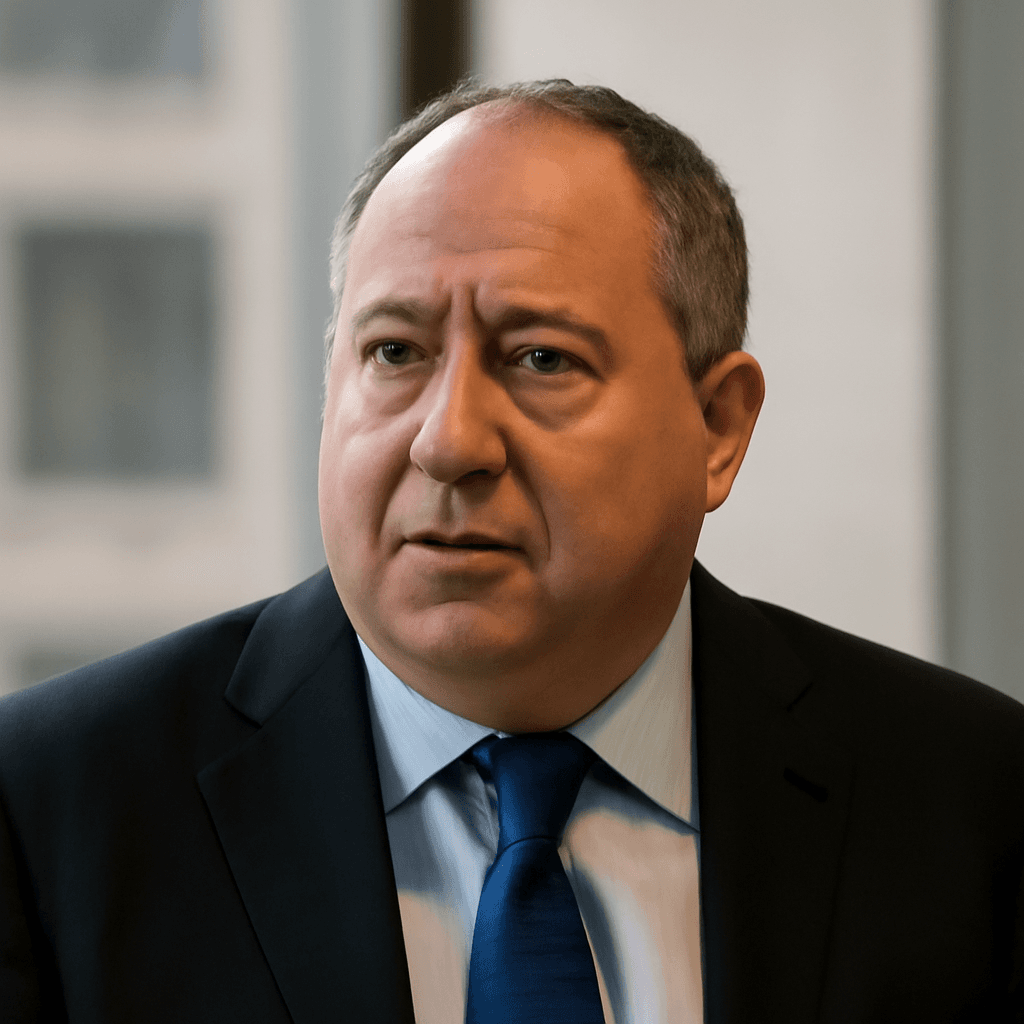

Steve Eisman Emphasizes Tariff Concerns Amid Market Optimism

Steve Eisman, renowned investor known for his successful bet against the housing market before the 2008 financial crisis, has expressed that tariffs remain his primary concern despite optimistic market conditions. Speaking recently, Eisman warned that Wall Street might be underestimating the complexities and risks associated with ongoing trade negotiations involving the United States, China, and Europe.

Market Complacency on Trade Risks

Eisman criticized the current market's complacency regarding tariffs, highlighting the unpredictability and number of variables in play. He cautioned investors not to chase upside recklessly, noting that a full-scale trade war remains a possibility that could significantly impact markets.

Stock Market Performance Amid Tariff Concerns

Despite these concerns, equity markets rallied at the start of the month, with the Dow Industrials recovering from an early-day deficit and the Nasdaq Composite gaining 0.7%. Eisman confirmed his position by maintaining a long-only stance with some risk reduction but refraining from major changes.

Fiscal Deficit and Treasury Yields: Eisman's Perspective

Regarding the growing U.S. budget deficit, Eisman appears unperturbed, largely due to the lack of attractive alternatives for investors compared to U.S. Treasurys. He deemed the notion that investors would pivot to assets such as Bitcoin, Chinese, or European sovereign bonds as unrealistic or 'absurd.'

U.S. Treasury Yield Outlook

Eisman acknowledged recent rises in the 10-year Treasury yield, which stood around 4.4% during his remarks, but did not interpret this as a significant sell-off or risk. He pointed out that while rates have increased from near-zero levels, they are still modest relative to historical norms. Eisman doubted that yields surpassing 5% would represent an outsized threat given this context.

Summary

In summary, Steve Eisman advises caution over tariff-related uncertainties that could derail market stability, while maintaining a relatively bullish position based on limited alternatives to U.S. Treasurys and contained risk from rising yield levels.

- Key Concern: Tariffs and trade negotiation risks

- Market Position: Long-only with moderate risk adjustments

- Fiscal Deficit View: Minimal concern due to lack of alternatives to Treasury securities

- Treasury Yields: Rising but not alarming, with 10-year yield around 4.4%