PLANO, Texas – Toyota Motor Corporation aims to significantly expand its plug-in hybrid electric vehicle (PHEV) offerings in the United States as part of its strategic response to evolving industry regulations and consumer preferences.

Building on its legacy of introducing Americans to hybrid technology with the Prius over 25 years ago, Toyota plans to increase PHEV sales from 2.4% of its U.S. volume in 2024 to roughly 20% by 2030. PHEVs combine an electric motor and battery with a traditional gasoline engine, allowing drivers to operate solely on electric power for a limited range before switching to gasoline.

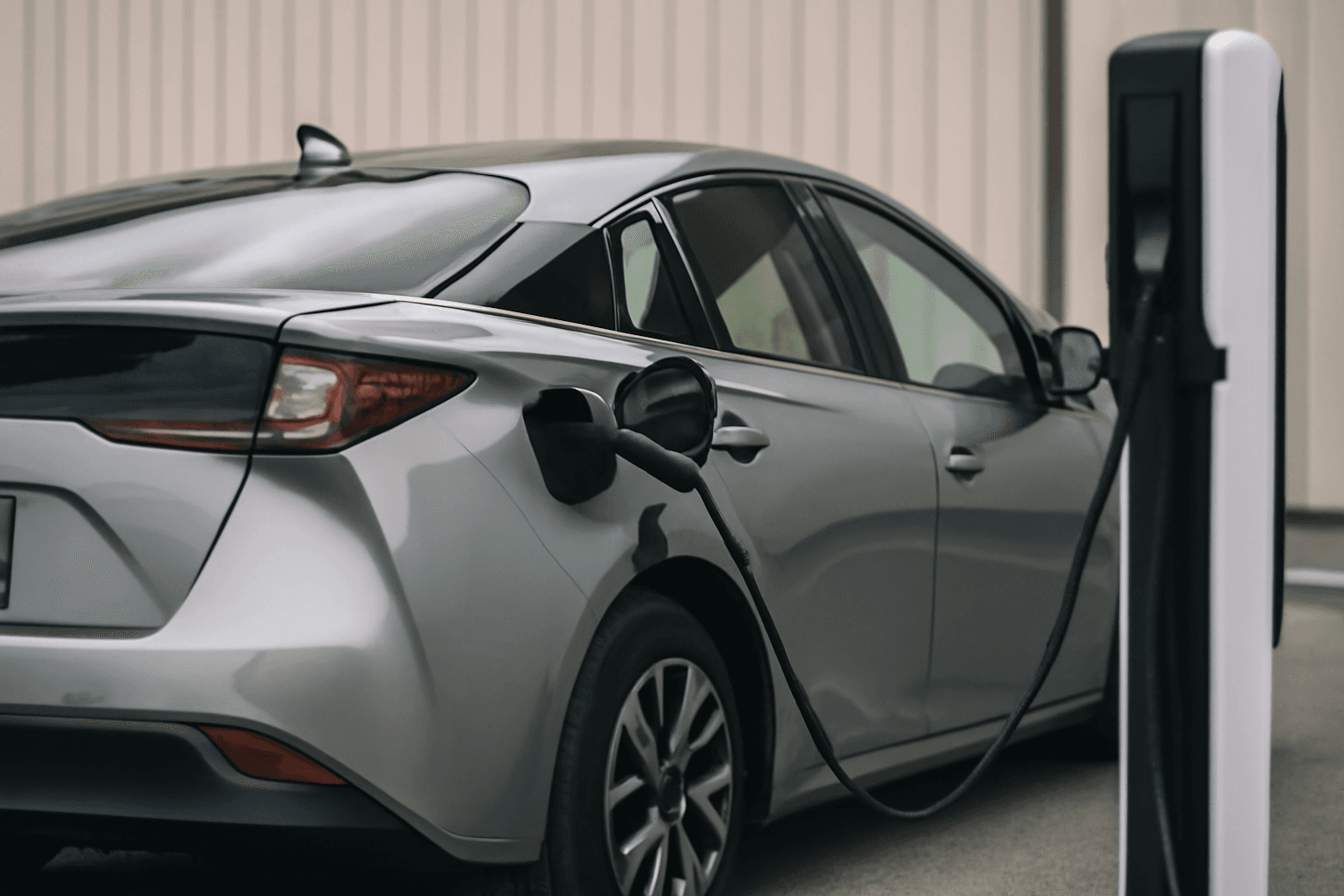

Unlike standard hybrids that rely primarily on gasoline with some electric assistance, PHEVs require external charging to maximize their electric-only driving range, offering consumers a transitional option toward full electrification. Toyota was among the first to bring PHEVs to the U.S. market in 2016 and is now revitalizing these models amid tightening federal fuel economy standards and emissions regulations.

David Christ, head of Toyota’s North American brand, emphasized the company's commitment to expanding PHEV availability across its vehicle lineup. "We love the PHEV powertrain and are focused on increasing the electric-only range to make these vehicles more attractive and practical," Christ said during a visit to the company’s headquarters.

This target aligns with California Air Resources Board regulations that mandate automakers sell only zero-emission vehicles in the state by 2035, although some regulatory uncertainties persist at the federal level.

Toyota’s PHEV advancement accompanies sustained investments in full battery electric vehicles (BEVs) despite market uncertainties. Technological improvements have extended PHEVs’ electric range to approximately 50 miles, exemplified by the recently unveiled 2026 RAV4 PHEV model.

Despite varying industry forecasts anticipating PHEVs to account for roughly 3-5% of U.S. vehicle sales by 2030, Toyota's ambitions notably surpass these estimates. Analysts attribute the segment's limited growth potential partly to the high costs of integrating dual powertrains and battery systems.

Toyota’s PHEV sales, including its Lexus luxury brand, surged about 39% in the previous year, supported by strong performance from models like the Prius and RAV4 PHEVs, as well as a nearly 89% increase in Lexus PHEV sales driven by new models like the TX.

Hybrids and PHEVs together are expected to represent over 50% of Toyota’s U.S. sales for the current year, up from 46% in 2024 and 30% in 2023. Cooper Ericksen, senior vice president for product and BEVs at Toyota North America, described the automaker’s diversified approach to electrification as a strategic advantage, comparing it to loading the bases in baseball with multiple player options available.

Consumer awareness remains a critical factor influencing adoption rates. PHEVs appeal to customers hesitant about fully electric vehicles due to concerns about charging infrastructure and range limitations. Educating buyers on PHEV benefits has led to growing interest, Ericksen noted.

Pricing remains a challenge, as Toyota's PHEVs command a premium of approximately $12,000 to $15,000 over comparable hybrid or base gasoline models, reflecting their complex dual powertrain systems. Nevertheless, the automaker sees the investment in PHEVs as a strategic option for regulatory compliance and attracting a broader customer base.

As Toyota advances its electrification strategy, the company continues to evaluate where to deploy PHEVs within its product array to maximize competitive strength and consumer appeal.