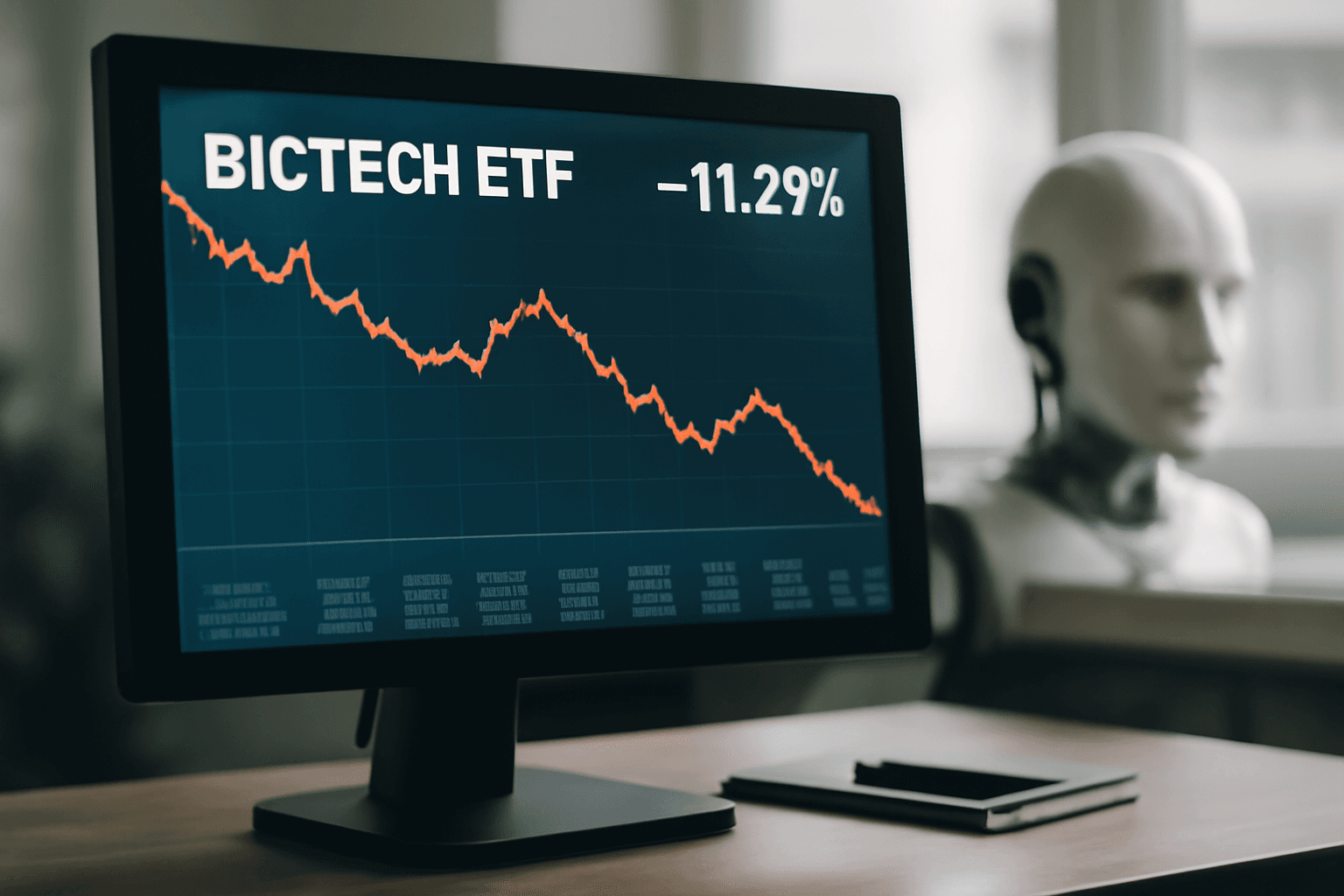

Biotech stocks have faced significant challenges in recent years, declining after initial gains during the early stages of the COVID-19 pandemic. Factors such as higher interest rates, tariffs, and staffing cuts at the U.S. Department of Health and Human Services have added pressures on the sector. Notably, the SPDR S&P Biotech ETF (XBI) has dropped over 11% in 2025, contrasting with modest gains in the broader S&P 500.

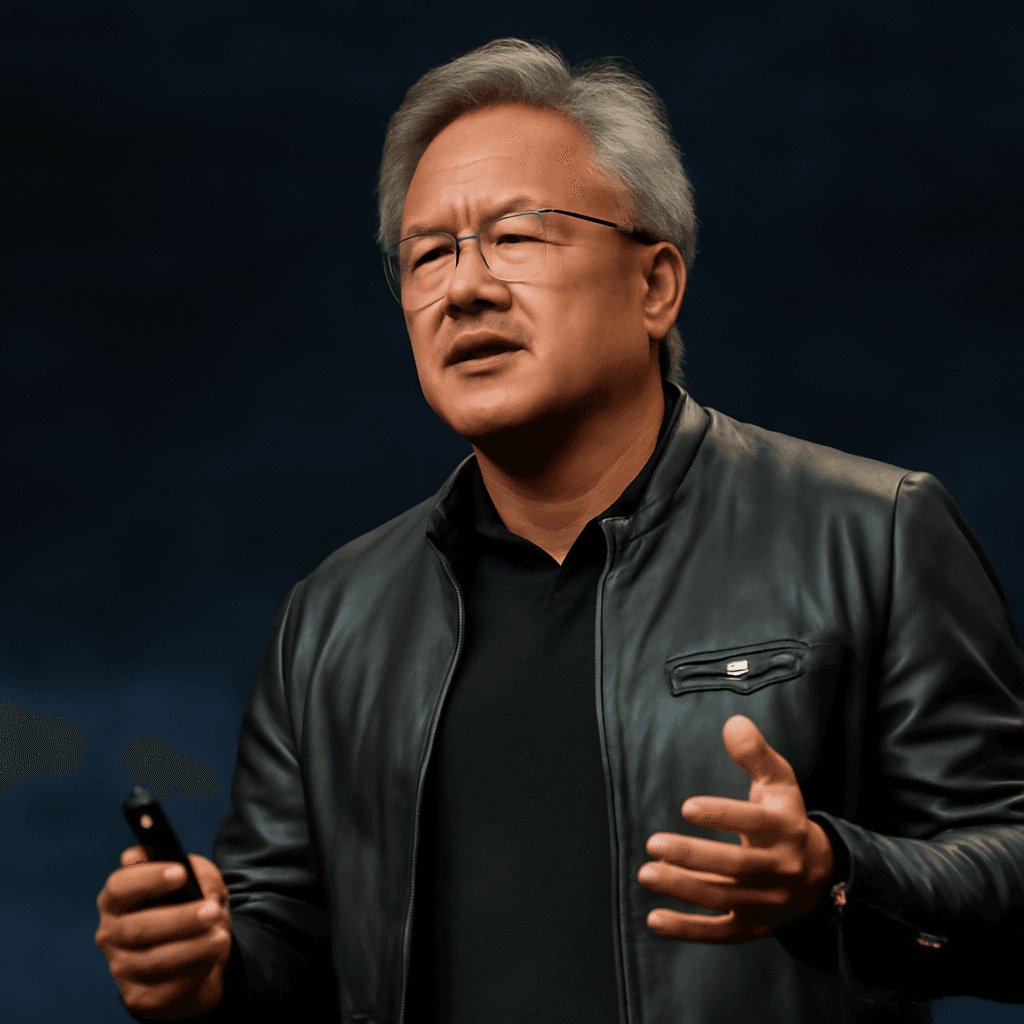

Despite these hurdles, Jefferies highlights the transformative potential of generative artificial intelligence (AI) in drug discovery, predicting substantial benefits for biotech companies. Michael Yee, senior biotech analyst at Jefferies, told CNBC's Squawk on the Street that generative AI could significantly reduce the timelines and costs associated with bringing new drugs to market.

"Developing a drug typically requires about a billion dollars and up to 10 years, with a 90% failure rate," Yee explained. "With generative AI technologies, we anticipate that drug development timelines could be cut by several years, and the probability of success could improve by up to 50%. This advancement can save billions of dollars and enhance returns for both companies and investors."

Yee emphasized that while these innovations are in their early stages, major progress is expected within the next five years. According to him, drug development processes that currently take about a decade could shorten to seven or eight years as AI-driven methods mature.

Although regulatory challenges remain, Yee suggested that much of the negative sentiment is already reflected in biotech stock valuations. He remains optimistic about the sector’s outlook for the remainder of the year.

Several companies are already capitalizing on generative AI capabilities. Amgen, one of the largest biotech firms globally, incorporates AI to analyze human datasets, with its stock rising approximately 7% this year. Schrodinger, a software company specializing in machine learning for drug discovery, has gained around 11% in 2025 amid increased research and development investments.

Other notable beneficiaries include Illumina, which focuses on genetic variation analysis, and Danaher, active in life sciences and diagnostics. While Illumina and Danaher have seen declines of 38% and 17% respectively this year, experts believe their AI integration positions them well for future growth.