Record Decline in U.S. Trade Deficit Observed in April

The United States experienced an unprecedented reduction in its trade deficit in April 2025, driven primarily by a significant decline in imports and a modest increase in exports. The trade gap fell to $61.6 billion, a drop of $76.7 billion from the previous month, surpassing analysts' expectations which had projected the deficit around $66.3 billion.

Factors Behind the Decline

This sharp decrease followed a prior surge in imports as businesses and consumers rushed to stockpile goods ahead of newly imposed tariffs. The reduction represents a reversal from the spike that occurred before the implementation of 10% tariffs on a broad array of imports, announced earlier in the year.

The tariffs, aimed at addressing perceived unfair trade practices and primarily targeting China and various other trading partners, initially caused a flurry of import activity. However, subsequent negotiations and softened tariff plans contributed to a pronounced easing in import volumes.

Import and Export Trends

- Imports: Declined sharply by 16.3% to $351 billion in April.

- Exports: Increased by 3% during the same period.

This contrast between falling imports and rising exports played a pivotal role in narrowing the trade deficit.

Interpreting the Trade Deficit Shift

While the term 'trade deficit' often carries negative connotations, economic experts emphasize a nuanced perspective. Importing more than exporting has historically supported the U.S. economy by providing consumers with a broader selection of goods and keeping prices competitive.

Therefore, a shrinking deficit does not necessarily signal positive economic development and should be examined in the broader context of trade dynamics and domestic economic health.

Trade Deficit by Key Partners

Despite the overall reduction, on a year-to-date basis, the deficit has increased by 65.7% compared to the previous year.

The largest goods trade imbalances in April were with:

- China: $19.7 billion

- European Union: $17.9 billion

- Vietnam: $14.5 billion

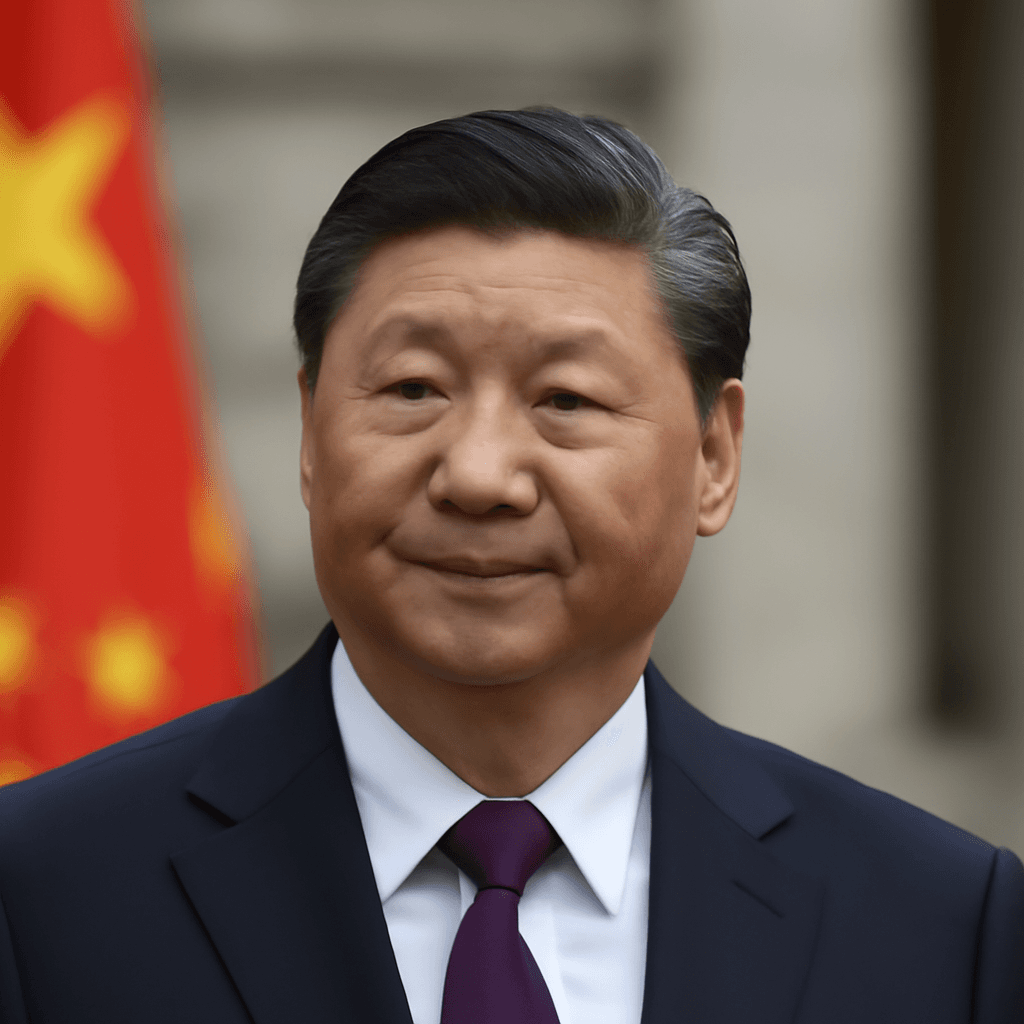

Recent Developments in U.S.-China Trade Relations

Diplomatic engagement continues with ongoing negotiations between the United States and China. A recent phone conversation between the two nations' leaders lasted 90 minutes and was characterized as "very good," signaling potential progress in resolving trade tensions.

Tariff-related measures remain in flux as both countries seek mutually acceptable terms amid heightened trade war concerns.