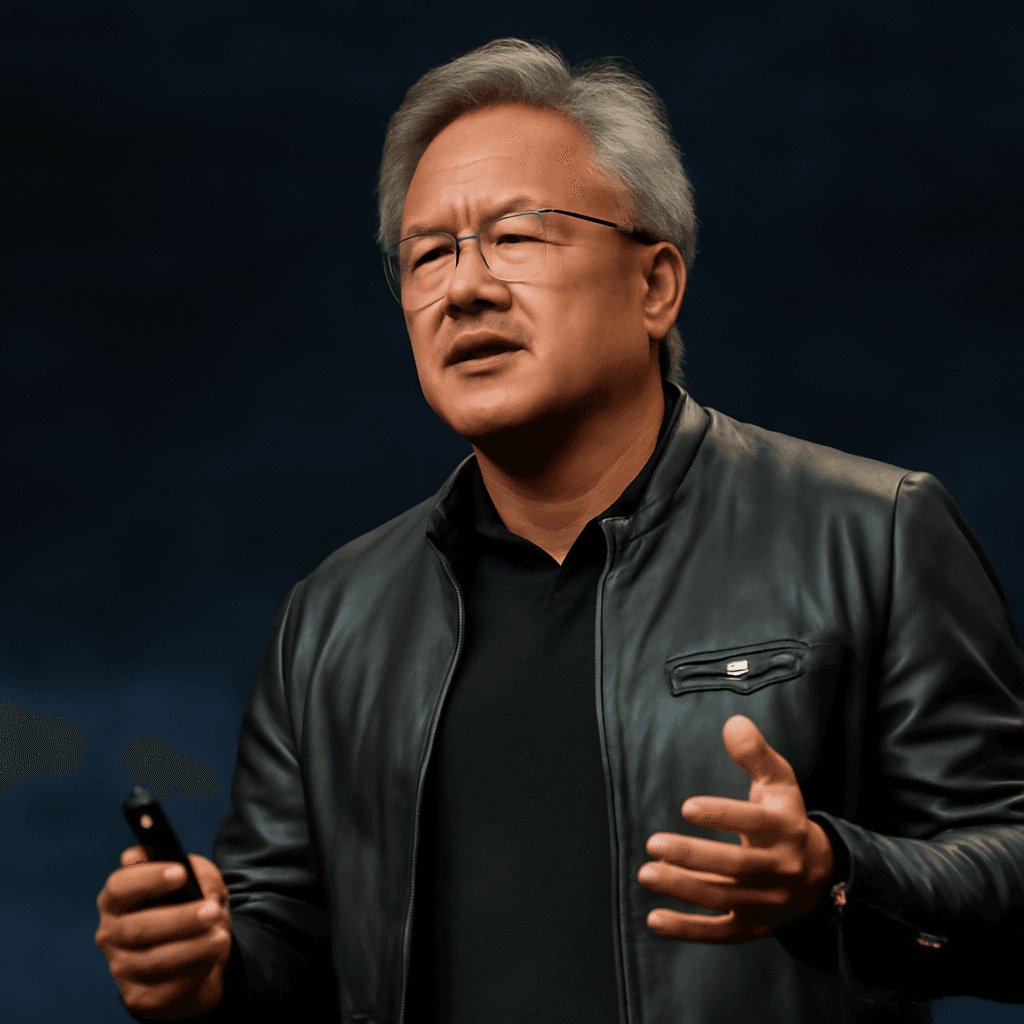

Nvidia, a global leader in artificial intelligence (AI) chips and semiconductor technology, recently reported outstanding financial results that exceeded market expectations. For the quarter ending April 27, 2025, Nvidia generated revenue of $44.06 billion, surpassing the consensus estimate of $43.31 billion. The company also posted adjusted earnings per share (EPS) of $0.96, outperforming the expected $0.93.

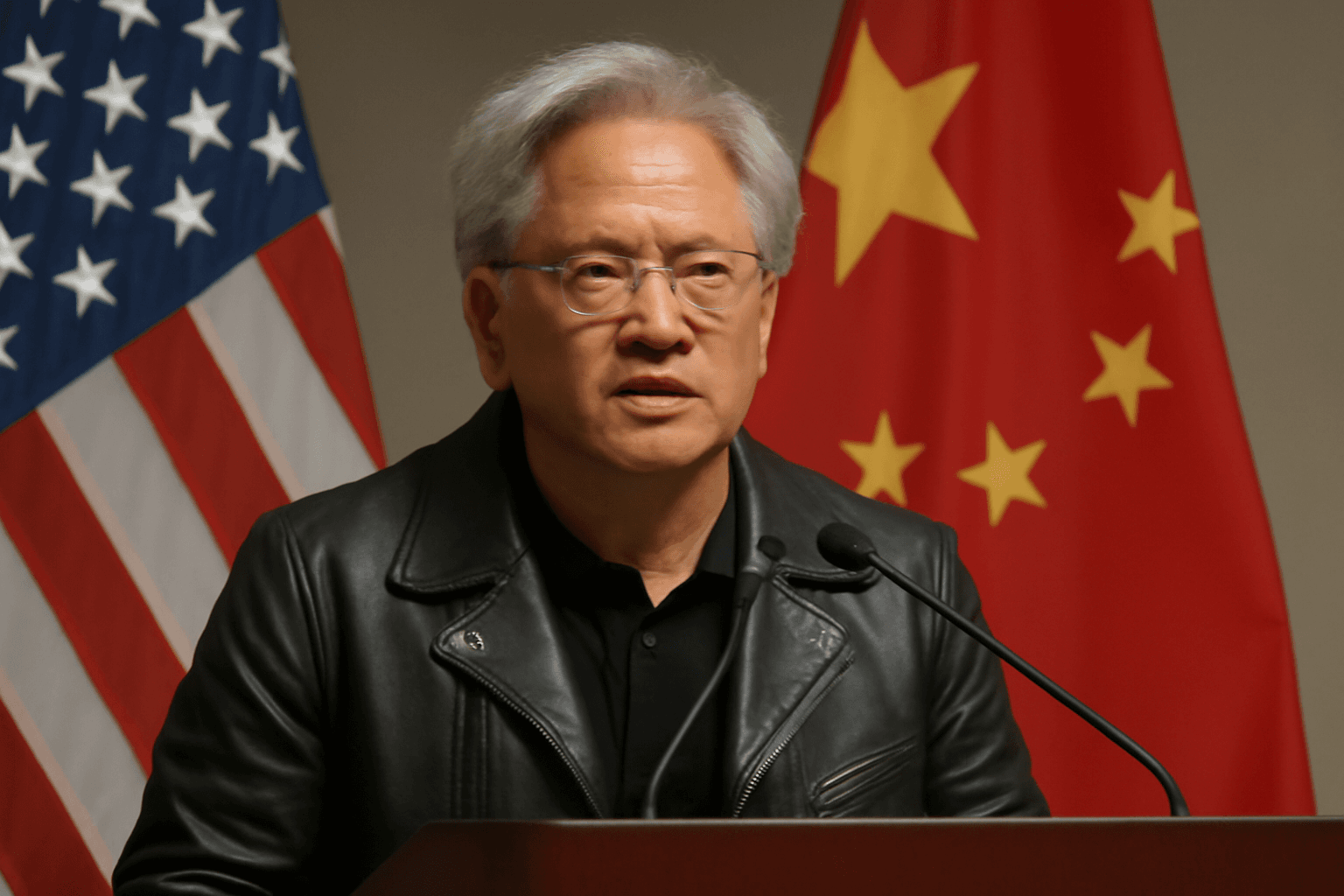

The company's CEO, Jensen Huang, highlighted the strong global demand for Nvidia's AI infrastructure, which continues to fuel the firm's growth despite challenges related to escalating trade tensions between the U.S. and China. Following recent trade policies, including tariffs imposed in April and May 2025 by the U.S. on Chinese goods—and matched reciprocally by China—Nvidia's stock initially faced volatility. However, it has since rebounded and closed above its value from a year ago.

Over the past five years, Nvidia's stock has surged approximately 1,490%, elevating its market capitalization and establishing it as one of the most valuable U.S. companies. It remains highly active in the market due to its significant role in advancing AI technologies utilized by companies such as OpenAI.

Growth of a $1,000 Investment in Nvidia Over Time

To illustrate Nvidia's remarkable stock performance, CNBC analyzed the total returns of a $1,000 investment made at different times since Nvidia's initial public offering (IPO) in 1999. These calculations incorporate dividends and are based on Nvidia's closing stock price of $134.81 on May 28, 2025.

- Investment 1 year ago: 18.4% increase, total value $1,184

- Investment 5 years ago: 1,490% increase, total value $15,897

- Investment 10 years ago: 24,287% increase, total value $243,868

- Investment at IPO in 1999: 539,914% increase, total value $5,400,142

Despite these extraordinary returns, financial experts caution investors against relying solely on past stock performance when selecting investments. The stock market is inherently unpredictable, and historical success does not guarantee future gains. Consequently, many financial advisors recommend diversified, passive investment strategies—such as investing in index funds—to mitigate risk and achieve more consistent outcomes.