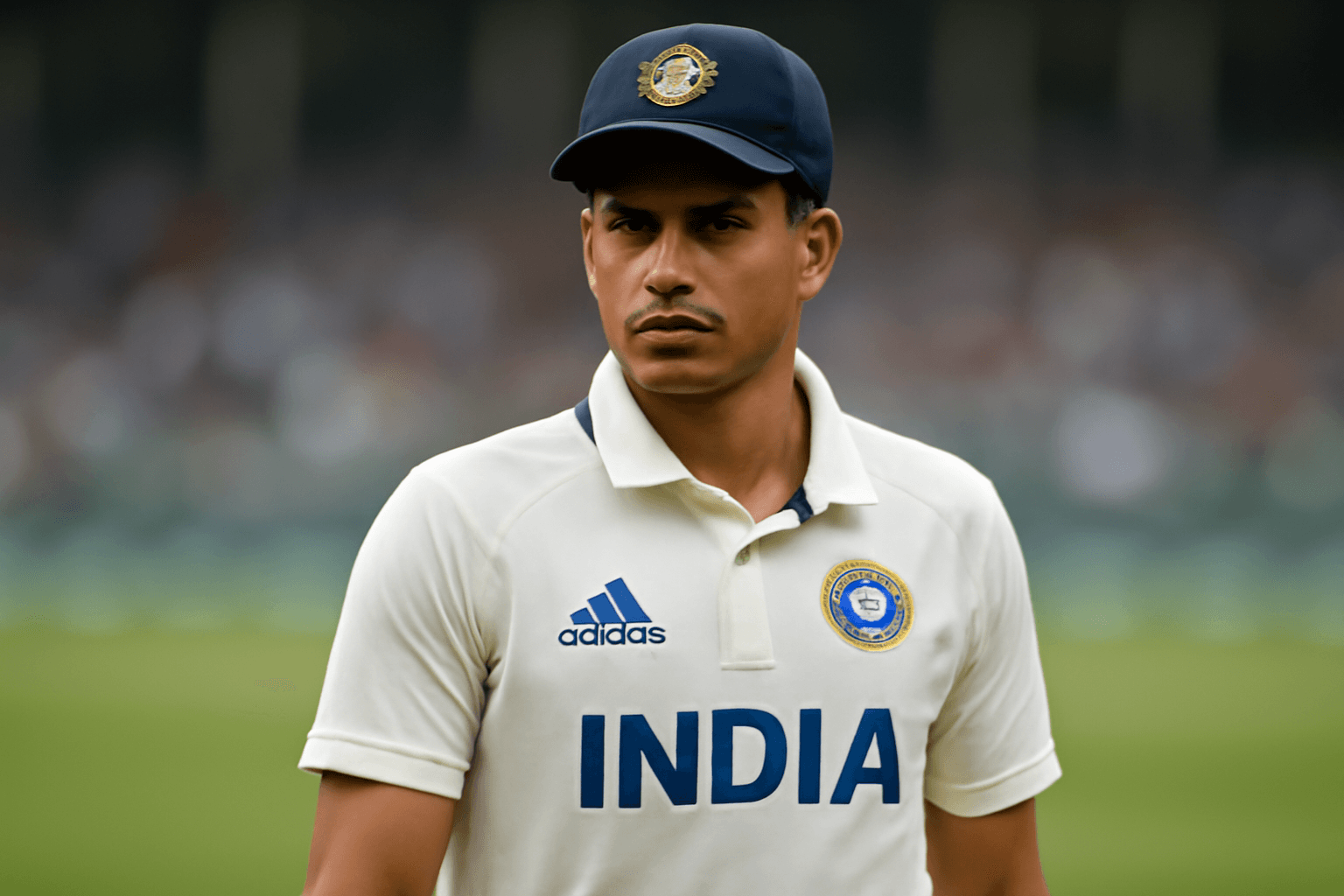

India is witnessing a notable increase in export opportunities as its firms capitalize on the ramifications of the US tariffs imposed during the Trump administration. With US tariffs on China reduced from 145% to 30%, Indian companies enjoy a temporary 10% tariff advantage, positioning them competitively in key sectors such as electronics, textiles, and consumer goods.

Prominent business leaders from major firms, including Dixon Technologies, Tata Consumer Products, Blue Star, Havells, and Arvind, have reported heightened business inquiries from US partners. This trend reflects a growing optimism for export-driven growth backed by the potential India-US bilateral trade agreement (BTA).

Despite the challenges posed by calls for local production and a looming 25% tariff on mobile phone producers like Apple and Samsung, analysts assert that manufacturing in India remains economically viable. There is anticipation that even though the current 10% tariff rate may revert to 26% in July, the overall outlook remains favorable.

During a recent earnings call, Dixon's managing director, Atul Lall, announced a 50% capacity expansion tailored for fulfilling increasing orders from a prominent US brand, hinting at partnerships with companies such as Compal. While specifics were not disclosed, industry insiders speculate that Motorola and Google are among the primary beneficiaries of this move, particularly with Google planning to export mobile devices manufactured in India.

Arvind's vice chairman, Punit Lalbhai, acknowledged challenges such as rising costs for strategic clients but expressed confidence in increased order volumes from American markets. He emphasized the company's commitment to overcoming temporary margin pressures, with expectations of significant growth in garment volumes by year-end.

Additionally, Tata Consumer Products' CEO, Sunil D'Souza, pointed out that their exports, including coffee and tea, are in a balanced competitive landscape, benefiting from the absence of local production within the US.

The export of India-manufactured air conditioners has commenced, with management at Havells displaying optimism about the potential advantages from the BTA. Both BlueStar and Amber Enterprises have reported a surge in export inquiries as businesses prepare for anticipated tariff shifts.

R. Kuruvilla Markose, CEO of Titan Company's international business, noted that they are closely monitoring the competitive pricing in the US market, anticipating prompt adoption of the BTA.