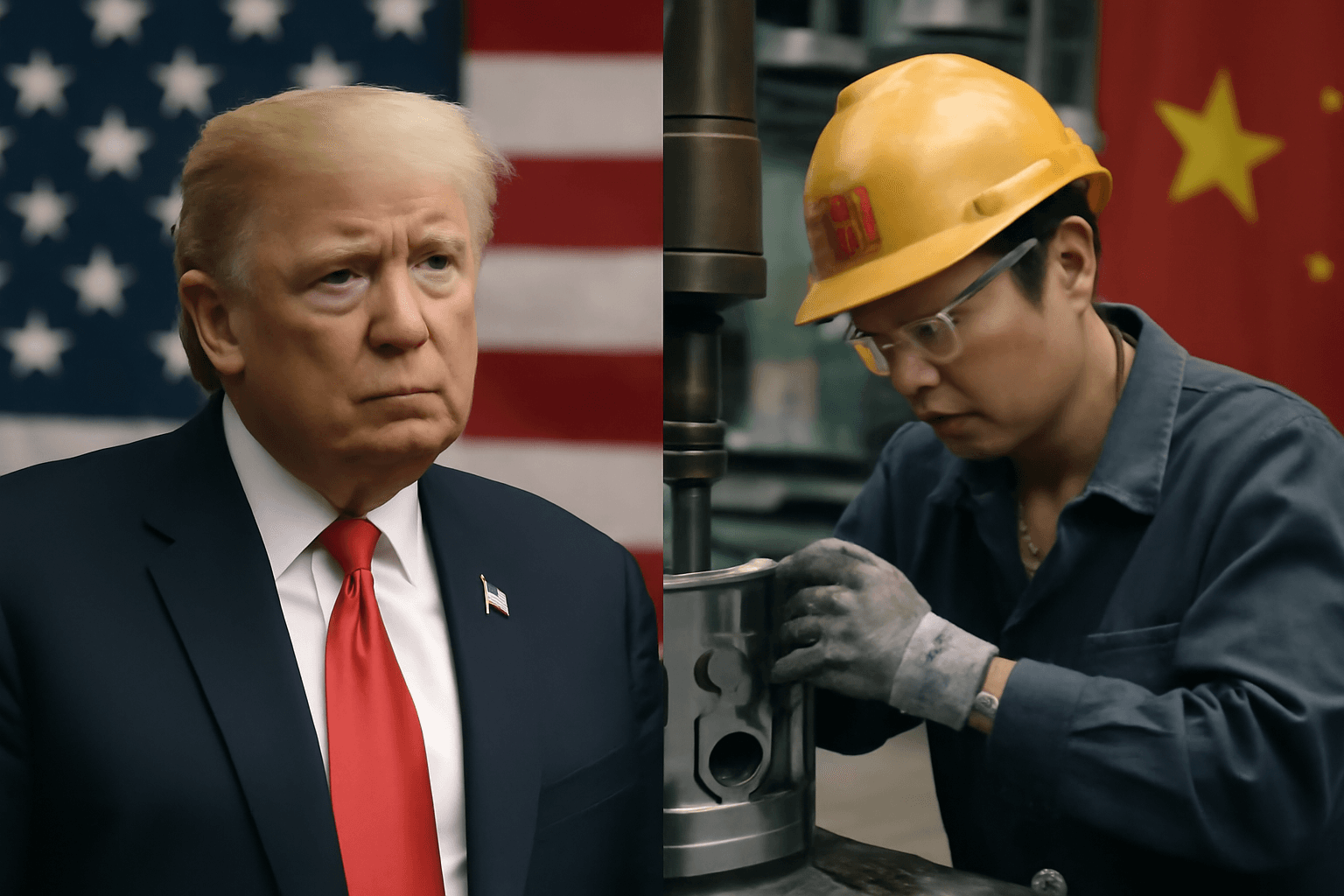

Manufacturing Activity Shrinks at Fastest Rate Since 2022

China's manufacturing sector experienced a notable contraction in May, marking the most significant decline since September 2022. The Caixin/S&P Global manufacturing Purchasing Managers' Index (PMI) dropped sharply to 48.3, falling below the critical 50-point threshold that separates expansion from contraction. This was a marked decrease from April's reading of 50.4 and missed market expectations.

This downturn reflected intensified challenges, particularly a steep fall in new export orders, which fell to their lowest levels since July 2023, underscoring the impacts of stringent U.S. tariffs on Chinese goods.

Export Orders and Domestic Demand Both Weaken

The survey highlighted a dual decline in demand: besides foreign orders dwindling, total new orders contracted for the first time in eight months. The slowing demand directly contributed to accumulating finished goods inventories—the first such increase in four months—due to reduced sales and shipment delays.

Labor Market and Employment Conditions Deteriorate

Alongside the contraction in manufacturing activity, employment conditions worsened, with factory job numbers shrinking for a second consecutive month. The pace of job losses accelerated to the fastest rate since January, signaling sustained stress in the labor market.

Divergence Between Private and Official PMI Readings

While the private Caixin PMI indicated contraction, the official manufacturing PMI released earlier showed a slight uptick from 49.0 in April to 49.5 in May, hinting at early stabilization. The official index covers a broader sample size and aligns more closely with industrial output, whereas Caixin’s survey focuses on more export-oriented firms.

Service Sector and Broader Economic Indicators

The official non-manufacturing PMI, which includes services and construction sectors, edged down slightly to 50.3 in May but remained above the growth threshold, maintaining a stable performance since January 2023.

April’s data showed China’s industrial output rose by 6.1% year-on-year, a slowdown from the previous month’s 7.7% growth. Despite higher tariffs, exports saw modest increases overall due to expanded shipments to Southeast Asian markets, partially offsetting declines in U.S. demand.

Policy Measures to Support Growth

In response to mounting economic pressures, Chinese authorities have implemented a range of monetary policy tools aimed at enhancing liquidity and supporting employment. The People's Bank of China reduced key interest rates and lowered the reserve requirement ratio for banks, easing credit availability.

These interventions come amid ongoing deflationary challenges, a slump in the property sector, and cautious consumer spending, all of which weigh heavily on China's economic outlook.

Outlook and Structural Challenges Ahead

With traditional growth engines such as property and exports now slowing, policymakers face increasing pressure to stimulate consumption and address structural issues.

- Expanding pension reforms and offering birth subsidies are potential strategies to sustain household spending.

- Support for the property market is critical to arrest ongoing declines.

The combination of global trade tensions and domestic economic headwinds suggests that China’s growth trajectory will require sustained and targeted policy responses moving forward.