Asian equities rallied strongly alongside US futures on Thursday after a US court ruled against former President Donald Trump’s expansive global tariff program, delivering a significant setback to his hallmark trade policies and providing relief to investors.

The three-judge panel of the US Court of International Trade concluded that the tariff actions exceeded presidential authority by circumventing Congress’s constitutional "power of the purse." This decision followed lawsuits filed by businesses and a coalition of state governments challenging the tariffs.

Despite the White House’s plans to appeal and its criticism of the ruling as an overreach by "unelected judges," the market interpreted the news positively. Analysts noted that traders took advantage of the ruling to buy shares amid hopes that the threatened tariffs would be halted.

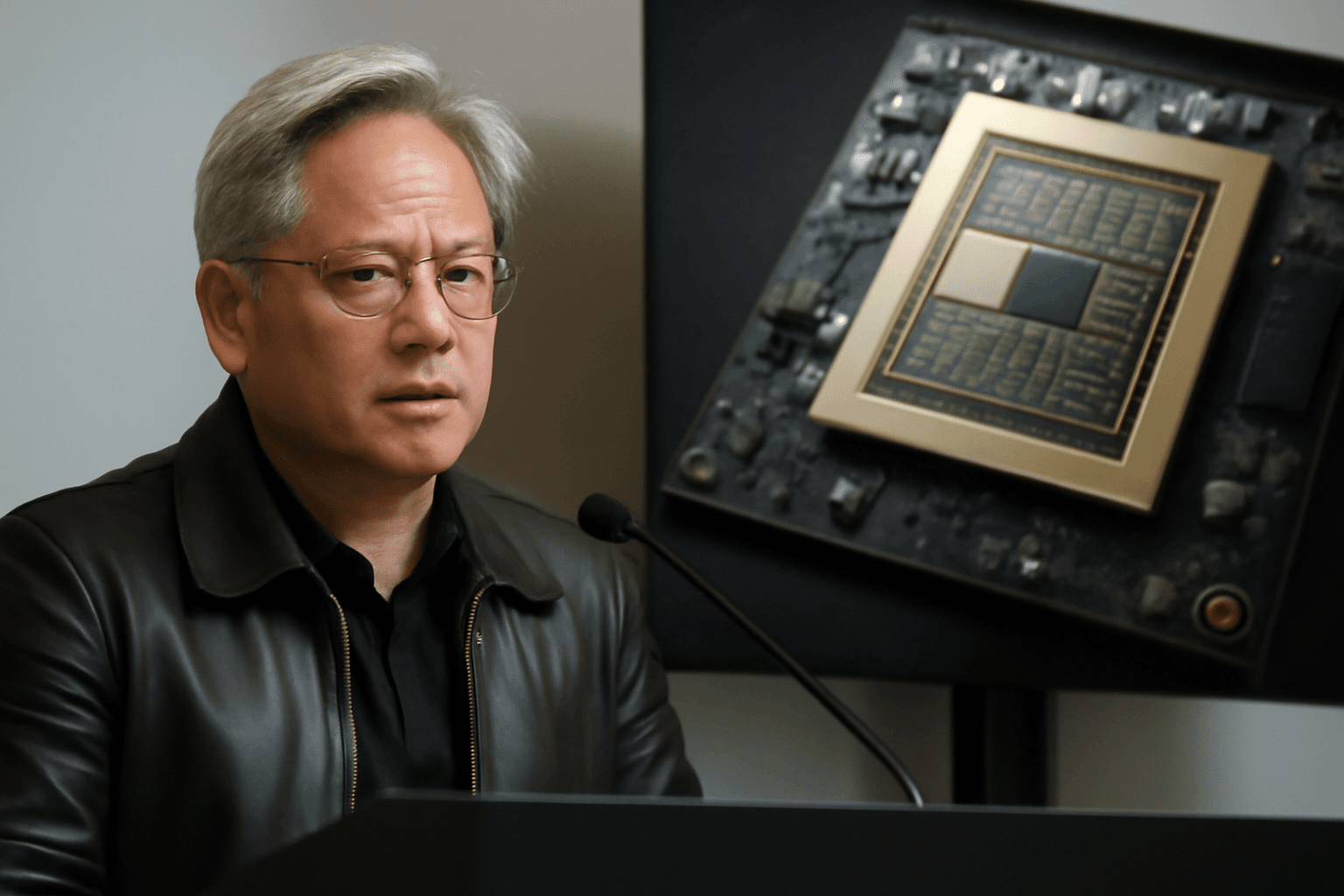

Adding to investor optimism, chipmaker Nvidia reported better-than-expected first-quarter earnings, driven by robust demand for artificial intelligence (AI) chips. Nvidia posted a $18.8 billion profit on $44.1 billion in revenue and forecast continued strong sales for the next quarter, despite warning of potential costs related to increased export controls.

Financial strategist Stephen Innes from SPI Asset Management commented that investors are "exhaling after weeks of white-knuckle volatility" caused by earlier trade tensions. He emphasized the judicial message that presidential trade actions have constitutional limits, signaling a shift "from strongman tariffs to institutional guardrails." This ruling potentially marks a turning point toward greater macroeconomic stability.

The tariff ruling buoyed markets in major exporting nations hit hard by the tariffs, including Japan and South Korea, whose markets rose over one percent. South Korea also benefited from a central bank interest rate cut. Stock indexes in Hong Kong, Shanghai, Sydney, Taipei, and Manila closed higher, while New York futures gained over one percent across major indices.

Risk appetite increased as safe-haven assets such as the Japanese yen and gold declined. Meanwhile, oil prices continued their upward trend amid an OPEC meeting focusing on output levels and escalating geopolitical tensions involving Russia and Iran.

Market Performance Highlights (as of 0230 GMT):

- Tokyo Nikkei 225: +1.7% at 38,355.70

- Hong Kong Hang Seng Index: +0.4% at 23,347.38

- Shanghai Composite Index: +0.6% at 3,359.32

- Euro/USD: 1.1242, down from 1.1291

- Pound/USD: 1.3430, down from 1.3468

- Dollar/Yen: 145.89, up from 144.82

- WTI Crude Oil: +1.1% at $62.50 per barrel

- Brent Crude Oil: +1.0% at $65.54 per barrel

- New York S&P 500 (previous close): -0.6% at 5,888.55

- London FTSE 100 (previous close): -0.6% at 8,726.01