Trump's impeachment and made controversial allegations suggesting Trump's involvement in sensitive files related to the late criminal Jeffrey Epstein. Trump denied any wrongdoing and rejected these accusations.

Market Impact and Analyst Perspectives

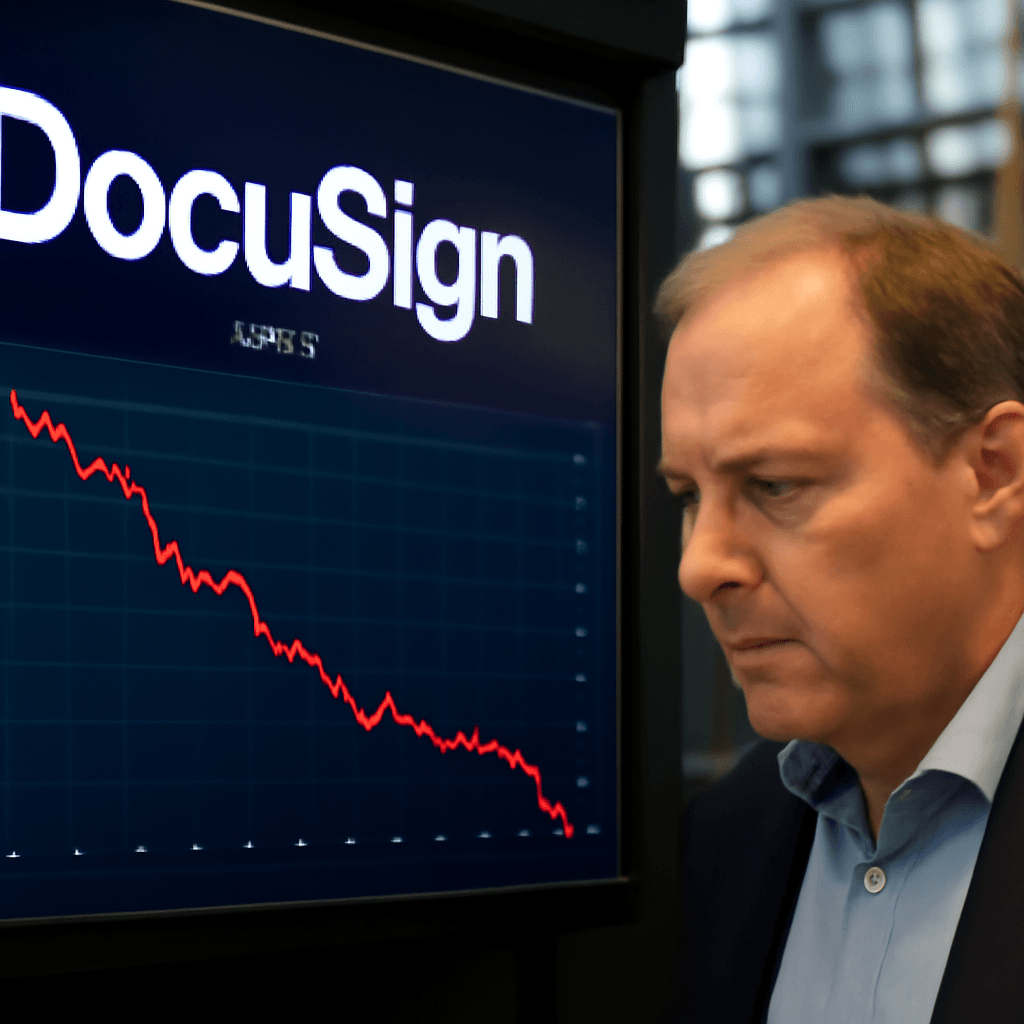

The public fallout between Musk and Trump caused Tesla shares to plummet, ultimately closing down by 14% and dropping the company's market value below the $1 trillion threshold.

However, analysts remain optimistic about Tesla's future. Wedbush Securities analyst Dan Ives noted the mutual importance of Musk and Trump and mentioned a scheduled call to ease tensions, which, though officially unconfirmed, has sparked hopes of reconciliation.

"Tesla shares have been oversold due to this news," stated Ives, emphasizing that the company’s fundamentals remain strong despite the recent volatility.

Summary of Key Points

- Tesla's market cap dropped $152 billion amid a public dispute between Elon Musk and Donald Trump.

- Musk criticized a tax and spending bill for excluding EV credits, calling it "disgusting."

- Trump expressed disappointment and threatened to cut Musk's contracts in retaliation.

- The clash caused Tesla’s stock to fall 14%, dipping below the $1 trillion market cap mark.

- Analysts anticipate a potential resolution and consider the stock oversold.

Looking Ahead

The situation remains fluid, with potential dialogue between Musk and Trump possibly mitigating further damage. Tesla investors and market watchers will be closely monitoring developments, particularly regarding government policies affecting EV incentives and the impact of public perceptions on Tesla's stock performance.