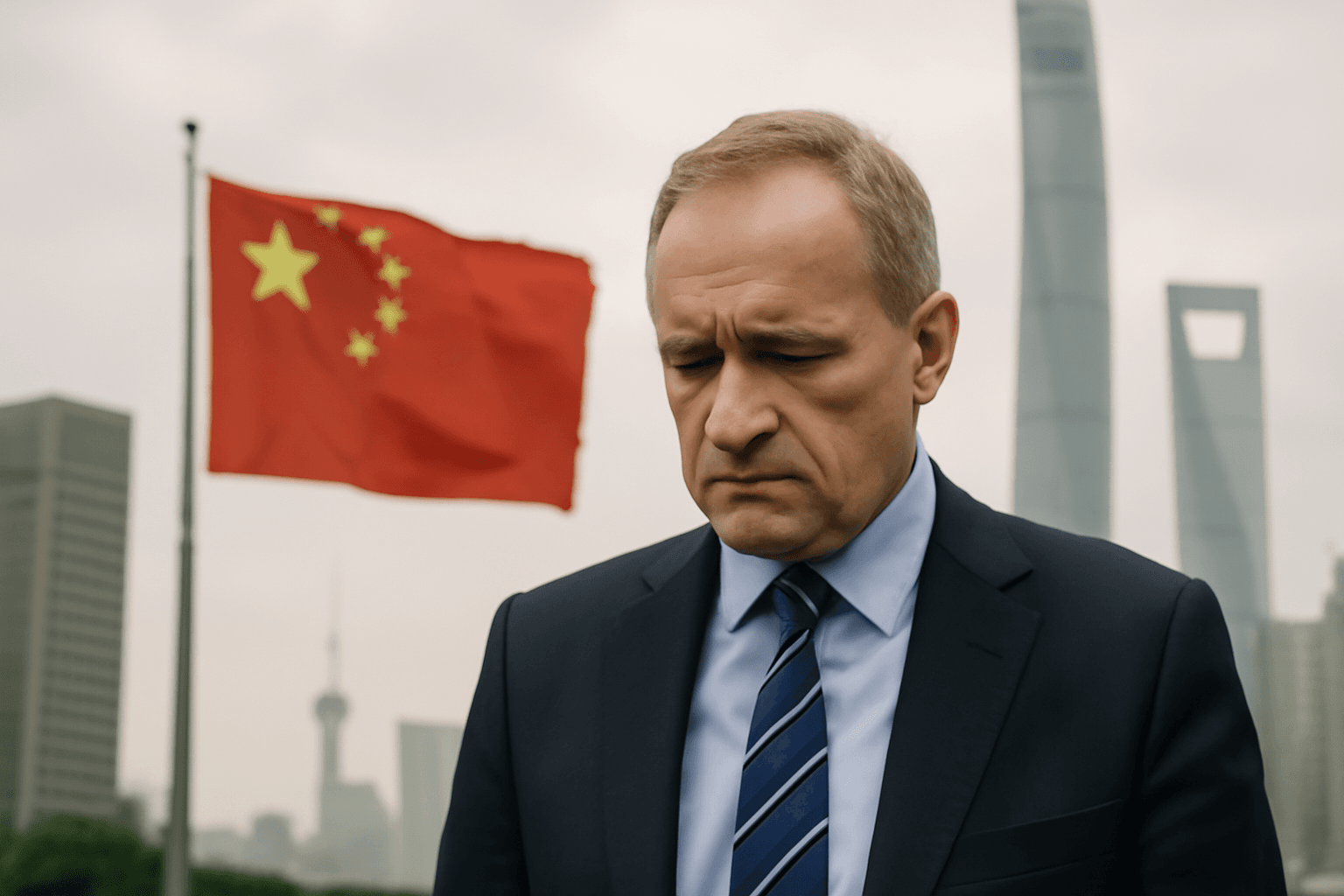

European business sentiment towards China has plummeted to its lowest level on record, surpassing the pessimism observed even during the COVID-19 pandemic. This downturn is primarily driven by slower economic growth and escalating geopolitical tensions.

According to the EU Chamber of Commerce in China’s annual survey released in May 2025, a record 73% of respondents reported increased difficulty in conducting business in China over the past year. This marks the fourth consecutive year of rising challenges for foreign enterprises operating in the country.

The survey, which covers responses from 503 companies collected in early 2025, highlighted multiple record lows in confidence and optimism. Jens Eskelund, president of the chamber, emphasized that while companies are increasingly pessimistic, many still maintain operations in China due to the indispensable nature of its supply chains.

"Companies are really feeling the squeeze, being pessimistic, but again finding very compelling supply chains in China that necessitate a continued presence in the Chinese market," Eskelund stated. Despite this, he noted no clear sign of improvement: "We haven't seen an inflection point yet. A lot of it boils down to uncertainty."

The survey reflects growing challenges since China's 2022 pandemic lockdown disrupted supply chains. Local brands have gained competitiveness, but consumer demand remains weak amid a real estate downturn and labor market uncertainties.

The cosmetics sector, in particular, experienced substantial declines, reporting a 45% drop in revenue during 2024 compared to the previous year—the second such decline in a decade.

In contrast, the aviation and aerospace sectors were among the few industries reporting eased business conditions in China.

Slowing economic expansion has eroded China’s appeal relative to other global markets. Only 12% of respondents expressed optimism about profitability in China over the next two years, the lowest proportion ever recorded. Likewise, just 38% planned to increase their investments in China during the upcoming year.

Market access restrictions and regulatory barriers remain significant hurdles. Sixty-three percent of companies said they missed business opportunities last year due to these challenges, with medical device firms citing discrimination favoring domestic players in public procurement.

These findings align with a similar survey of U.S. companies published earlier in 2025, which revealed increasing plans to shift manufacturing or sourcing away from China.

Nevertheless, 53% of surveyed European companies indicated willingness to boost their investments if the Chinese market became more accessible.

Supply Chain Dynamics

China continues to dominate the global supply chain by providing high-quality parts at competitive prices—a critical factor enabling businesses to remain competitive worldwide. Eskelund pointed out that over the past three weeks, discussions with hundreds of companies across the Chamber’s six regional chapters underscored this ongoing competitive advantage.

Regarding supply chain strategies, more than 25% of respondents reported increasing their onshoring efforts within China to comply with localization policies and better serve domestic consumers. Conversely, only 10% are developing alternative overseas supply chains while maintaining their existing Chinese networks.

Additionally, nearly half of respondents disclosed that their Chinese suppliers have begun relocating operations to other countries.

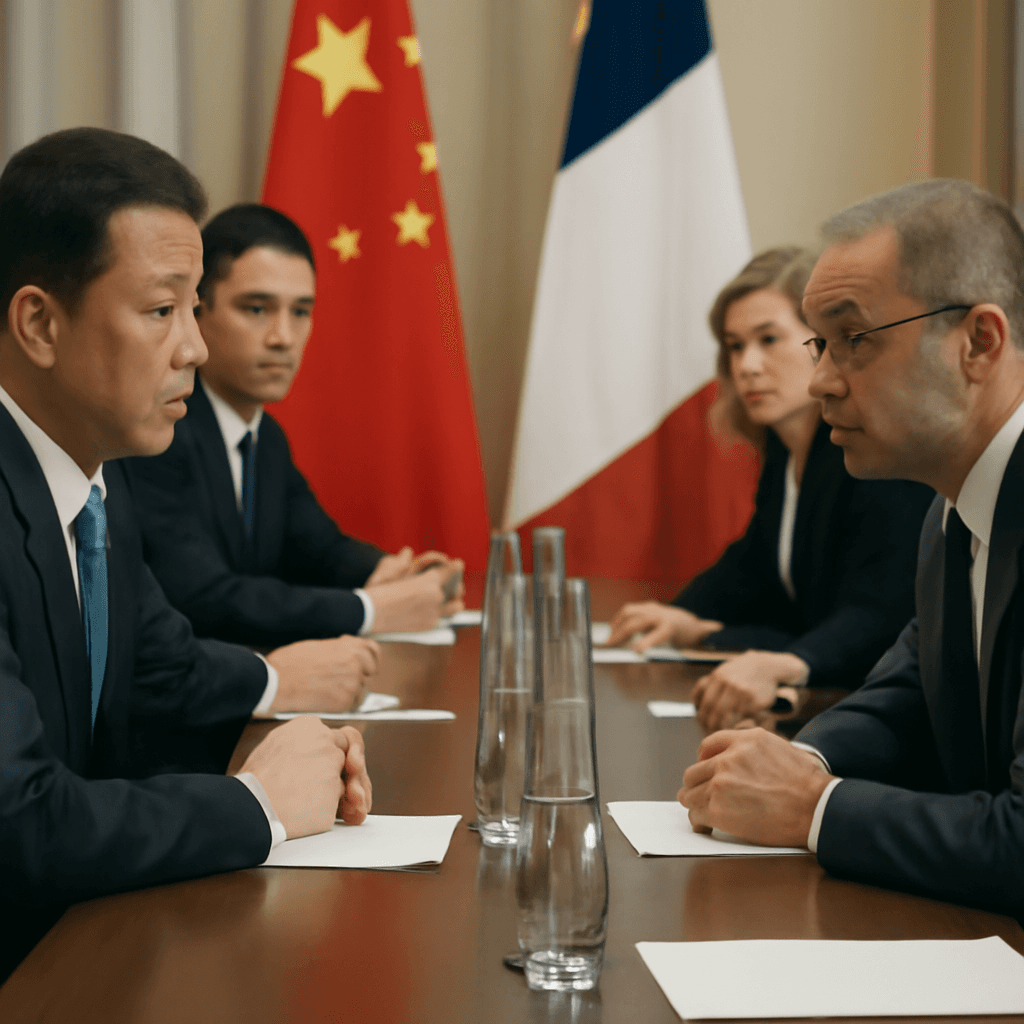

Outlook on EU-China Relations

Both Chinese and EU leaders are preparing for upcoming discussions aimed at strengthening bilateral trade ties amid increasing U.S. tariffs. The European Union remains China's second-largest trading partner by region, underscoring the importance of this relationship despite current uncertainties.