Nvidia is set to announce its fiscal first-quarter earnings on Wednesday after the market closes, with the earnings call scheduled for 5 p.m. ET. Investors and analysts will be closely monitoring the results amid ongoing geopolitical challenges and sustained demand for the company's AI chips.

Wall Street consensus expects Nvidia to report adjusted earnings per share (EPS) of 93 cents and revenue of $43.31 billion for the quarter. Looking ahead, Nvidia is projected to guide for 99 cents in adjusted EPS on $45.9 billion in sales for the July quarter, reflecting continued growth driven by artificial intelligence.

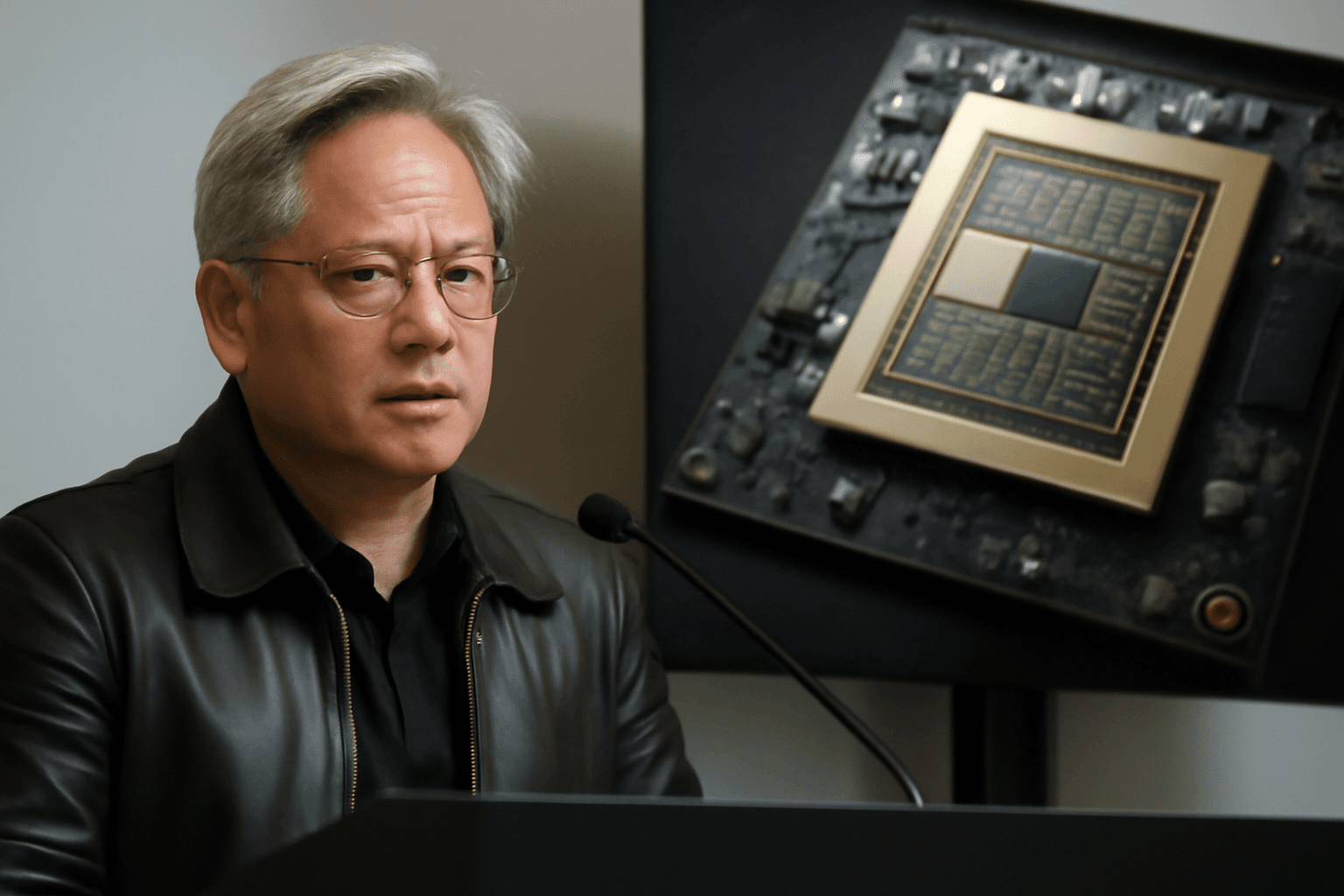

The company’s sales of graphics processing units (GPUs), particularly those designed for AI applications, remain robust. Nvidia's chips, including its latest Blackwell generation products such as the GB200 racks, continue to see strong demand among major cloud providers, known as hyperscalers. These hyperscalers are investing heavily to integrate Nvidia’s AI infrastructure into their data centers, supporting the company's impressive revenue growth.

However, Nvidia is grappling with significant export restrictions imposed by the U.S. government. On April 9, the Trump administration issued a letter requiring Nvidia to obtain an export license for a specific version of its Hopper AI chips tailored for use in China. This measure aligns with previous U.S. efforts to limit advanced technology exports to certain foreign entities.

As a result of these export controls, Nvidia announced a $5.5 billion write-down on inventory, underscoring the financial impact of the restrictions. Analysts and investors will closely examine the company's commentary on how these limitations affect current and future revenue streams.

Nvidia CEO Jensen Huang has recently engaged in international efforts to promote the company's AI technologies, including visits to foreign markets such as Saudi Arabia. Investors will anticipate his insights on navigating the evolving export control environment during the earnings call.

Market experts, including Morgan Stanley analyst Joseph Moore, emphasize the importance of Nvidia demonstrating strong momentum with its Blackwell-line products. Moore noted that optimism surrounding the GB200’s market reception and sustained demand could positively influence the stock, even if quarterly numbers see minimal changes.

Despite expectations for a 66% revenue increase compared to the prior year’s April quarter, this growth rate signals a slowdown from the triple-digit gains Nvidia reported previously. Nonetheless, the company’s dominant position supplying AI hardware to hyperscalers like Amazon and Microsoft continues to fuel its long-term growth prospects.

As Nvidia releases its earnings, market participants will weigh the impacts of geopolitical constraints against persistent demand for AI acceleration technology, seeking clarity on the company's trajectory amid a complex global landscape.