India Ramps Up Efforts to Harness Rare Earth Reserves

India, home to the world’s third-largest reserves of rare earth elements (REEs), is accelerating its push to develop domestic mining and refining capabilities. This move aims to reduce dependency on China and position India as a vital alternative source for crucial minerals used across modern technologies, including clean energy, electronics, and defense.

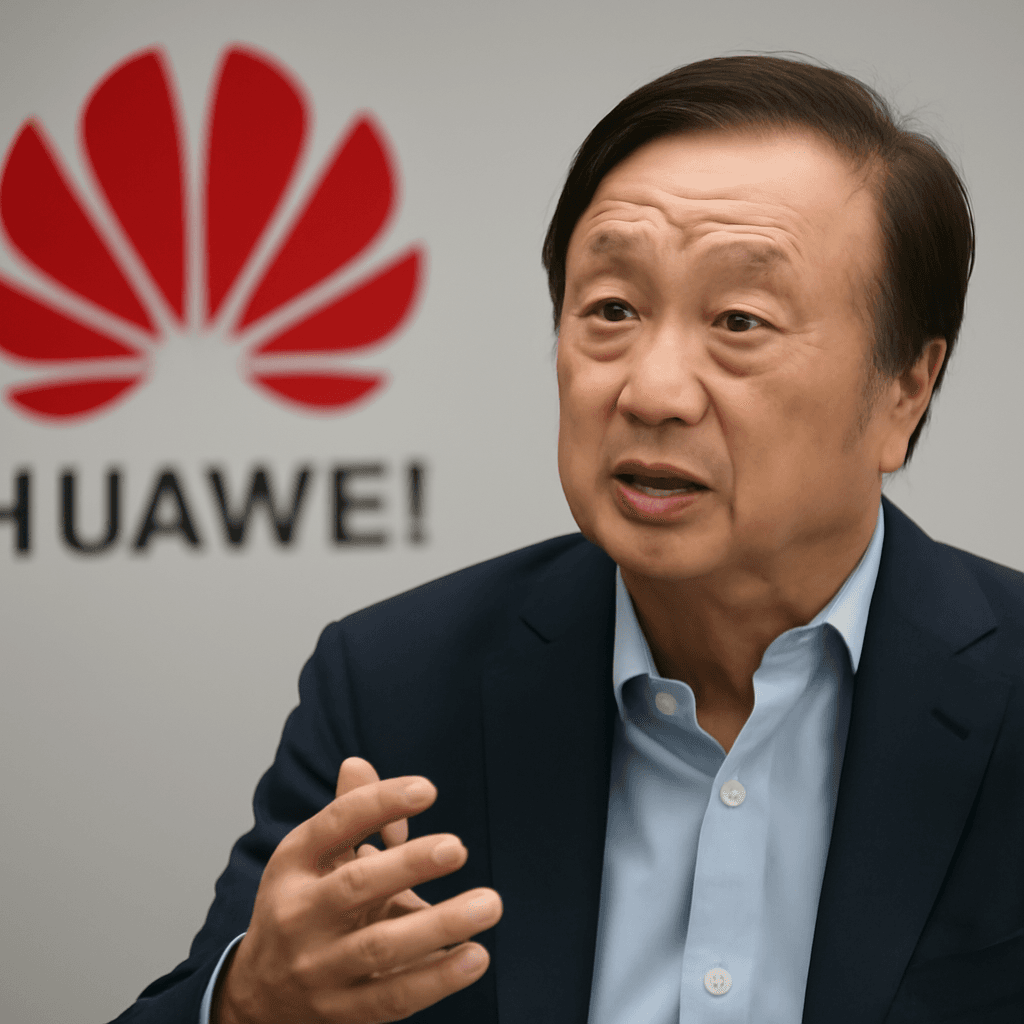

China’s Continued Hold on Rare Earth Supply

China currently controls a dominant share of the global rare earth market, supplying approximately 60% of the world’s rare earth elements and refining nearly 90% of these materials, some sourced from imports. This dominance grants China significant leverage over critical supply chains essential for technologies like robotics, batteries, and military hardware.

Recent Chinese export restrictions have highlighted vulnerabilities in global supply chains, prompting countries like India and the United States to seek diversification options.

Unlocking India’s Rare Earth Potential

Although rare earths are not scarce in nature, their extraction and processing require substantial infrastructure and expertise. India’s reserves, quantified at around 6.9 million tons, place it behind China but well ahead of many other nations, including Brazil. Moreover, India boasts nearly 35% of the world’s beach and sand mineral deposits, a key source of several rare earths.

This geological advantage positions India as a potential linchpin in a more diversified and resilient global rare earth supply chain.

Building Mining and Processing Capabilities

India’s government-owned company, India Rare Earths Limited (IREL), stands as a cornerstone in this endeavor. Established in 1950, IREL specializes in extracting valuable rare earth elements from beach sands, particularly in Kerala. Its operations are notable for lacking any Chinese investment, making it an appealing partner for countries wary of Beijing’s influence.

To further strengthen its position, India launched the Critical Minerals 2025 Initiative, aiming to foster self-reliance amidst geopolitical uncertainties and concentration risks associated with REE supply.

Challenges Ahead: Investment and Innovation Needed

Despite these promising factors, experts caution that rapidly scaling domestic mining and refining capacities is no small feat. Significant investments from central and state governments, as well as private enterprises, will be critical in advancing research, development, and infrastructure in this sector.

Government discussions are reportedly underway to incentivize private collaboration with India Rare Earths through subsidies and capital support, targeting accelerated growth of local mining and processing capabilities.

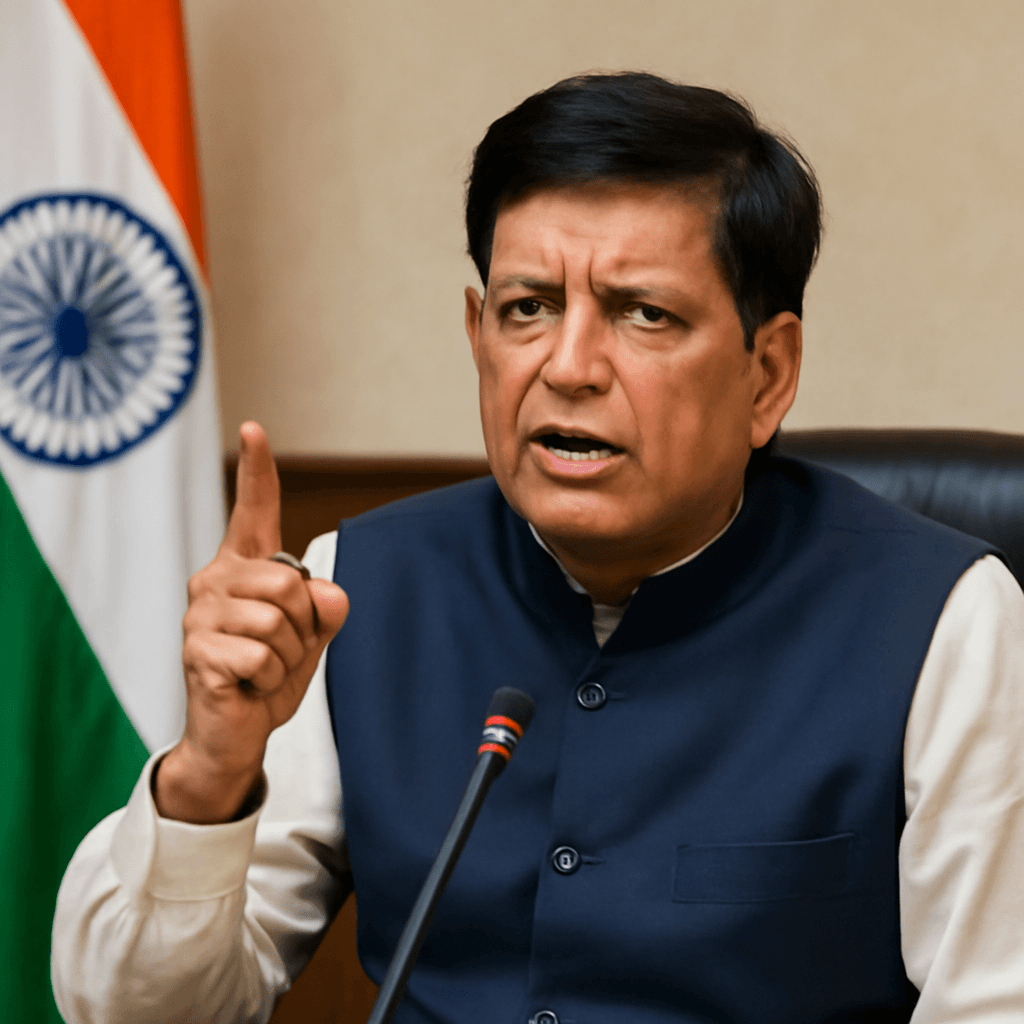

India’s Role: Complement, Not Replacement

Country experts emphasize that while India is unlikely to supplant China as the leading rare earth supplier in the short term, it can nonetheless emerge as a meaningful alternative source, reassuring global partners of a more balanced supply chain.

Commerce and Industry Minister Piyush Goyal describes China’s recent export halt as both a challenge and an opportunity for India to step up. Meanwhile, India is actively pursuing alternative import routes, including seeking faster approvals for rare earth imports from China.

Furthermore, an Indian delegation from the automotive industry is preparing to visit China with hopes of expediting imports of rare earth magnets crucial for electric vehicles and other technologies.

Looking Ahead

The global rare earth landscape is shifting, and India’s ambitions and reserves position it well to play a pivotal role in building a more diversified and secure supply chain. However, turning this potential into reality hinges on sustained commitment, investment, and international collaboration.