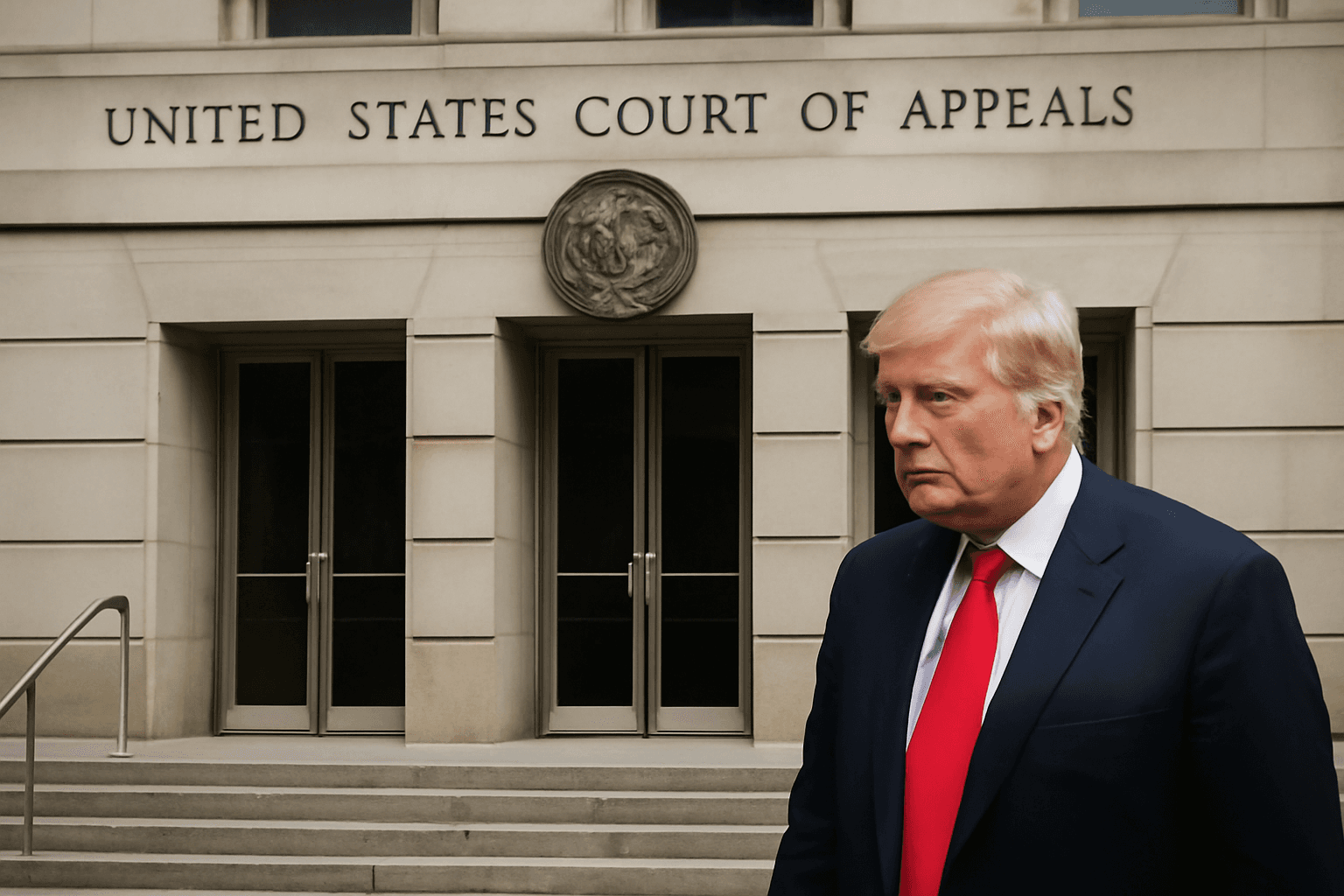

On May 29, 2025, the United States Court of Appeals for the Federal Circuit in Washington issued a temporary stay reinstating the broad tariffs imposed under former President Donald Trump, following a lower court ruling that had blocked them.

The U.S. Court of International Trade had earlier ruled that President Trump exceeded his authority by imposing these tariffs using the International Emergency Economic Powers Act (IEEPA), citing that tariff and tax powers constitutionally belong to Congress. This ruling sought to halt what were known as the Liberation Day tariffs on imports from most U.S. trading partners, as well as additional tariffs on goods from Canada, Mexico, and China tied to accusations of those countries facilitating fentanyl trafficking into the United States.

However, the appeals court suspended this decision to review the government's appeal, ordering the plaintiffs to respond by June 5 and the administration by June 9. The Trump administration expressed confidence in prevailing on appeal or invoking alternate presidential powers to maintain the tariffs.

These tariffs have been critical leverage in the administration's international trade negotiations, and their abrupt removal could disrupt ongoing talks. Treasury Secretary Scott Bessent indicated that negotiations continue even amid the legal uncertainties, noting active engagement from partners including a significant Japanese delegation.

Responses from U.S. trading partners have largely been measured, with the British government emphasizing the domestic nature of the legal proceedings, and other major players like Germany and the European Commission refraining from comment. Canadian officials welcomed the initial trade court ruling, viewing it as consistent with their stance on the tariffs' legality.

Financial markets initially responded positively to the trade court's decision but tempered enthusiasm due to the expected protracted appeals process. Analysts point to significant unresolved uncertainty regarding the future of these tariffs, which have resulted in over $34 billion in lost sales and increased costs for affected companies.

It is important to note that certain tariffs imposed on steel, aluminum, and automobiles—levied under separate national security grounds—remain unaffected by the recent rulings.

The Liberty Justice Center, representing several small businesses challenging the tariffs, described the appellate stay as a procedural matter, maintaining that the tariffs impose severe and potentially existential harm on their clients through disrupted supply chains and lost business.

Additionally, a separate federal court has recently ruled that the use of IEEPA to impose at least 10% reciprocal tariffs on most trading partners and 25% tariffs related to fentanyl was unlawful, although relief in that case was narrowly limited and has also been appealed by the government.

Since the tariff announcements in April 2025, the administration imposed a 90-day pause seeking bilateral trade agreements, but except for a recent deal with the United Kingdom, progress remains limited. The interplay of ongoing legal challenges and negotiation dynamics has left future trade relations and tariff policy in considerable flux.

Economists highlight that if appeals fail, the key impact would be additional time to adjust and a cap limiting tariffs to 15% temporarily. The current effective U.S. tariff rate remains at approximately 15%, elevated from 2%-3% levels before the Trump administration.

Industries across sectors—from luxury goods to automotive—have felt the strain of these tariffs, with companies like Diageo, General Motors, and Ford revising down their forecasts. Several foreign companies, including Honda, Campari, Roche, and Novartis, have considered relocating or expanding U.S. operations to mitigate tariff impacts.