Omada Health's Successful Nasdaq IPO Launch

Omada Health, a virtual chronic care company, marked a strong debut on the Nasdaq stock exchange with shares surging over 42% on the first trading day. The company priced its initial public offering (IPO) at $19 per share before opening at $23 and quickly climbing above $27.

IPO Details and Company Valuation

In its IPO, Omada Health sold approximately 7.9 million shares, raising around $150 million. The offering valued the company at just over $1 billion, based on the IPO pricing. However, the valuation could be higher on a fully diluted basis.

The company, founded in 2012 and listed under the ticker symbol OMDA, specializes in virtual care programs aimed at managing chronic health conditions such as prediabetes, diabetes, and hypertension.

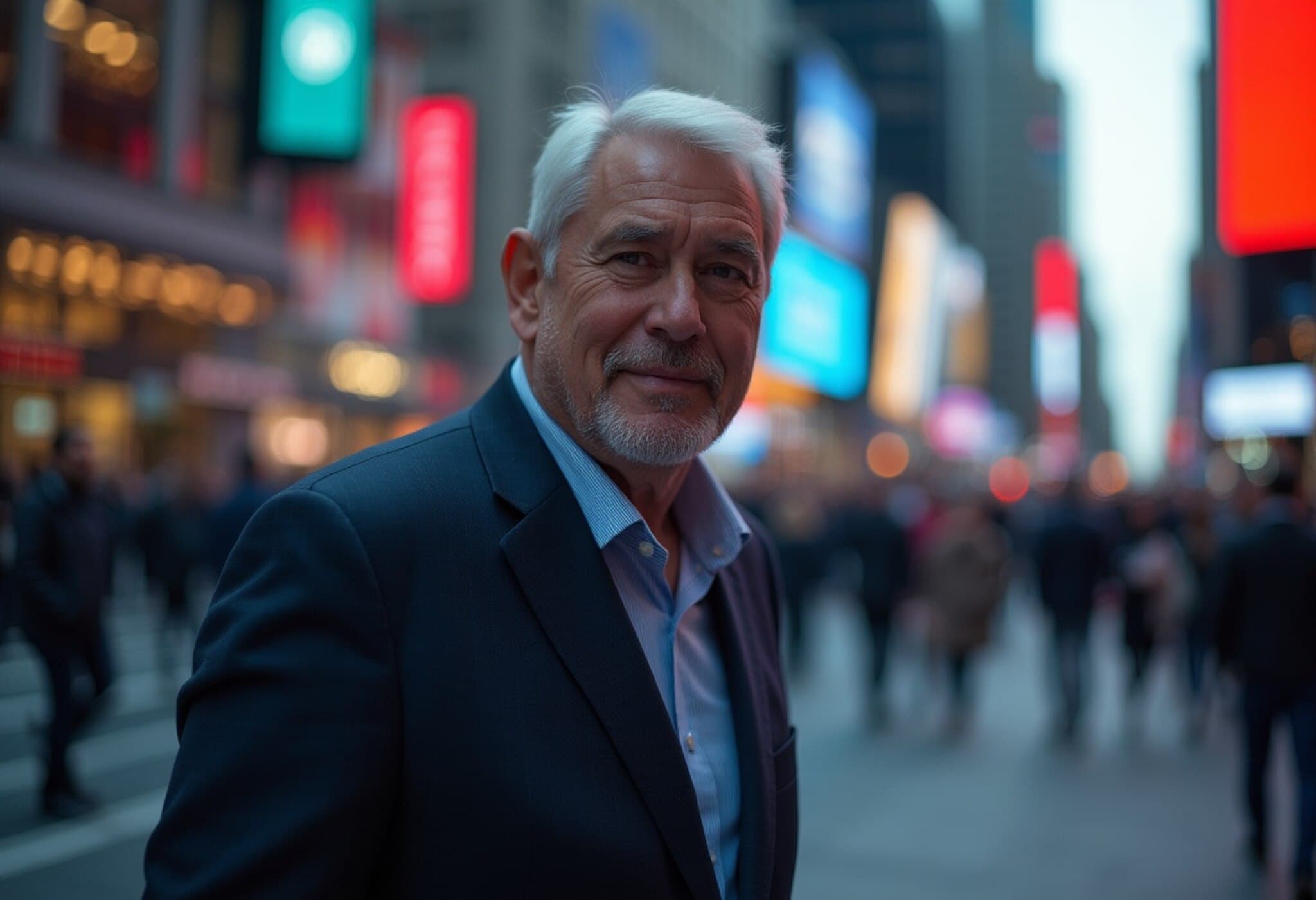

Leadership and Founding Team

Omada Health's CEO, Sean Duffy, co-founded the company alongside Andrew DiMichele and Adrian James. While Duffy continues to lead the organization, the co-founders have since moved on to other ventures.

Growing Digital Health IPO Activity

This represents the second digital health IPO in recent weeks after a period of few offerings in the sector. The recent uptick in digital health public listings parallels broader momentum in the tech IPO market, with other companies such as a digital physical therapy startup and fintech firms entering public markets.

- Digital physical therapy company debuted on the New York Stock Exchange in May, with shares rising from $32 to $38.50 post-IPO.

- Crypto company saw a dramatic 168% surge during its initial NYSE trading.

- Fintech firms like eToro and Chime Financial have also recently or will soon enter public markets.

Financial Performance Highlights

According to the company’s prospectus, Omada Health reported a 57% year-over-year revenue increase in the first quarter, reaching $55 million compared to $35.1 million in the same period the previous year. For the full year 2024, revenue rose 38% to $169.8 million from $122.8 million in 2023.

Additionally, the company improved its net losses, reducing the first quarter loss to $9.4 million from $19 million a year prior.

Major Stakeholders and Market Outlook

Top institutional investors include U.S. Venture Partners, Andreessen Horowitz, and Fidelity’s FMR LLC, each holding between 9% and 10% ownership stakes.

CEO Sean Duffy emphasized the timing of the IPO, noting the company’s scalable business model and strong pull from capital markets as conducive to going public now.