Since his inauguration on January 20, 2017, U.S. President Donald Trump has implemented a series of tariff measures that have significantly impacted global financial markets. These actions have generated widespread uncertainty across the international economic landscape. Below is a detailed timeline highlighting key moments in the escalation of the tariff disputes and their effects worldwide.

Timeline of Major Tariff Developments

- February 1, 2017: Trump announced tariffs on imports from Mexico and most Canadian goods, along with a 10% tariff on products from China, aiming to reduce fentanyl inflows and illegal immigration.

- February 3: He temporarily suspended tariffs on Mexico and Canada for 30 days, contingent on border and crime enforcement commitments, but no such agreement was reached with China.

- February 7: Tariffs on low-cost Chinese imports (de minimis packages) were suspended pending verification of compliance with tariff collection procedures.

- February 10: A flat 25% tariff was imposed on steel and aluminum imports without exceptions.

- March 3: A 25% tariff on a wide range of Chinese goods was announced, effective March 4, and fentanyl-related tariffs on Chinese products were raised to 20%.

- March 5–6: Tariffs on certain vehicles and automotive parts from Canada and Mexico were temporarily suspended following consultations with major automakers and North American trade partners.

- March 26: Implementation of new tariffs on imported cars and light trucks was announced.

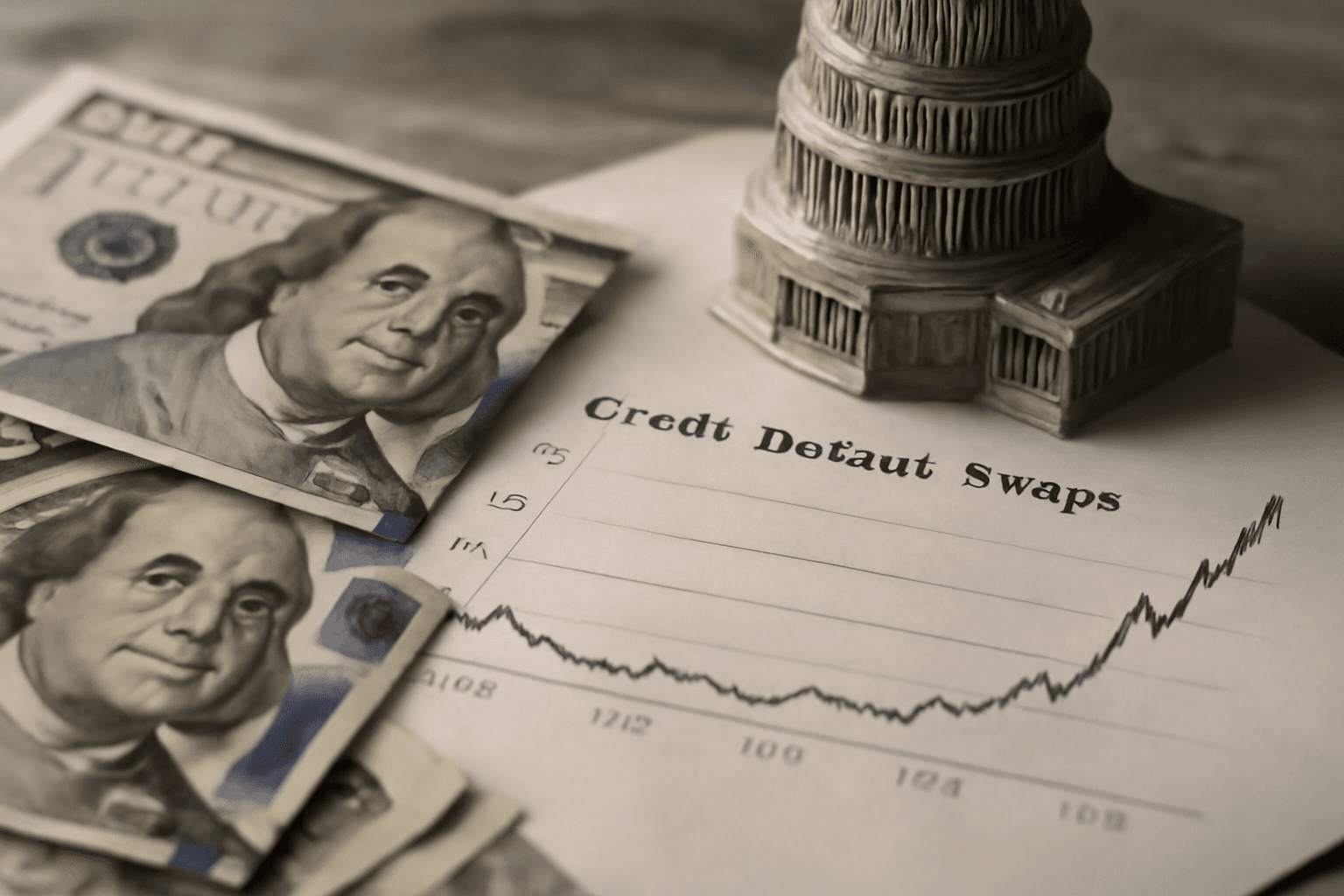

- April 2: A baseline tariff of 10% was introduced on all imports, with higher rates for key trading partners.

- April 9: Most newly imposed country-specific tariffs were paused for 90 days following a significant global stock market decline, though the 10% blanket tariff on imports remained. Trump announced plans to increase tariffs on Chinese goods to an overall 145% including fentanyl-related ones.

- April 13: Tariffs on electronics such as smartphones and computers, largely imported from China, were waived.

- April 22: National security investigations targeting pharmaceuticals and semiconductors began under Section 232 of the Trade Act of 1962 as a prelude to possible tariffs.

- May 4: Tariffs were imposed on all non-U.S. produced movies.

- May 9: The U.S. and the U.K. finalized a trade agreement maintaining 10% tariffs on British exports but improving agricultural access and reducing U.S. duties on British cars.

- May 12: A 90-day truce with China was brokered, reducing the tariffs on Chinese imports from 145% to 30%, while China cut duties on U.S. goods to 10%.

- May 13: Tariffs on low-value Chinese shipments (up to $800) were reduced from 120% to 54%.

- May 23: Trump proposed a 50% tariff on EU goods effective June 1, also threatening Apple with a 25% tariff on iPhones made abroad.

- May 25: Trump delayed the proposed EU tariffs to allow negotiations through July 9.

- May 28: A U.S. court blocked the implementation of comprehensive tariffs, ruling the President had exceeded his authority. The administration announced plans to appeal.

- May 29: A federal appeals court stayed the lower court's ruling, pausing the block on tariffs while considering the government's appeal.

These tariff policies have led to disruptions in international trade flows, fluctuations in global stock markets, and increased tensions among major economic powers. The evolving trade landscape remains a key factor shaping global economic prospects.