China's manufacturing sector experienced a contraction for the second consecutive month in May, according to an official survey, intensifying expectations for additional economic stimulus as trade conflicts with the United States persist.

The official Purchasing Managers' Index (PMI) inched up slightly to 49.5 in May from 49.0 in April but remained below the 50-point threshold that separates expansion from contraction. This figure aligned with market forecasts.

The new orders sub-index rose to 49.8 from 49.2, while the new export orders sub-index improved to 47.5 from 44.7, suggesting some stabilization though still under contraction levels.

Meanwhile, the non-manufacturing PMI, which covers services and construction sectors, declined marginally to 50.3 from 50.4, maintaining a slim lead above the contraction line.

Earlier in May, China’s central bank introduced several monetary easing measures, including interest rate reductions and a substantial liquidity injection, aimed at bolstering economic growth. Analysts have noted that a successful trade agreement with the U.S. could reduce the necessity for further aggressive stimulus.

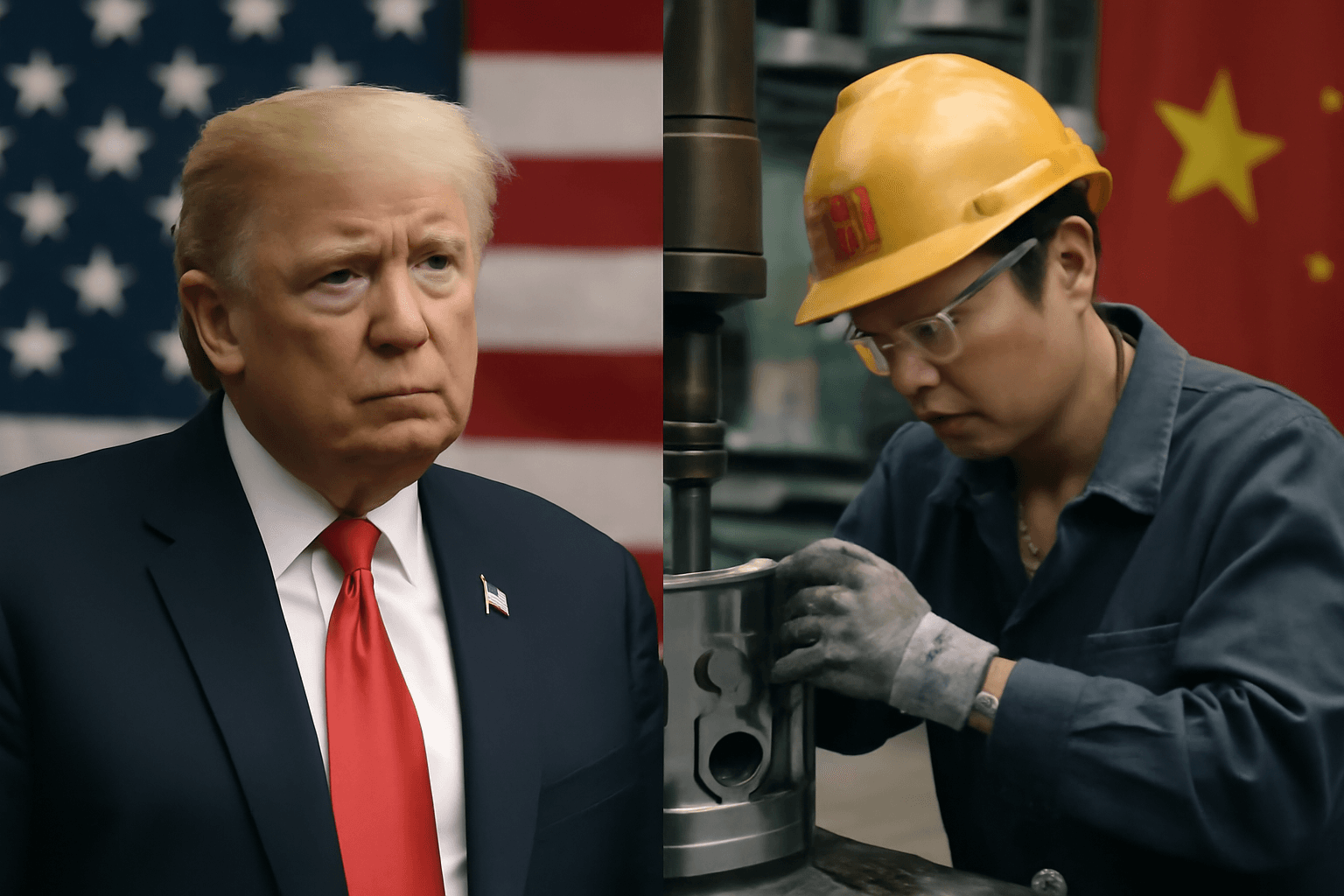

Beijing and Washington had agreed upon a 90-day tariff truce, during which both nations agreed to scale back import tariffs, raising hopes of easing trade tensions. However, concerns remain about the slow pace of negotiations amid ongoing global economic uncertainties.

In a recent development, U.S. President Donald Trump accused China of breaching the terms of the bilateral tariff agreement and announced plans to double tariffs on steel and aluminum imports to 50%, triggering renewed uncertainty in international trade relations.

China's economy demonstrated faster than expected growth in the first quarter of 2025, with officials maintaining a target growth rate near 5% for the year. Nonetheless, analysts warn that escalating U.S. tariffs could substantially weaken economic momentum moving forward.

Exports exceeded forecasts in April, driven largely by demand from overseas manufacturers rushing shipments to capitalize on the temporary tariff suspension. This raises questions about sustainability once the tariff pause ends.