As recent college graduates transition into the workforce, financial experts emphasize the importance of beginning retirement savings immediately, even if it means contributing modest amounts.

Brad Klontz, a financial psychologist and author, highlights that initiating investments early can lead to substantial wealth over time, thanks to the power of compound interest and sustained market growth. "Exiting school is the best opportunity to set yourself up to become a multi-millionaire effortlessly," he stated.

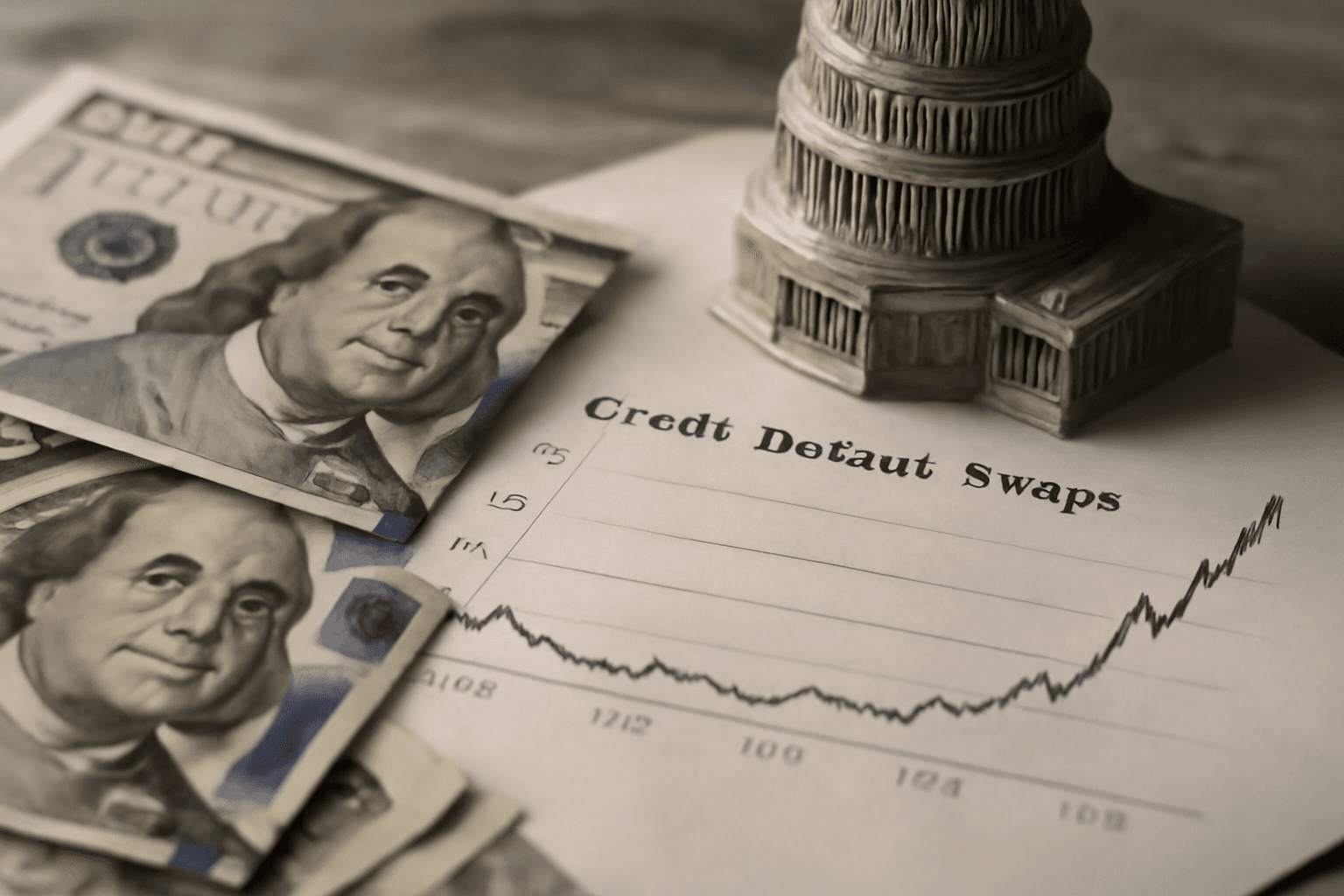

New investors need not master complex stock market strategies or dedicate excessive time to research; instead, adopting a "set-it-and-forget-it" approach with consistent contributions is the key. Given market volatility, especially recent fluctuations, some may hesitate to start investing. However, experts like Lan Anh Tran from Morningstar Research Services advocate for focusing on time spent in the market rather than attempting to time it, underscoring that fluctuations are less consequential over long periods.

Starting Small and Steady

Todd Sohn, senior ETF & technical strategist at Strategas Securities, encourages graduates to invest as much as possible, but acknowledges that even $100 monthly contributions can be meaningful. Particularly for students living rent-free, allocating a portion of their earnings to investments can yield significant future rewards.

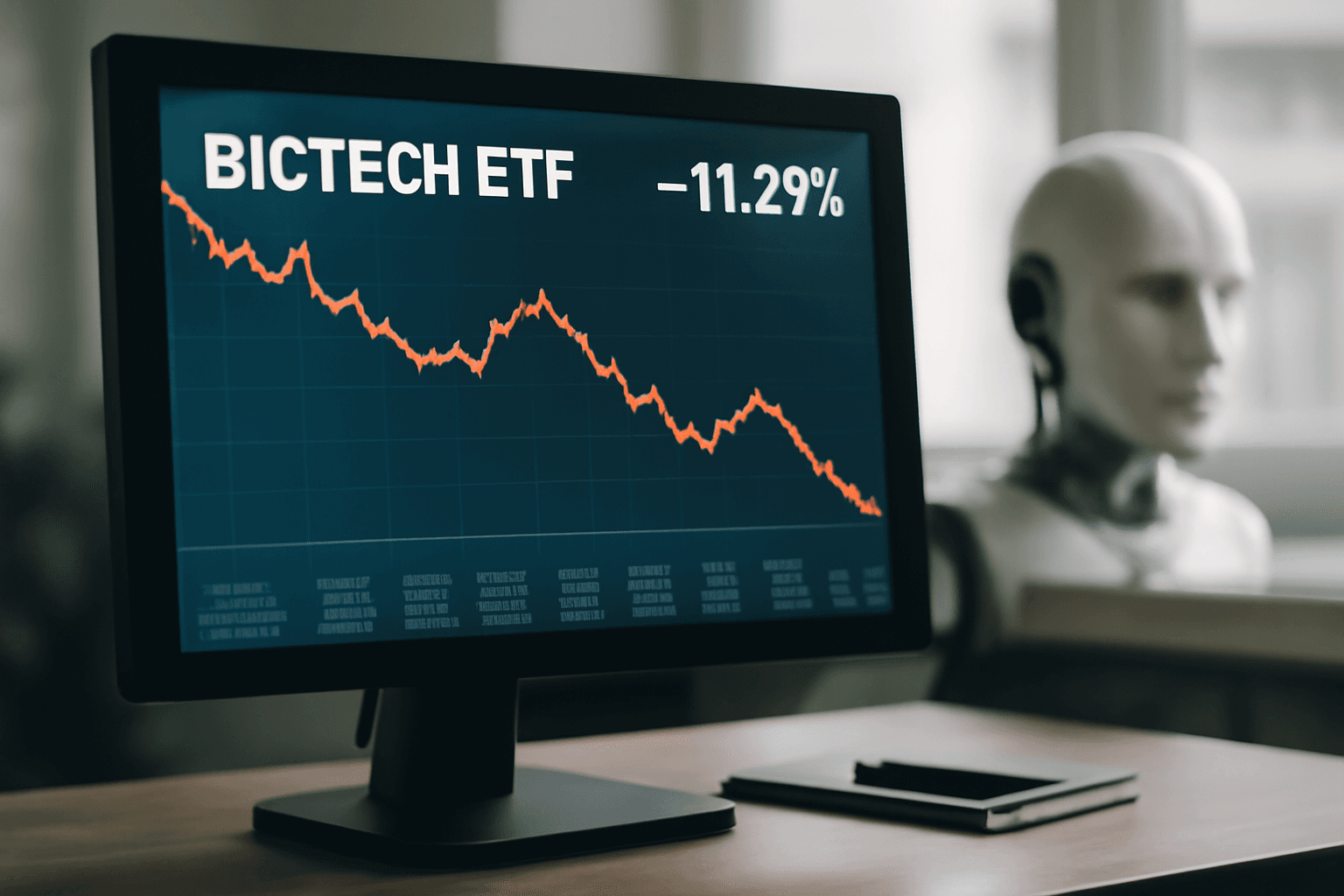

Index funds and exchange-traded funds (ETFs) tracking broad market indices, such as the U.S. stock market or international markets, offer diversified and cost-effective starting points. Younger investors are advised to allocate a higher percentage to stocks, complemented by a smaller portion in bonds for risk mitigation. Warren Buffett’s recommended allocation of 90% stocks and 10% bonds serves as a useful guideline for beginners.

Popular Core ETFs for Beginners

- Vanguard S&P 500 ETF (VOO)

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard Total Stock Market ETF (VTI)

- Invesco QQQ Trust (QQQ)

- Vanguard Growth ETF (VUG)

- Vanguard FTSE Developed Markets ETF (VEA)

- iShares Core MSCI EAFE ETF (IEFA)

- Vanguard Value ETF (VTV)

- Vanguard Total Bond Market ETF (BND)

- iShares Core U.S. Aggregate Bond ETF (AGG)

These funds offer exposure to core domestic and international equities and bonds, typically at low fees from providers like Vanguard, iShares, and State Street.

Balancing Core Investments with Thematic Opportunities

While building a portfolio with diversified ETFs provides a stable foundation, graduates interested in themes such as artificial intelligence, natural resources, or cryptocurrency can allocate a smaller portion (5-10%) to targeted investments with higher risk and potential reward. This strategy demands more research but can enhance long-term returns.

Understanding personal risk tolerance is critical to avoid emotional reactions during market volatility. Younger investors are generally encouraged to embrace more risk to capitalize on growth opportunities over an extended horizon.

Financial Mindset and Consistency

Klontz advises that the journey to financial independence begins with disciplined allocation from the very first paycheck. Making investment a non-negotiable part of budgeting helps avoid a lifetime of financial struggle. "It’s a mindset of committing a set percentage of every dollar earned to building financial freedom," he explained.

Despite retirement feeling distant, taking responsibility early is vital. Delaying investment often stems from the abstract nature of retirement, but immediate action remains the most effective strategy. As Klontz concludes, "Taking action is imperative. The sooner you begin, the better the outcome."

For graduates entering their careers, prioritizing even modest retirement savings today can unlock multi-million dollar potential in the future.