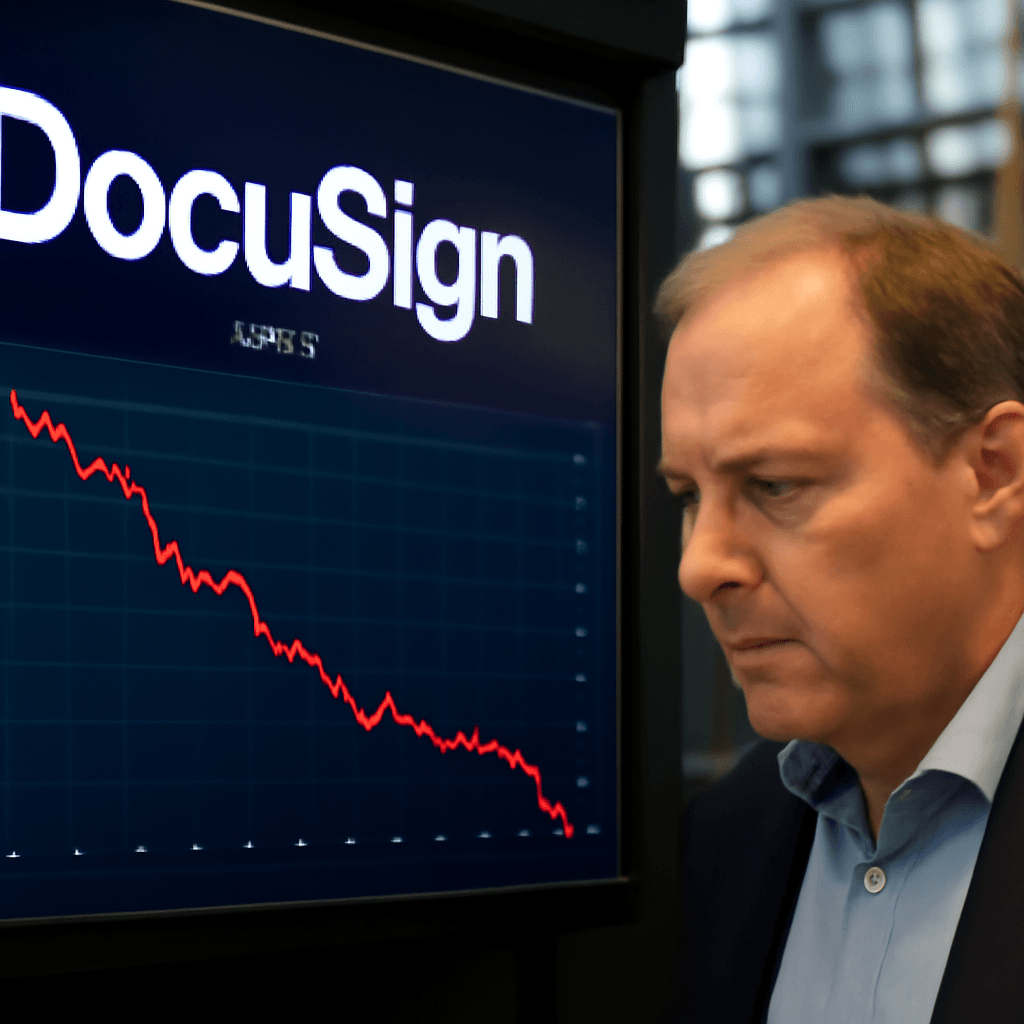

DocuSign's Stock Drops Following Billings Outlook Revision

DocuSign experienced an 18% decline in its stock price on Friday after the electronic signature company reported fiscal first-quarter results that missed its billings expectations and subsequently lowered its full-year billings forecast.

Fiscal First-Quarter Performance

In the fiscal first quarter ending April 30, DocuSign posted revenue of $764 million, marking an 8% increase compared to the same period last year and surpassing analyst estimates of $748 million. Adjusted earnings per share also exceeded expectations, coming in at 90 cents versus the projected 81 cents.

Subscription revenue rose 8% year-over-year to $746.2 million. Net income increased substantially to $72.1 million (34 cents per share) compared to $33.8 million (16 cents per share) in the prior year.

Billings and Outlook Disappointment

Despite strong revenue and earnings results, the key metric of billings—indicating frontline sales—fell short of market expectations. The company reported billings of $739.6 million, below the anticipated $746 million and also beneath DocuSign's own forecast range of $741 million to $751 million.

Reflecting caution, DocuSign revised its full fiscal year billings forecast downward to a range of $3.28 billion to $3.34 billion, down from the previous guidance of $3.3 billion to $3.35 billion.

Forward Guidance and Additional Initiatives

For the upcoming fiscal second quarter, DocuSign projects revenue between $777 million and $781 million, aligning closely with the consensus estimate of $775 million. Full-year revenue guidance was maintained at $3.15 billion to $3.16 billion, slightly above analyst expectations of $3.14 billion.

Additionally, the company announced an increase in its stock buyback program, adding $1 billion to the existing plan, bringing the total authorized share repurchase amount to $1.4 billion.

Market Impact and Performance Year to Date

DocuSign shares have declined more than 16% year to date, as investor concerns over billings continue to weigh on the stock despite earnings beat and solid revenue growth. The recent selloff highlights the importance of billings as a key indicator for market sentiment toward subscription-based technology companies.